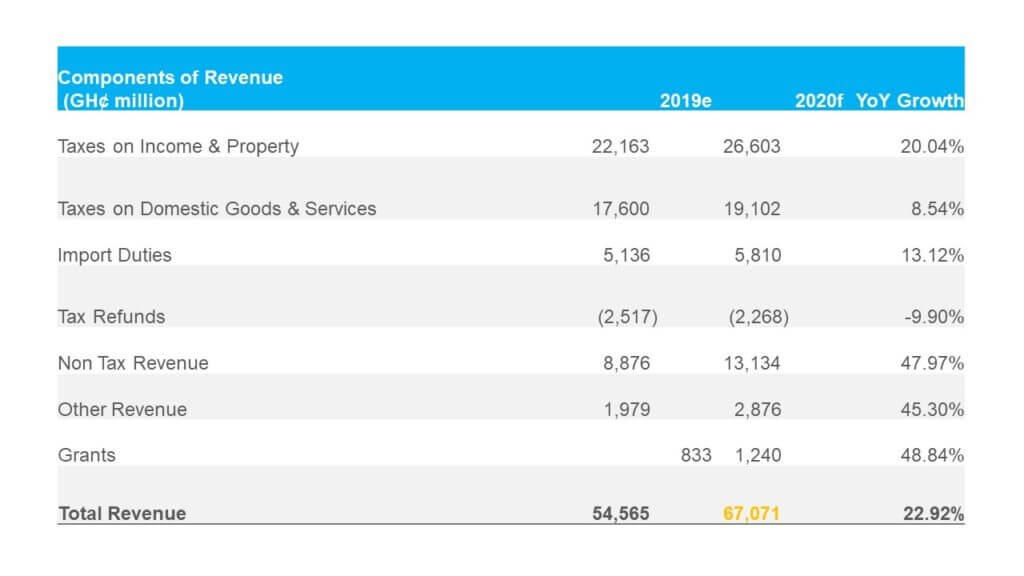

On Wednesday, 13th November, 2019, Finance Minister Hon. Ken Ofori-Atta delivered a GH¢67.1 billion (+23% YoY) Ghana budget, with significant allocations to the fulfillment of the NPP government’s flagship programs (Free SHS, Road Infrastructure, Nation Builders Corp.,etc.) and a bouquet of subsidies in the form of personal reliefs for the populace and adjustment of tax bands.

The revenue targets are quite ambitious with most revenue lines projected to record double digit growth which we think is stretching.

Revenue Risks

Revenue risks include potential under-performance on income and property tax collection, and potential recession in the developed markets and lower consequent demand and prices of commodities (oil, cocoa, gold) in the world markets.

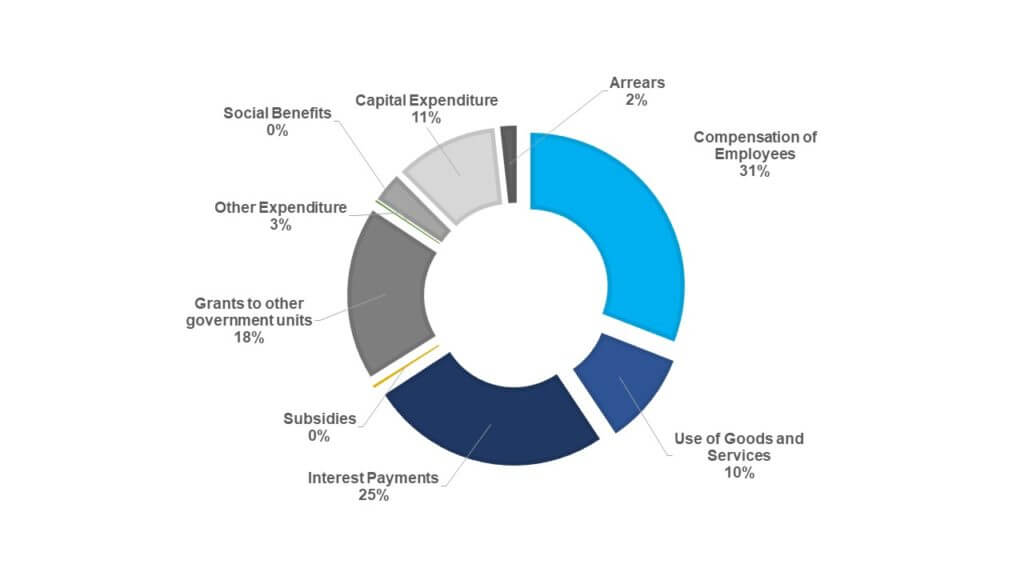

Total expenditure is budgeted to increase 21% to GH¢85.9 billion in 2020. While labor compensation costs can be predicted and managed well, there is significant room for overspending on capex in an election year. Market uncertainties, particularly from offshore and the risks of portfolio reversal in an election year or due to global market factors (with higher interest costs) are extant. There could well also be significant latent costs associated with the clean-up of the financial sector. Resultantly, without positive performance from revenue sources, there is considerable risk of government breaching the 5% fiscal deficit rule.

