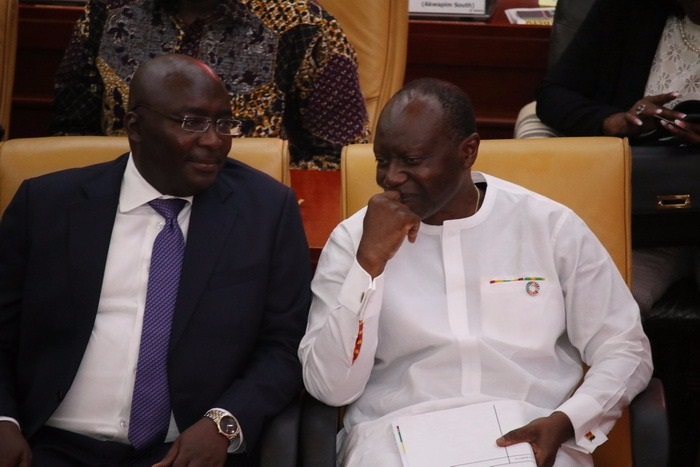

The government of Ghana has scrapped the Luxury Vehicles Levy introduced in 2018. Finance Minister, Ken Ofori-Atta, said the government has considered agitations by the public and various bodies advocating the cancellation of the levy.

Consequently, he told parliament in his Mid-year budget review presentation on Monday, 29 July 2019, that “as a listening government, we are proposing to the House, the withdrawal of the levy”.

Mr Ofori-Atta added that the government will continue to improve compliance, expand the tax net and explore other innovative sources of raising the revenue of the country.

Parliament passed the Luxury Vehicle Levy to impose an annual levy on vehicles with high engine capacities effective from Wednesday, 1 August 2018.

The levy was supposed to affect vehicles with engine capacity of two thousand, nine hundred and fifty (2950) Cubic Centimeters and more.

The levy was GHS1000 for vehicles with engine capacity of 2950cc – 3549cc, GHS1,500 for vehicles with engine capacity of 3550cc – 4049cc and GHS2,000 for vehicles with engine capacity of above 4049cc.

Meanwhile, The leadership of the Car Owners and Dealers Association early this month met the Ministry of Finance to discuss the luxury Vehicle Tax policy.

The association maintained that the luxury Vehicle Tax policy negatively affect their businesses and therefore government must scrap the policy.