- Meeting inflation target by 2016 required further tightenin

- Cedi extends decline after decision, near 4 per U.S. dollar

Ghana’s central bank unexpectedly raised its benchmark interest rate to 25 percent as inflation remained outside of its target band.

The Bank of Ghana increased the policy rate by 1 percentage point, Governor Kofi Wampah told reporters in the capital, Accra. All 10 economists surveyed by Bloomberg predicted the rate would stay unchanged. The cedi extended its decline after the decision, dropping 6.8 percent to 3.995 per dollar at 11:47 a.m. in Accra.

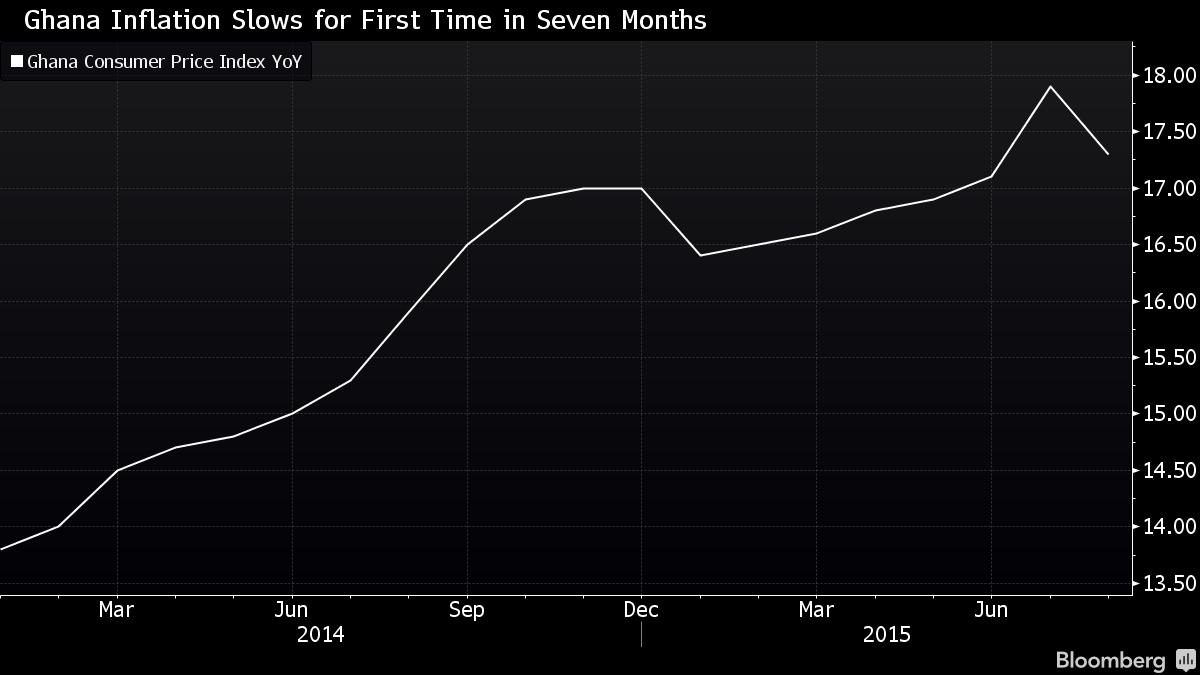

Policy makers have raised borrowing costs by 5 percentage points since last year to bolster the currency. While inflation slowed for the first time in seven months to 17.3 percent in August, it remains above the central bank’s target of 6 percent to 10 percent.

“The decision of the committee to increase the policy rate is consistent with the bank’s forecasts, which requires further tightening in order to bring inflation back within the target band by the end of 2016,” Wampah said. “The committee will continue to monitor developments and take appropriate action if necessary.”

The domestic economy continued to face challenges because of power shortages and fiscal consolidations, the committee said. Foreign gross reserves dropped $1.1 billion to $3.2 billion in June, while the government cut its growth forecast for 2015 to 3.5 percent, the slowest in about 20 years, from 3.9 percent in July.

“Since the beginning of the year, inflation pressures have persisted due

to uncertainties in the foreign exchange market,” Wampah said. “Inflation and inflation expectations remain elevated and outside the medium-term

target band.”

The central bank is keeping on eye on volatility in financial markets, the uncertainty in timing when the the U.S. Federal Reserve will raise its benchmark interest rate and a drop in commodity prices, including oil, according to the statement. Trading in futures indicates that there is a 30 percent chance the the Federal Reserve may raise its rate as soon as Sept. 17, its next meeting.

“Given that the Bank of Ghana’s foreign reserves have fallen substantially in recent years, interest rates are the only weapon to shore up the currency,” London-based Capital Economics said in a note to clients after the decision. “With the economy likely to remain weak and inflation set to ease, we don’t see further rate hikes.”

Last month the Bank of Ghana merged the policy rate and reverse repo rate at 24 percent. The policy rate was previously 22 percent. The bank said at the time the adjustment didn’t reflect further tightening in the monetary policy stance.

The government will start the roadshow for a $1.5 billion Eurobond on Sept. 22, Wampah said.

Source: Bloomberg.com