Capital Markets

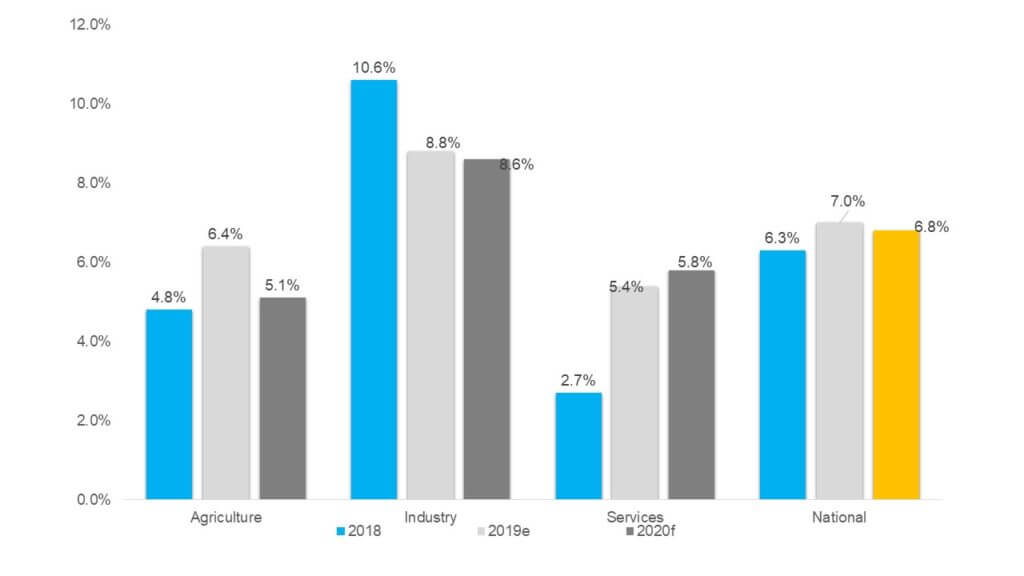

For the capital markets, the government’s borrowing plans to finance the 4.7% budget deficit present new investment opportunities for domestic and offshore investors. The large increase in issuance size will likely keep yields stable or cause an upward trend. While we are cautiously optimistic about growth prospects for economic output in 2020, with increased oil production expected to anchor forecast GDP growth of 6.8% in 2020, the budgeted 21% increase in government spending is likely to be inflationary. We do not expect the MPC to begin to ease in the short-term.

Below is a summary of key highlights of the 2020 National Budget.

Economy to grow 6.8% in 2020 on the back of increased oil production and BOP surplus expected. The Ghanaian economy grew 6.2% during the first six months of 2019 (higher than the 5.4% seen during the prior comparable period). Government targets 6.8% growth for 2020, a slight moderation on the 7% growth projected for 2019. YoY inflation which was 7.6% as at September 2019 is expected to close the year under 8%, and the central bank expects to maintain inflation within the 8 +/- 2% range in the medium term through its interventions. On the external front, an overall balance of payments surplus of USD 500 million is projected for the medium term, on the back of improved FDI inflows, increased oil output from new oil wells, among other stimulants. This development is expected to strengthen the Cedi, but strength depends largely on the stability of commodity prices, among other factors.

Budget Deficit

Budget deficit of 4.7% of GDP very close to the fiscal deficit ceiling of 5% Total revenue and grants for 2019 has been revised downwards to GH¢54.6 billion (7.4% below target) resulting in a projected deficit of 4.7% of GDP. For 2020, the government expects to collect GH¢67.1 billion in total revenue and grants, a 23% increase YoY, on anticipated improvements in tax compliance and effective revenue administration. On the other hand, total expenditure (including arrears clearance) is expected to grow 21.2% YoY to GH¢85.9 billion (21.6% of GDP), driven largely by full funding of government programs (reflected in a 20% uptick in use of goods and services) as well as by one-off payments associated with the 2020 Presidential and Parliamentary elections. A total of GH¢9.3 billion has been allocated towards Capital Expenditure in line with government efforts to deliver on the promise to improve the country’s road network. The resultant overall budget deficit is projected to be GH¢18.9 billion (4.7 percent of GDP).

