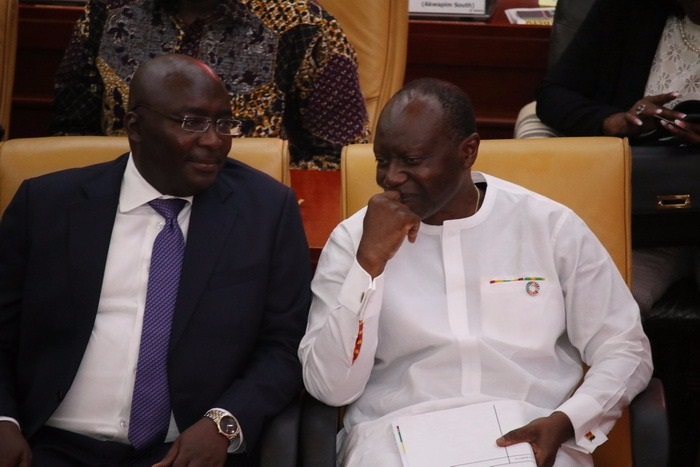

In accordance with Section 28 of the Public Financial Management Act, 2016 (Act 921), the Minister for Finance will today July 29, 2019 present the Mid-Year Review and Supplementary Estimates to Parliament

According to a Finance Ministry press release, this year’s presentation will have a particular focus on issues affecting the energy sector, alongside their planned reforms.

Another major area expected to be addressed is the financial sector’s performance. Ghana’s debt situation, domestic revenue mobilization, and the review of the Luxury Vehicle Tax will also be highlighted.

This presentation to Parliament will see an upward revision of the 2019 appropriation ceiling and its underlying measures, in order to achieve the objectives of the 2019 budget theme of expanding the economy and increasing jobs. The government will, therefore, seek the approval of Parliament for supplementary estimates.

Aside from highlighting Ghana’s fiscal performance between January and June 2019, as well as a fiscal strategy going forward, this year’s Mid-Year Budget Review will touch on policies leading to increases in industrial output, such as the agro-food sector. Roads Rehabilitation & Construction, the strengthening of Security, and Government Priority Programmes, among others, will also be addressed.

Also this Mid-year presentation to Parliament is expected to explain how Ghana will take advantage of the opportunities that come with the hosting of the Secretariat of the Africa Continental Free Trade Area (AfCTA).

The review covers:

- a brief overview of the macroeconomic developments (2018 & 2019);

- analysis of revenue, expenditure, and financing performance for 2019;

- a revised fiscal outlook for the unexpired term of the financial year; and

- overview of the implementation of the annual budget.