Bank of Baroda Ghana is auctioning its properties which include chairs and water dispenser as it prepares to finally pack out of Ghana.

The auction according to sources is the final stage of the bank’s voluntary liquidation process, which started in December 2018.

The decision to wind up the Ghana operations is in compliance with an order from the parent company of the bank, Bank of Baroda India, the bank said in a release in December last year.

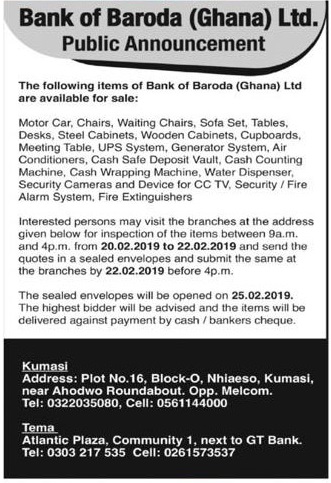

In a public notice published in the Wednesday edition of the Daily Graphic newspaper, Bank of Baroda Ghana said it was selling its motor car, chairs, waiting chairs, sofa set, tables, cash safe deposit vault, cash counting machine and fire extinguishers, among others.

According to the notice, interested persons are to visit the bank’s branches for inspection between 9am and 4pm from February 20 to February 22.

It said those interested should send the quotes in sealed envelopes and submit to its branches.

“The sealed envelopes will be opened on February 25. The highest bidder will be advised and the items will be delivered against the payment by cash/bankers cheque.

ALSO READ: Bank of Baroda clarifies its deal with Stanbic Bank Ghana

Bank of Baroda Ghana has provided the facts about a deal it entered with Stanbic Bank Ghana following its intention to voluntarily wind up operations in Ghana.

According to the Bank, the decision to wind up commenced in December 2017 when the shareholders of Bank of Baroda (Ghana) Ltd. (BOBGL), accorded approval for the closure of BOBGL.