The COVID-19 pandemic has had a huge influence on the economies of many countries, so much so that the current financial score of many brands now wears a new look, significantly different from what it was in the last fiscal year. The stock market seems to be running on pins and needles, with trades and businesses no longer in full swing as they used to be.

While some brands hit a new low during this period, others have been at the tailwind of the robust stock market, hitting astronomical figures in profits. To determine how well or not businesses have adjusted to the whims and caprices of the coronavirus pandemic, we have organized a study based on some industrial and retail giants.

This case study, based on fifty (50) large companies that maintained a market capitalization of over USD $10 billion before the pandemic highlights what areas of the economy were most hit, and which of these industries managed to stay afloat regardless. It also discusses whether the current state of the economy is only temporary or whether brands should prepare for a new normal.

For the purpose of this study, it is assumed that these companies started feeling the influence of the coronavirus pandemic on January 30, 2020, when the World Health Organization (WHO) announced Covid-19 as a global health emergency.

The Rise and Fall of Global Business Empires

A temporary phase? Yes? No? Whatever the case, it is difficult to ignore the fact that the modifications major commercial players are making on their business models are going to affect the world economy significantly.

Worthy of note is that most of the companies that have prospered during the pandemic have American and Chinese roots. Coincidentally, many big players in the US are also bearing the brunt of the pandemic, recording meager profits; and some of them, even losses.

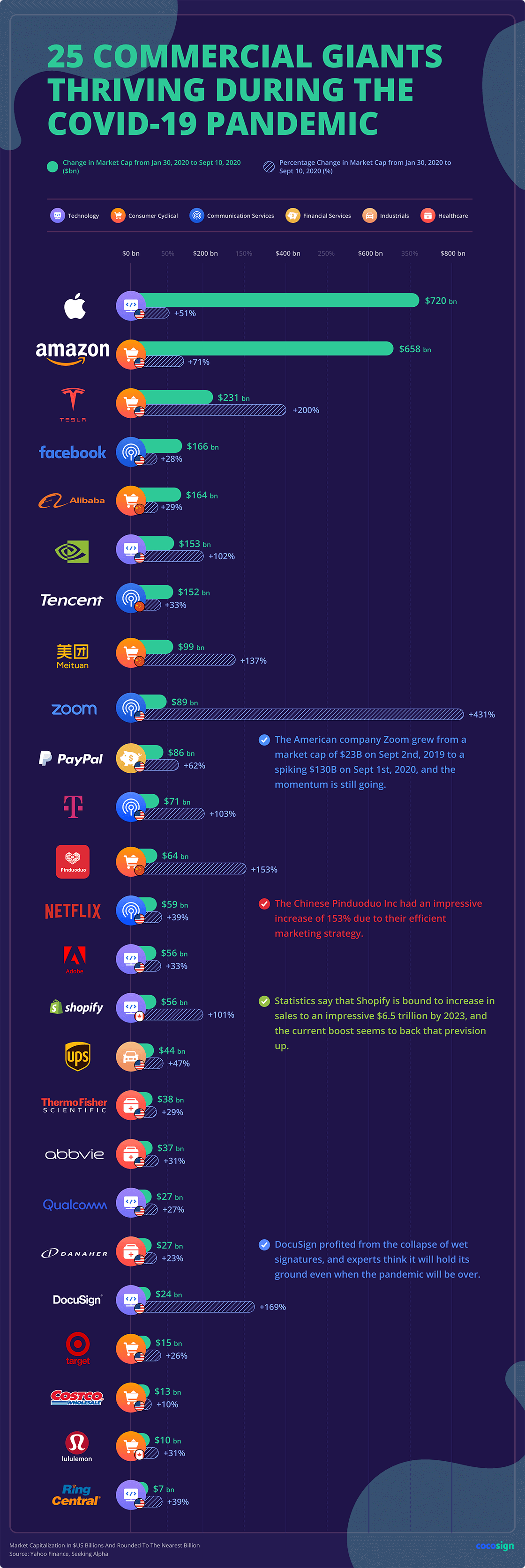

In what is turning out to be a dismal year for many, certain technological giants have somehow flourished, plausibly due to the types of services and products they provide.

Even with governments imposing lockdown measures and ordering citizens to stay indoors, companies like Apple, Amazon, Facebook, PayPal, T-Mobile, and Alibaba have still managed to pull through the pandemic with ease, registering significant growth in the process, with the potential to maintain their high capitalization values even past the crisis.

According to the study, Zoom Video Communications Inc has enjoyed the largest increase in market capitalization, more than twice that of Tesla in second place. Interestingly, this number is still on the rise.

However, it remains to be seen if this trend will continue or there is a potential dip in market capitalization percentage lurking around for Zoom.[1] Eric Yuan, the CEO and founder of Zoom, has been touted as one of the best business leaders during the pandemic.

Tesla INC also received a major boost in market capitalization. A major contribution to the sudden spike was an announcement about a stock split made on August 11, 2020. Since doubling the number of shares doesn’t necessarily translate to an increase in earnings, the evolution for the next period is uncertain.

NVIDIA Corporation, Pinduoduo INC, Shopify, Meituan Dianping, and DocuSign Inc, as well as the United Parcel Service, all had a decent increase in market capitalization, and are likely to keep that score steady for a longer-term compared to others on the list.

Online shopping and deliveries became essential during the lockdown, but it remains to be seen whether people will choose to do a significant part of their shopping this way in the post-pandemic period, or simply hurry back to brick-and-mortar stores as soon as the situation allows.

