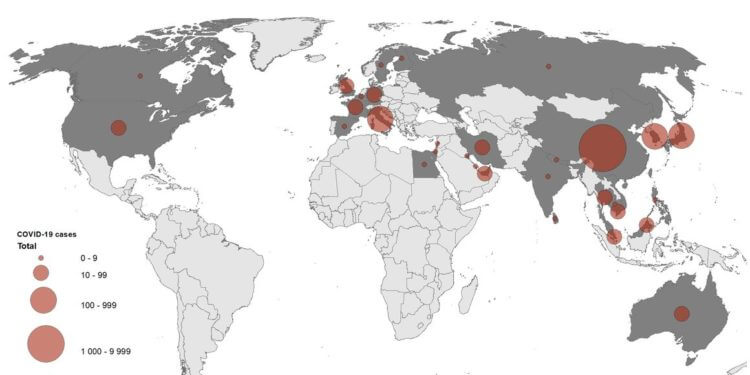

Markets Today

The rapid spread of the coronavirus disease outside China (see chart above) has sparked a global sell-off and rush toward safe havens. Global markets are plunging, and U.S. futures indicate a sharp fall. Dow futures are down 771 points and the S&P 500 and Nasdaq 100 futures are down 2.5% and 2.8%, respectively. The total number of coronavirus cases in the world has topped 79,000.

In Italy, confirmed cases jumped from three on Friday to over 150 on Sunday, and at least three people have died. Several towns in the north are on lockdown, and supermarket shelves are empty as people horde essentials. South Korea continues to be badly affected with the total number of coronavirus cases exceeding 800. Iran’s semiofficial news agency has reported that 50 people died in the city of Qom this month, but the government has disputed this figure. The price of gold soared to $1,678.58, the highest in seven years, as the U.S. 10-year Treasury yield fell to its lowest level since 2016.

In case you missed it, you can read the big takeaways from Warren Buffett’s annual letter to shareholders released Saturday here. It’s also a good time to share his advice for surviving a bear market: “During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy. It will also be unwarranted. Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do well.” Buffett certainly has.

It’s going to be a rough one today….hang in there.

Source: www.investopedia.com