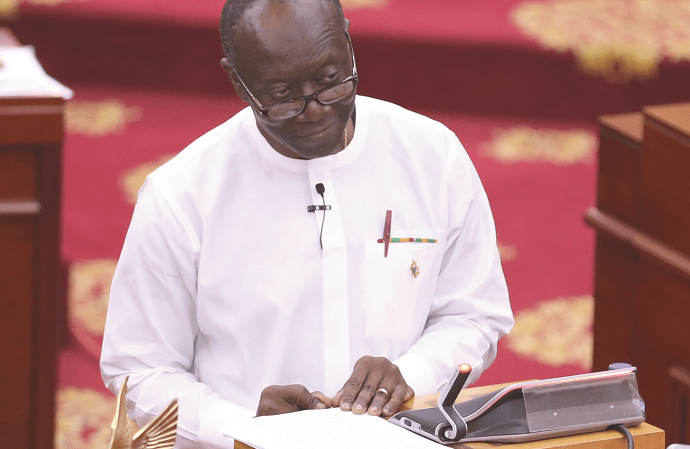

The Minister of Finance in delivering the 2020 Budget announced the establishment of an Enterprise Credit Scheme (ECS). This is an incentive-based risk-sharing system meant to support agricultural lending. It is similar to the operations of a non-bank private company called Ghana Incentive-Based Risk-Sharing System for Agricultural Lending (GIRSAL) which is already in operation.

The government’s objective is to ease the risk burden which financial companies carry when they lend to agricultural businesses. The risk-sharing institutions work by issuing agricultural credit guarantee instruments – to enhance the total amount of credit to the agricultural and agribusiness sectors.

Incentive and Motivation to Lend

According to the Minister of Finance, the initiative is to create some incentive and motivation for participating financial institutions to lend to the agric sector.

The operation of the Enterprise Credit Scheme (ECS) would be inculcated into the operations of the National Development Bank (NDB), which is set to be operational in 2020. Government is working together with the Banking Community to launch a GHS2 billion credit and guarantee scheme in 2020. This initiative will be structured to create incentives for banks to lend to private sector at discounted lending rates.

The scheme which will start in the first quarter of 2020 will be targeted at specific industries such as agri-business, manufacturing, hospitality and tourism and the tech-sector amongst others. This initiative will be structured to create incentive banks to lend to private sector at discounted lending rates.

Promotion of micro businesses and household lending.

In addition to the ECS, Government seeks to partner with Fintech companies, local Banks and mobile money operators to deliver micro credit to Ghanaian businesses and individuals.

This intervention is expected to deliver quick loans on favourable terms using technology driven platforms to conduct credit assessment. The initiative is in line with Government’s digitization agenda and offers an opportunity for MSMEs to apply for loans on their mobile phones with minimal human intervention.

The initiative is expected to go live by Q1 2020

Additional Boost – Lending to Agric

This is an additional boost to the GHS50 million syndicated financial support from Ghana banks to smallholder farmers in respect of the electronic warehousing receipt system introduced by the Ghana Commodity Exchange (GCX).