Another category of companies are those without any significant rise in market capitalization, but with the potential to maintain steady numbers or grow steadily considering their well-established market presence and strong consumer base. Among them are Tencent, Netflix, Adobe Inc, Thermo Fisher, Target, Costco Wholesale Corporation, Lululemon, Qualcomm, RingCentral Inc.

As for businesses like Abbvie INC and Danaher, the public response would become a huge factor in whether the rising trajectory will continue or dip in the near future. At this point, it is hard to tell which would be the case.

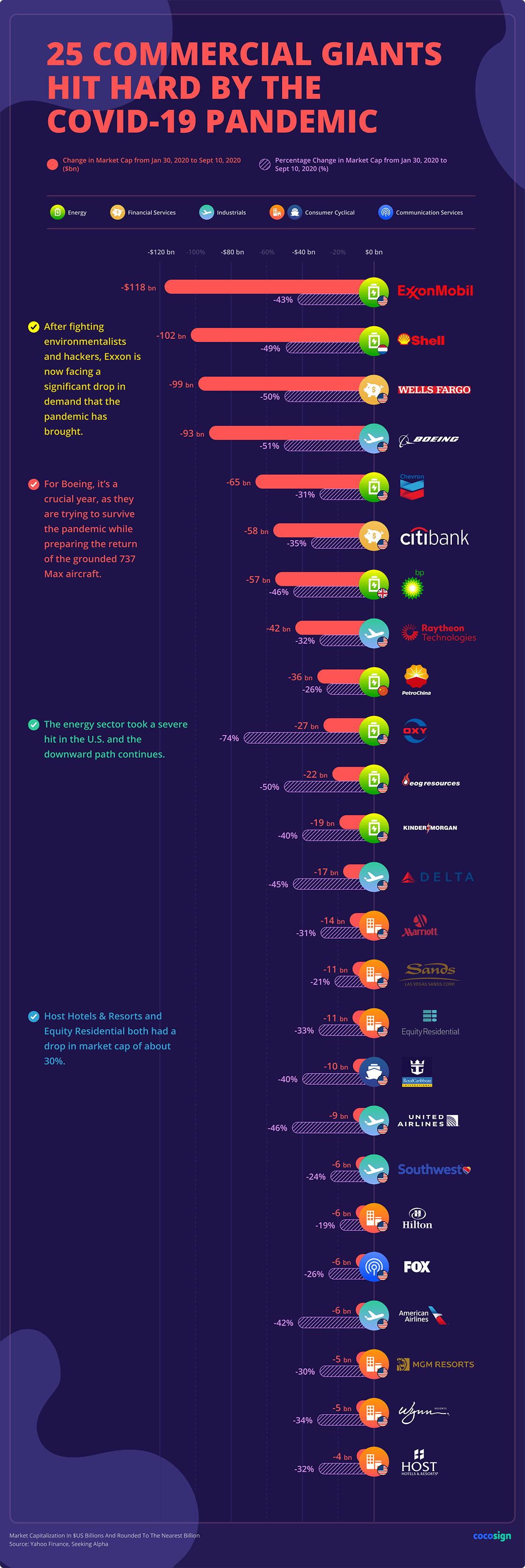

Taking a look at percentage drops, it’s not so difficult to spot Occidental Petroleum Corporation with the biggest slump in market capitalization, a whopping 74% drop. The oil-producing giant is struggling to move forward, after repeatedly slashing its budget to avoid accumulating massive debts it could potentially incur due to the oil price crisis.

The Boeing Company is not left out either, placed only a few points shy off Occidental Petroleum Corporation. Between the efforts to bring back the Boeing 737 Max and the headache in solving the manufacturing issues of the Boeing 787 Dreamliner against a gloomy backdrop in the whole airliner industry this year, it’s hard to say what 2021 will bring for this aerospace and defense giant.

Exxon Mobil Corporation is also on the other end of the spectrum, showing a significant drop in market capitalization by USD. In retrospect, it’s not the company’s first severe hit, and the fact that it’s managed to bounce back indicates its resilience to possibly rebound once the current climate starts to clear away.

Numerous industrial and retail giants suffered huge drops of around 30-50% in market capitalization during the coronavirus crisis. Big corporations like EOG Resources, Wells Fargo & Co, Royal Dutch Shell (in the Netherlands), B.P. p.l.c. (in the U.K.), United Airlines Holdings Inc, American Airlines Group, Delta Air Lines, Kinder Morgan have declined by between 40 and 50%.

Others like Citigroup, Wynn Resorts, Equity Residential, Host Hotels & Resorts, Raytheon Technologies Corporation, Marriott International, Inc., Chevron Corporation, and MGM Resorts all saw a dip in their market capitalization by about 30 and 40 percent.

How A Shift in Consumer Habits Plunged Some Brands Into The Doldrums

The coronavirus pandemic was not only a health crisis but a black swan event that exposed the vulnerabilities of many companies and industries. Most of these companies were unable to cope with the shift in consumer habits, and not even clutch decisions by their management could save their faces. In one clean sweep, these industries lost a large fraction of their customers because they were unable to cater to the new needs of their customers.

This shift in consumer habits no doubt dealt a huge blow to some industries while ordering some others to the forefront of things. The response of these businesses to the change in consumer habits is what separates those that flourished in this period from those who were hit hard by the crisis.

Source: cocosign.com