Deficit containment anchored on resource mobilization

Given the revenue under-performance for the first 9 months of 2019 (86.4% performance), Government will focus instead on efficiency of already imposed programs and base broadening in 2020. To achieve this, the government will: Renew and extend the National Fiscal Stabilization Levy (5%) and Special Import Levies (SIL) (2%) for another five years (2020-2024). Pursue non tax revenue inflows associated with the operations of some telecom companies and State-Owned Enterprises. Adjust the personal income tax bands to exempt the 12% minimum wage increase from tax. Review other personal reliefs such as marriage relief, child education relief and old age relief upwards.

Projected Budget Deficit

The projected Budget deficit of GH¢18.8 billion is expected to be financed from local and foreign sources The government intends to finance the GH¢18.8 billion budget deficit in 2020 from domestic sources (GH¢8.2 billion, 2% of GDP) and from foreign sources (GH¢10.6 billion, 2.7% of GDP). Ghana will borrow an additional USD3 billion in the international capital markets (USD1 billion of which will be used for domestic debt liability management) in 2020.

Re-Profiling of Government Debts

In 2019, Government continued to emphasize the re-profiling of the public debt balance by targeting the issuance of longer term, lower cost instruments, despite pressure from a slow down in the global economy, exchange rate volatility and the financial and energy sector bailouts. Government issued largely longer-term paper in the domestic market (with about GH¢1,490.0 million going towards contingent liabilities in the banking sector). A total size of USD3 billion Eurobonds was issued in February, 2019, while a total of USD 701 million in non-concessional loans was contracted in various sectors. As at the end of September 2019, the nominal public debt stock was GH¢208,565.18 million (60.55% of GDP, slightly above the 60% target) with external debt of GH¢107,166.78 million and domestic debt of GH¢101,398.4 million. Debt balances increased based on the need to provide bailout funds for the financial sector, as well as the depreciation of the Ghana cedi against major currencies.

By Strategic African Securities and/or its affiliates (collectively “SAS”).

The data contained in this document is based on material we believe to be reliable; however, we do not represent that the data is accurate, current, complete, or error free. Assumptions, estimates and opinions contained in the document constitute our judgment as of the date of the material and is subject to change without notice. There is no obligation to update, modify or amend this document or to otherwise notify the recipient if information, opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. The document may not be reproduced or distributed, in whole or in part, without the express prior written approval of SAS and/or its affiliates. The document does not constitute investment advice and SAS is not acting in a fiduciary capacity with respect to you or any other party. Any offering of any security or other financial instrument that may be related to the subject matter of this communication (a “financial instrument”) will be made pursuant to separate and distinct documentation (a “prospectus”) and in such case the information contained herein will be superseded in its entirety by any such prospectus in its final form. In addition, because this communication is a summary only, it may not contain all material terms and this communication in and of itself should not form the basis for any investment decision. To the extent that one has been prepared, the recipient should consult the prospectus for more complete information about any proposed offer of any financial instrument.

Before entering into any transaction or making any investment decision the recipient is strongly advised to seek their own independent advice in relation to any investment, financial, legal, tax, accounting or regulatory issues discussed herein. Further you should take steps to ensure that you fully understand appropriateness of the action in the light of your own objectives and circumstances. You should also consider seeking advice from your own advisers in making this or any other assessment. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed.

This communication and the information contained herein is CONFIDENTIAL and may not be reproduced or distributed in whole or in part without the prior written consent of the company that prepared this communication. The distribution of this document and availability of these products and services in certain jurisdictions may be restricted by law.

SAS hereby specifically disclaims all liability for direct, indirect, consequential or other losses or damages, including, but not limited to, loss of profits, that may arise from any reliance on the data, or for the reliability, accuracy, completeness or timeliness thereof, or for any delays or errors in the transmission or delivery of the document.

RATING RATIONALE

Strategic African Securities endeavors to provide objective opinions and recommendations. SAS assigns ratings to its stocks according to their notional target price vs. current market price and then categorizes them as Strong Buy, Buy, Hold and Sell. The performance horizon is one year unless specified and the notional target price is defined as the analysts valuation for a stock.

Strong Buy: >45% for large caps/midcaps, respectively, with high conviction;

Buy: >20% and <45% for large caps/midcaps;

Accumulate: Between 15% and 20%;

Hold: Between -5% and 15%;

Sell: Below -5%;