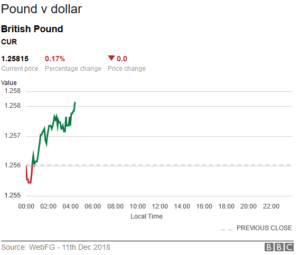

The pound’s fall has accelerated after the prime minister confirmed she would defer the vote on her Brexit deal.

It had already fallen 1% earlier on reports of the delay, but fell further as Theresa May addressed Parliament.

Sterling remained weak on global exchanges after markets closed in London, down almost two cents against the dollar at $1.2562, close to its lowest level since April 2017.

It was 1% lower against the euro at €1.1059, its lowest level since August.

Meanwhile, the domestically focused FTSE 250 share index fell 2%, hitting its lowest since December 2016.

The steep falls reflect mounting uncertainty about the terms of the UK’s exit from the European Union, analysts said.

“Until the market knows what will happen with respect to Brexit one way or the other then they [traders] will remain extremely anxious,” said Jane Foley, head of foreign exchange strategy at Rabobank.

Ms Foley said the threat of a hard Brexit, under which the UK leaves the EU without a deal, as well as the continuing political uncertainty was “an extraordinary and toxic mix” for the pound.

“Once we know what is happening, things will be more settled,” she added.

This week had always been expected to be a volatile one for the pound because of the vote on Tuesday, which has also heightened political uncertainty.

Dozens of Conservative MPs had been planning to join forces with Labour, the SNP, the Lib Dems and the DUP to vote down Mrs May’s deal.

Neil Mellor, currency strategist at BNY Mellon, said the pound’s movements were directly linked to the current political uncertainty.

But he said there was also a question of valuation and how investors “price in Brexit”.

The pound’s movements over the past decade suggested that the pound could be spared a “drastic fall” over a prolonged period, he said.

Mrs May made a statement to MPs at 15:30 GMT, confirming that the vote would be delayed because it “would be rejected by a significant margin”.

She said MPs backed much of the deal she had struck with the EU, but there was concern over the Northern Irish backstop.

She said she believed she could still get the deal through if she addressed MPs’ concerns.

And that, she added, was what she intended to do in the next few days.

However, Speaker John Bercow – who chairs debates in the House of Commons – called on the government to give MPs a vote on whether Tuesday’s vote should be cancelled, saying it was the “right and obvious” thing to do given how angry some MPs were about the cancellation.

Eoin Murray, head of investment at Hermes Investment Management, said: “The vote could be delayed for as little as a week, or even put off until January. At this stage, it is unlikely to directly impact the timing of the Article 50 process, as Prime Minister May has repeatedly refused to countenance shifting that from the 29 March date.”

However, there is a theory in the market that the turbulence could work in the government’s favour, encouraging MPs to back Theresa May’s deal to avoid a no-deal Brexit.

Silvia Dall’Angelo, senior economist at Hermes Investment Management, said: “In our – admittedly low confidence – base case, stress in financial markets and pressure from businesses should lead to a last-minute approval of the deal in Parliament.”

Dr Adam Marshall, director-general of the British Chambers of Commerce, said: “Avoiding a messy exit from the EU is a matter of national urgency. Efforts must be redoubled to find a route forward, while at the same time ensuring that preparations are stepped up to help businesses and communities deal with any potential scenario.”

Credit: BBC