This is a time for good judgement as a bumpy road is expected ahead in terms of investment performance.

Active fund managers often find transient market volatility to be thrilling as the short-term dislocations become stimuli for alpha (returns on investments in relation to their benchmarks). This was the case in the first quarter of 2019 as we took advantage of the temporary dislocation in the yield curve brought on by currency weakness.

However, sustained periods of market stress can numb sentiments, converting optimism into apprehension. It is in these episodes that portfolio resilience is truly tested.

The 2nd Quarter of 2019

This was the case in 2nd quarter of 2019 as we struggled to maintain a balance between risk and return in both the capital and money markets. Bullish sentiments accompanying a successful Eurobond issuance had quickly fizzled into cautionary plays. This was underpinned by concerns over lower-than-expected fiscal performance, a fragile financial sector and energy sector strangulation. The triple effect of these shocks reflected in the mounting pressures on the central bank’s international reserves.

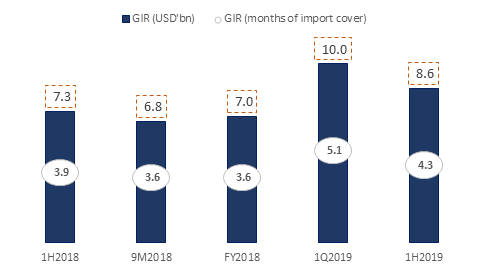

Ghana: Gross international reserves (GIR)

Lower-than-expected fiscal performance

On the macro front, although the economy expanded by 6.7%1 y/y in 1st quarter of 2019 amid indicators which largely pointed northwards, what occupied the minds of investors were the disappointing revenue numbers for 1st half year of 2019.

Government revenue performance as at 1st Half of 2019

| Description | Actual (GHSbn) | Budget (GHSbn) | Variance () |

| Tax revenue (non-oil) | 17.5 | 19.3 | -9.3% |

| Oil revenue | 1.9 | 2.7 | -29.6% |

| Non-oil Non-tax | 2.2 | 2.8 | -21.4% |

| Other revenues | 0.9 | 1.5 | -40.0% |

| Grants | 0.2 | 0.6 | -66.7% |

| Total revenue and grants | 22.8 | 26.9 | -15.2% |

Source: Ministry of Finance

Lower revenue numbers led to a wider fiscal deficit than envisaged for 1st Half of 2019.

Government overall budget balance and financing as at 1st Half of 2019

| Description | Actuals (GHSbn) | Budget (GHSbn) | Variance |

| Overall budget deficit (cash) | 11.5 | 9.9 | 16.2% |

| % of GDP | -3.3% | -2.9% | 400bp |

| Domestic financing | 2.1 | 0.3 | 600.0% |

| Foreign financing | 9.3 | 9.6 | -3.1% |

| Primary balance | -2.6 | -0.2 | 1200.0% |

Source: Ministry of Finance

The lower numbers informed the decision by government to increase communication tax to 9% from 6% and energy sector levies by GHp20 per litre for petrol, and GHp8 on LPG. Government believes the new tax increment will improve revenue numbers for the second half of the year.

Increased Expenditure & Financial Sector Clean-up

In spite of the increase in taxes we find the request by government to expand the expenditure envelope from GHS78.7bn to GHS 85.1bn a cause for concern, given the country’s debt levels. The new spending will increase the fiscal deficit to -4.5% from a budgeted -4.2% of GDP. This raises the risk to the fiscal outlook amid the rising clean-up cost in the financial sector.

Breakdown of the bailout funds

| Description | FY2017 (GHSbn) | FY2018 (GHSbn) |

| Banking sector costs | 10.3 | 1.5 |

| GCB resolution bonds (UT, Capital Bank) | 2.2 | |

| CBG resolution bonds (Unibank et al.), the first tranche | 3.2 | |

| CBG resolution bonds (Unibank et al), the second tranche | 4.4 | |

| CBG equity injection | 0.5 | |

| CBG resolution bond (Heritage, Premium) | 1.5 | |

| SDIs costs | 4.0 | |

| MFI clean-up | 1.0 | |

| Savings and Loans and Finance Houses clean-up | 3.0 | |

| Total costs | 10.3 | 5.5 |

Source: International Monetary fund (IMF)

We believe that the expansion in spending amid lower-than-budgeted revenue numbers and rising cost of financial clean-up exercise will have a huge knock-on effect on yields. Given the country’s current fiscal performance, any potential gains from a favourable external environment such as a Federal Reserve interest rate cut is likely to be undone. Consequently, we believe the impact of the recent cut in the U.S Federal Reserve interest rate will be mild on local currency assets.

