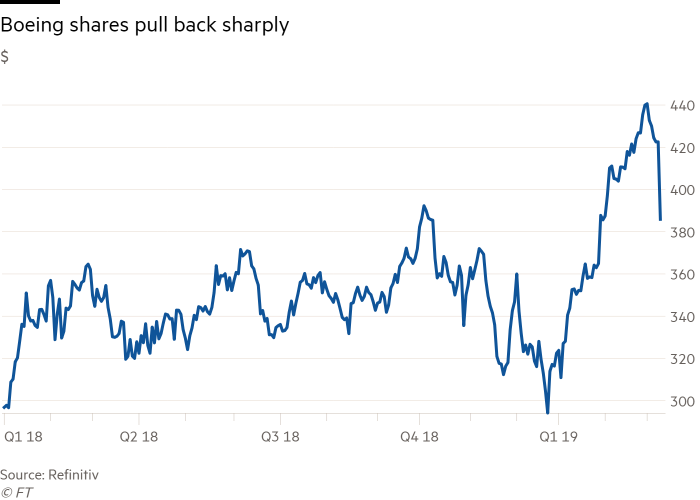

Boeing shares dropped sharply on Monday, leaving them at risk of posting the heaviest fall since the aftermath of the September 11 terrorist attacks, following the second deadly crash of one of its flagship jets in five months.

Ethiopian Airlines flight ET302 on Sunday lost contact with air traffic control six minutes after it departed Addis Ababa airport for Nairobi, then plunged to the ground, killing all 157 people on board. The crash involved the same kind of aircraft as a Lion Air crash in Indonesia that killed 189 passengers and crew in October. Both flights used the 737 Max, one of Boeing’s most important commercial aviation programmes. The blue-chip company has garnered more than 5,000 orders for the 737 Max, having delivered 300 737 Max aircraft since the first delivery on March 2018.

ALSO READ: Ethiopia Joins China in Grounding Boeing 737 Max Jets After Crash

Shares in the world’s largest aerospace group tumbled 12 per cent just after the opening bell on Wall Street. That leaves them poised for their worst trading day since September 17 2001, when the shockwaves of the worst terrorist attack on US soil were being felt throughout the industry. The drop knocked $28.1bn from Boeing’s market value and dragged the Dow Jones Industrial Average, of which Boeing is a member, by 337 points.

China’s aviation regulator has told domestic airlines to suspend

Credit: FT