Traders expect Ghana’s cedi and the Kenyan shilling to come under pressure next week but predict other African currencies will remain stable.

GHANA

The cedi could remain under pressure on increasing dollar demand from offshore investors and local businesses needing to settle their last quarter obligations, analysts said.

After rallying 2 percent against the greenback last month, it has since shed some of the gains, despite regular forex sales by the central bank and was trading at 4.8816 to the dollar by mid morning on Thursday, compared to 4.8750 a week ago.

“For the remainder of the week, we see the cedi staying on the back foot; the pair (USD/GHS) is likely to test the 4.90 big figure,” Barclays Bank Ghana said in a market update.

KENYA

The Kenyan shilling is seen under pressure due to increased dollar demand from importers of oil and other goods making payments ahead of Christmas and New Year.

Commercial banks quoted the shilling at 101.70/90 per dollar, compared with 101.60/80 at last Thursday’s close.

“There is demand from general importers wishing to make payments ahead of the festive season next month,” a senior trader at one commercial bank said.

ZAMBIA

The kwacha is expected to trade within the current range next week. On Thursday, commercial banks quoted the currency of Africa’s second-largest copper producer at 11.7380 per dollar from 11.8500 a week ago.

TANZANIA

The Tanzanian shilling is expected to hold steady or appreciate next week due to the cashew nut sale season that began last month.

Mohamed Laseko, Senior Forex Trader at CRDB Bank said the shilling is likely to remain around 2,290/2,295 next week.

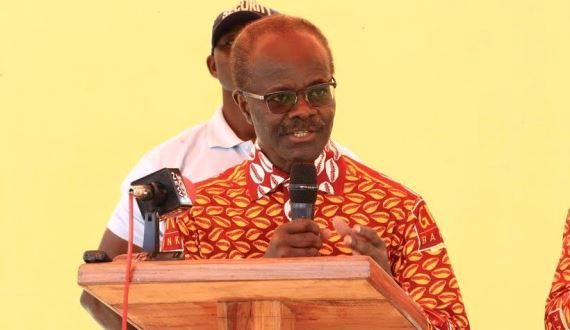

“Next week, cashew nuts sales will likely boost the shilling. This will either make the shilling remain stable or appreciate a little bit,” said Laseko. (Reporting by John Ndiso,Elias Biryabarema, Kwasi Kpodo, Chris Mfula and Nuzulack Dausen; Compiled by Chris Mfula; Editing by Alexander Smith)

Credit: Reuters Ghana