Liquidity constraints and depressed asset prices

In addition to the GHS 15.8bn in bailout funds for the banks and NBFIs, there is an estimated GHS 5.0bn at risk in the investment advisory space according to the Securities and Exchange Commission. While this may not require a government bailout, the regulatory decision to clean-up the sector has led to a liquidity crunch.

In our opinion, the clean-up is laudable; however, the liquidity crunch has also impacted schemes in good standing with the regulator. Investors with locked-up funds in non-compliant schemes have had to resort to redemptions from compliant schemes to meet their liquidity needs. Panic redemptions have also affected some compliant schemes as the pace of withdrawals outstrip inflows. Consequently, fund managers have had to sell assets at fire-sale prices, particularly in the equities and real estate sectors leading to depressed asset values.

In effect, local fund managers who prior to Half year 2018 were the key drivers of demand on the Ghana Stock Exchange (GSE) are now exiting with little regard to price due to redemptions.

Energy sector wobbles account for a leaky reserve

The Cedi depreciated by 3.3% in 2nd Quarter of 2019 compared with 5.2% in 1st Quarter of 2019. The moderate depreciation in 2nd Quarter 2019 was mainly supported by a successful Eurobond issuance which propped up the Bank of Ghana’s reserve position from 3.2 to 5.1 months of import cover. However, the government’s huge commitments towards some power purchase agreements coupled with an average of USD 20m in weekly auctions have weakened the reserves to 4.3 months of import cover as at the end of 2Q2019. However, proceeds from the cocoa syndicated loan in 3Q2019 are likely to shore up the country’s reserve position and thus expect moderate depreciation of the local currency for the rest of the year.

Energy sector debts

| Description | (USD’bn) |

| Net sector arrears, January 2019 | 2.7 |

| Sector costs, FY2018 | 0.5 |

| Sector costs, 1H2019 | 0.6 |

| Estimated sector costs for FY2019 | 1.0 |

Source: Government of Ghana Half year 2019 Budget review statement

According to the Finance Minister, the service costs to the government will accumulate to USD 12.5bn by 2023 if nothing is done to resolve debts surrounding the energy sector comprehensively. We think that the increase in the energy sector levy and conversion of take-or-pay to take-and-pay energy contracts will improve funding for the country’s power sector. However, we believe currency depreciation could undermine these new measures as most of the contingent liabilities are denominated in U.S. dollars.

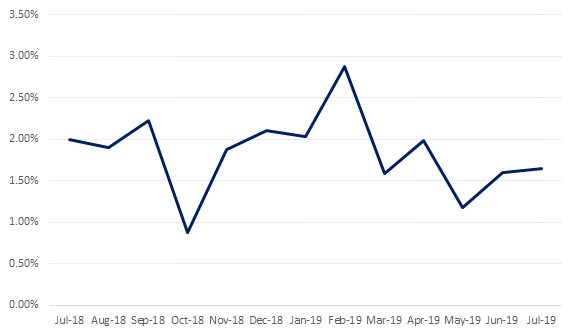

Our view on the macros

Since the beginning of the year, we have indicated our concerns about the short-term outlook of the economy on the back of challenges within the financial sector, energy sector, and lower-than-expected fiscal performance. Short term concerns, together with an expansionary expenditure envelope, makes the local currency vulnerable to external shocks. Currency vulnerabilities could force off-shore investors to sell their longer-dated securities at higher yields and thus force a return to a wider spread between the 15-year treasury bond and its 1-year counterpart over the next 12 months.

Evolution of yield spread: 15yr -1yr Treasury bond yield spread

How we have positioned based on what we expect

The collapse in yields in 1st Quarter 2019 has lowered our expectations for bond returns for the rest of the year. However, considering that we are largely at the end of monetary tightening by major Central Banks, we believe that rates will remain range-bound for the rest of the year.

Rates

We see income or carry reassertion as the critical driver of bond market returns, taking back the reins from price appreciation as we head to the last quarter of the year. We will remain biased towards the front end of the curve as the likelihood of investor uncertainty and anxiety remains high. Consequently, the opportunities to juice up returns through relative-value trading still exist in the market.

Credit

Our view on credit has not changed since the 2nd quarter in 2019; we believe that credit offer less compensation for more risk. However, given the cap of 60% allocation to risk-free assets for pension funds, we are hamstrung to hold credit. We intend to engage the pension regulator to have a rethink on the current asset allocation of private pension funds in Ghana.

Equities

For equities, despite the disappointing stock market performance, we remain steadfast in our convictions and believe that our concentrated position will deliver growth in the medium to long-term. That notwithstanding, given the shallow depth and relatively smaller size of the local stock market, we believe an activist private equity investing approach towards managing listed equity portfolio is the best route for our clients. This will enable us to eliminate the volatility that is associated with the local bourse.

Issac Adomako Boamah, CFA

Isaac is the Chief Investment Officer (CIO) of IC Asset Managers, Ghana