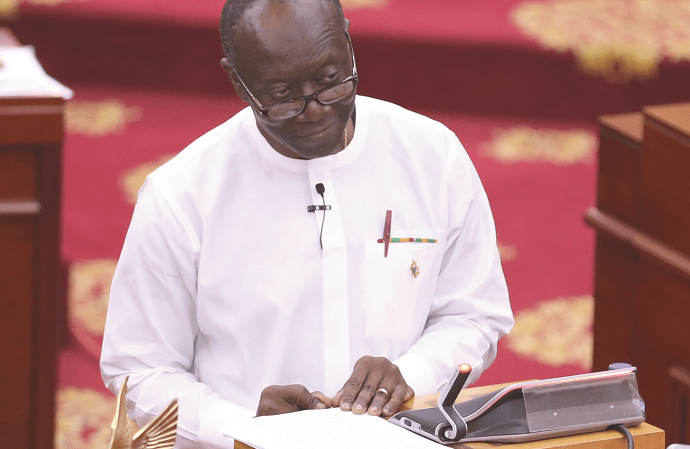

Finance Minister Ken Ofori-Atta is likely to present the 2019 budget to parliament on November 15 2018, according to Ghanatalksbusiness sources.

Our sources say the November 15 proposed date is subject to Parliamentary approval.

The Ministry is currently engaging the various interest groups and business associations in terms of seeking their inputs, especially in the areas of proposed revenue and some policy measures.

Meanwhile, Ken Ofori-Atta has stated that the yet to be read 2019 budget will boost corporate tax mobilization in Ghana. According to the Minister, the 2019 Budget will bring to bear several initiatives that will encourage corporate entities to file their tax returns.

Addressing some corporate companies at a budget forum, Finance Minister, Ken Ofori-Atta disclosed that lots of corporate companies have defaulted in paying taxes to the tune of GH¢3bilion. He stated that most of the PAYE companies in the country have issues in paying taxes, resulting in the government losing lots of revenue.

“If we look at PAYE companies. There are about 888 of them, there is about 67 per cent (540) that are paid regularly, and then another 350 that have issues and of that about 223 are not even attempting to file their tax”, he said.

Ken Ofori-Atta added that the situation provides a challenge to the Ghana Revenue Authority to design effective methods of getting the funds for the government.

“It is either the problem is from the GRA, or I don’t understand your (companies) challenges. Because clearly, GRA needs to do better”.

Nonetheless, the Trades Union Congress (TUC) has charged the government to use the 2019 budget to reduce the rising unbearable cost of living. The union wants the government to use the budget to support the private sector to complement government initiatives to create more jobs, overhaul the exemption system, eliminate distortions and inequities in pay across public sector institutions, address challenges of pension, health care, housing, labour administration, among others. These are contained in TUC’s proposals for the 2019 budget and economic policies of the government submitted to the Finance Ministry.

Read Also: 2019 Budget will Boost Corporate Tax Mobilisation – OFORI-ATTA HINTS