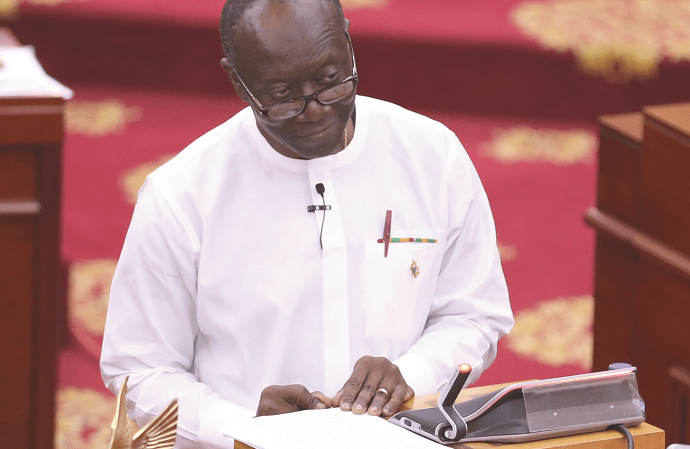

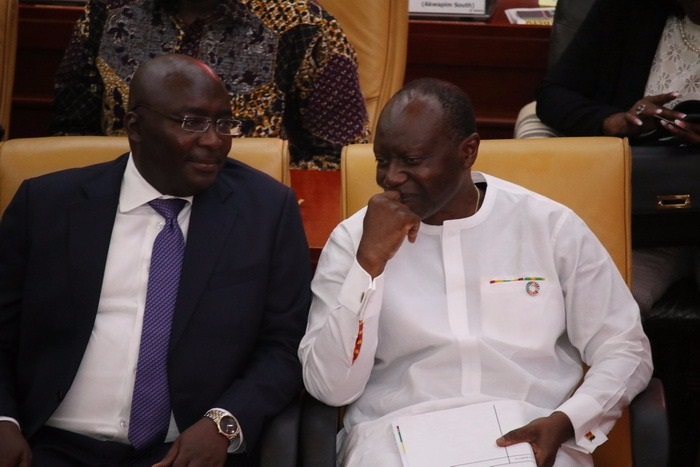

Delivering the 2022 Budget-themed, “BUILDING A SUSTAINABLE ENTREPRENEURIAL NATION: FISCAL CONSOLIDATION AND JOB CREATION,” the Finance Minister, Ken-Ofori-Atta noted that a 1.75% levy will be imposed on MoMo transactions and other electronic transactions such as bank transfers.

According to the Minister, the 1.75% levy will be imposed on mobile money and other electronic transactions that exceed GH¢100 per day. This levy will be known as “Electronic Transaction Levy or E-Levy.”

Levy on MoMo Transactions – the reasons why

Given that the informal sector of Ghana’s economy is largely engaged in tax evasion and avoidance, the government of Ghana in an effort to increase its revenue by widening the tax net is instituting this levy to rope in the informal sector.

“After considerable deliberations, the Government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector. This shall be known as the “Electronic Transaction Levy or E-Levy,” the Finance Minister said.

The Finance Minister also indicated that the proceeds will be used for the construction and maintenance of roads since the government plans to scrap off-road tolls.

The levies according to the Finance Minister will also be used to support entrepreneurship, youth employment, cyber security, among others.

Who bears the levy on MoMo Transactions

In the budget presentation, the Finance Minister noted that transactions covering mobile money, and bank transfer merchant payments will be borne by the sender while inward remittances will be borne by the recipient.

“Electronic transactions covering mobile money payments, bank transfers merchant payments, and inward remittances will be charged at an applicable rate of 1.75%, which shall be borne by the sender except for inward remittances, which will be borne by the recipient,” he said.

Levy on MoMo transactions – Implications

Currently, we are charged an average of 1% on the mobile transaction. Thus if we are executing a transaction of GH¢200.00 we pay a GH¢2.00 charge (1%*200). With the government’s plans to institute the 1.75% levy, if one is executing the same GH¢200.00 transactions, one will now pay a charge of GH¢3.5 (1.75%*200).

Levy on MoMo Transactions – Exemptions

According to the Finance Minister, there will be exemptions for all transactions that sum up to GH¢100 or less per day (which is approximately GH¢3000 per month). This he says is in an effort to safeguard efforts to enhance financial inclusion and protect the vulnerable.

“To safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GH¢100 or less per day (which is approximately GH¢3000 per month) will be exempt from this levy,” he said.

Reactions to the Levy on MoMo transactions

Many Ghanaians have taken to social media to register their displeasure at the news.

“Cashless economy but we will levy and tax you so hard for every electronic transaction that you will want to pay in cash.” – Efo Dela

“This Electronic Levy is uncalled for…Why….Meanwhile, salaries were only increased by 4%.” – Apana 1

“Tolls are abolished but an even more expensive electronic levy has been imposed on you. This joke is on you.” Sam ‘Dzata’ George. Everyone who does any digital transaction be it call, data, transfer is charged. Many people never used tolled roads, they all have to pay an e-levy now.” – Sam ‘Dzata’ George.