The Ghana Revenue Authority with support from the Finance Ministry has announced it will soon name, shame and also prosecute tax evaders especially those in the informal sector.

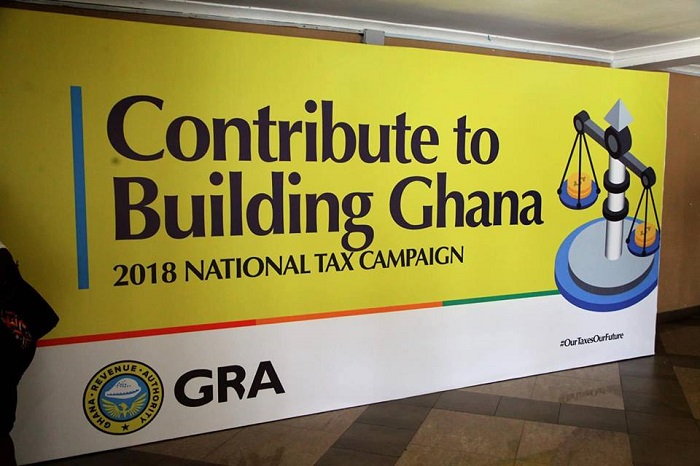

The Authority today launched the 2018 National Tax Campaign to help the voluntary tax payment, especially from the informal sector.

Currently, the informal sector contributes only two percent of the total taxes paid in Ghana though 6 million people have been captured in the tax net, only 1.5 million people pay taxes regularly mostly from the formal sector.

Speaking at the launch of the 2018 National Tax Campaign, Deputy Finance Minister, Abena Osei Asare charged the Ghana Revenue Authority to develop stringent measures to broaden the tax net.

“Currently as we speak, we have about 6 million people who are supposed to be on the tax net but we have only 1.5 people paying taxes regularly and on this the informal sector contributes just 200 thousands of the 1.5 million, this gap must be bridged at all cost so we must do everything possible to change this situation is we to make any headway to develop Ghana. For GRA in as much as we encourage the informal sector to contribute their quota, GRA must also make paying taxes easier.”

In a related development, Officers from the Ghana Revenue Authority in early this month stormed the factories of Coca-Cola bottling company and Kasapreko beverage limited to prevent excisable products without tax stamp from entering the market.

The operation was part of measures by the revenue agency to ensure that all manufacturing companies comply with the excise tax stamp policy.

“Our mandate here this morning for the team is to ensure that all products coming out of the factories are affixed with the tax stamp” leader of the GRA team, Emmanuel Spio Abaidoo said.

In line with the Excise Tax Act passed by parliament in 2013, all carbonated beverages and alcoholic drinks must be embossed with the tax stamp to help the state generate the right taxes on the products.

Tax Stamps are small stickers with security features supplied by the government to some manufacturers and importers to be affixed to their products before they are released onto the market.

The presence of the Tax Stamps on a product, therefore, provides enough guarantee of product authenticity.

Other Related Articles…

GRA Set For Full Implementation Of Tax Stamp

You’ll be arrested if you fail to affix excise tax stamps – GRA warns