The Ghana Amalgamated Trust (GAT), the special purpose vehicle tasked with raising financing to support some five (5) banks in recapitalising is turning to the public to raise bonds for the said banks.

The GAT first came to light when the Bank of Ghana (BOG) governor,

The banks in question are National Investment Bank (NIB), Agricultural Development Bank (ADB), Omni Bank, UMB Bank and Prudential Bank. The news of

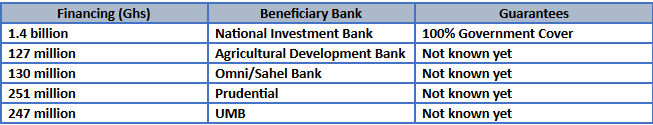

The announcement did not also sit well with industry practitioners who have had some current and past unpleasant experiences with government and quasi-government’s involvement in the private pension space. The GAT picking up the signals of the weak enthusiasm of private pension fund’s stakeholders have now turned to the public to raise financing through bonds to finance their mandate. The exercise aims to raise a total of about Ghs2 billion in a 5-year corporate bond paying zero coupons at the end of the year, but accruing 21% interest rate per annum to be paid collectively with the principal at the end of the 5-year term. This is optional for pension funds to invest in after their own assessment.

Though analysts see the 21% promised annual returns as laudable, there are concerns on the structure and the security of the debt. The GAT would raise this as a fixed-income (guaranteed return) instruments to investors, while funds would be deployed on equity (non-guaranteed return) basis with the beneficiary banks.

Some refreshing news which may give investors some comfort however, is the fact that the government is providing 100% for the 2nd tranche of the bond being the Ghs1.4 billion which would be used to support NIB. It could be noted that some of these banks have not paid dividends for 15 years, while it was in the news that NIB’s accounts have not been audited for the past three years.

ALSO READ: Gov’t to issue US$403m bond for 5 undercapitalized banks

What may give absolute comfort, especially for pension schemes to invest, is if the government is able to provide 100% cover for the entire bond issue.

The bonds are scheduled to be issued before the end of February 2019.

ghanatalksbusiness.com will follow up the story and bring updates