The question of where to invest has been a major deal on Ghanaians since the financial sector clean up. Locked up deposits has been a dreadful experience making people walk on egg shells. We established in an earlier article that keeping money under bed is not a good option unless it is gold. We mentioned asset classes such us property investments, whether directly or indirectly, in the form of land and buildings and then (indirectly) in Real Estate Investment Trusts (REITs). However, today we will look into government’s Treasury bills and bonds.

Government Instruments

Government instruments have begun to gain popularity following the uncertainties that have characterized the financial system. Individuals are looking for safer investments more than just high return investments. Not just are they safer but in terms of returns, they seem to be competing well with the higher risk investments like banks’ fixed deposit and mutual funds from the investment houses which will be discussed later. These observations have made the government’s shorter-term treasury bills and longer-term treasury notes and bonds more popular. Trends in enquiries of investments into government securities have rather shot up. Individuals used to be just satisfied with 91-day or 182-day T-Bills. But now inquires are coming for the longer-term bonds.

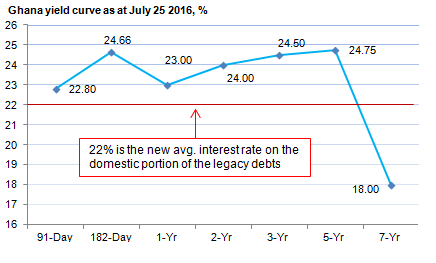

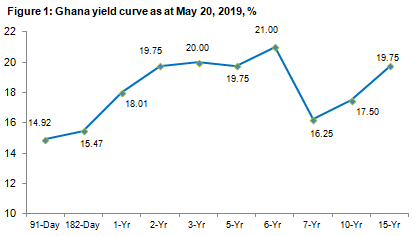

Another development that has additionally necessitated investors turning more for the longer dated bonds is the fact that investors are now being rewarded for holding their funds longer. For a long time into 2015 thereabout, investors were getting lower returns for longer dated government investments (see graphs 1 & 2 showing the yield curve*). The government had not also embarked on any intentional strategy to correct this trend.

The Yield Curve*

As its been done now. Note that the highest return of government instruments in 2016 was 182-day t-bill at 24.66 per cent while in 2019 the highest return of government treasury bills and bonds on the curve is the 6 year bond at 21 per cent.

Source: Doobia.com

This article seeks to educate the individual investor or a potential investor to a certain extent. Therefore, one has to seek a professional advice when they intend to invest. For instance investing in a 5 year bond may come with certain terms and conditions an advisor could be interpret. Ecocapital is one of a proven investment advisory company that could help you to make your investment decisions better. We are now in an era where such services have become critical. Better pay some 0.1% for sound financial advice to do safe and informed investments, than losing the whole capital to investment losses or locked up deposit. The next in the series would look at the mutual funds market

* A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates.