The management of now-defunct Capital Bank used liquidity support given by the Bank of Ghana as capital to secure a license for another collapsed bank, Sovereign Bank.

The report cites an emergency board and Executive Committee meeting on October 13, 2015, which notes concern with the manner in which the Ghc 610 million liquidity support to the struggling bank was being used.

The monies were moved by a member of the Board, Ato Essien into companies believed to be owned by him and others.

The rest of the money was used to set up the Sovereign Bank.

“Funds raised through the commercial paper issuance by MC Management Services Limited and Breitling Services were used as capitalization for the establishment of the Sovereign Bank Limited.

“The placement of GHc 130 MC to Alltime Capital and GHc with Nordea Capital, was a round-tripping of the liquidity support from Bank of Ghana to set up Sovereign Bank,” the report said.

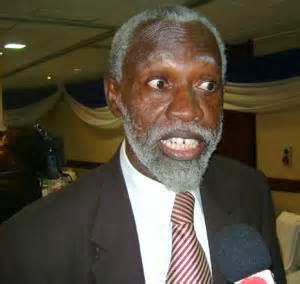

The report also indicated that Dr. Mensa Otabil may have been party to the misuse of liquidity support given the bank by the Bank of Ghana.

Among the flagged transactions were GHc 27.5 million used for business promotion and handled by a board member; transfers to IFS amounting to GHc 23.9 million, transfers to Nordea Capital amounting to GHc 65 million, and transfers to Alltime Capital amounting to GHc 130 million.

Concerning Alltime Capital, the report noted that “Mr. Ato Essien stated that the placement of GHc 130m with Alltime Capital was strategic and funds would be paid back by March 2016.”

Dr. Otabil also assured management that he would ensure the funds were returned by March 2016.

Alltime Capital provided evidence that it was acting as an arranger for two separate commercial papers purchased by Capital Bank and issued by MC Management services limited.

The commercial papers are seen to be signed for Capital Bank by both its CEO, Rev. Fitzgerald Odonkor, and Chief Business Officer, Horace Tettey, according to the report.

www.citibusinessnews.com