Savings consists of the amount left over when the cost of a person’s consumer expenditure is subtracted from the amount of disposable income he earns in a given period of time,according to Keynesian economics, as quoted by Investopedia.

The amount left over is sometimes left in the bank account over a period of time, sometimes over a year.

A recent report published by the Bank of Ghana (BOG) shows Commercial banks in Ghana pay between 3.4% to 16.40% as interest on deposits (savings); an average of 11.20% by all the banks. Click here for full Bank of Ghana Report on the rates.

There are some bank customers who are unaware or careless about these rates and are even happy by justseeing their monies remain in their accounts. However, there are others who complain of receiving minimal interest on their savings while others complain of not receiving at all. The banks are then happier keeping customers’savings with them. In fact, if it tends to span over a long period, banks go the extra mile by offering customers exceptional services such as assigning personal relationship managers.

The BOG report is to guide customers in making decisions regarding their savings/deposits/leftovers and what is being earned on them.

Let’s delve into some reasons people open bank accounts:

For Accessibility: To be able to make regular withdrawals during business hours. This is why Banks offer 24/7 ATM service and others for this purpose.

For EmergencyPurposes: Money is put aside to cover emergencies. For instance, an unexpected car repair, friends and family requests, loss of job, are supposed to be catered for by emergency funds

Savings for Retirement: The earlier this begins the less the requirement in future. In the period in life when one cannot engage in full time employment, it is necessary that a retirement fundworks for you.

Saving to make a down payment for House, Car:People save to use asdown payment for such facilities. This also provides an avenue for accessing loans. With banks,a better rate could be negotiated if the customer is able to provide a percentage of the cost of the product.

Savings to have fun: Another reason to save is to afford the luxury of a vacation.

Save for Sinking Funds: Sinking funds are set aside for improvements on car, house and other possessions. This fund can free the emergency fund.

To earn interest:the opportunity to earn an interest of“3.4%” is always better than to keeping the money under your pillow.

Savings for education:Additionally, people save for future education. Masters and doctorates can be achieved by taking the first steps of savings.Children’s education is also a factor to save money.

From the reasons above, it can be noted that apart from savings for accessibility,funds for the other reasons are likely to be kept for up to a year or more. In this case, the left overs.

Itis necessary to fish outgood returns in order not to lose money, especially to inflation, therefore, it is better to invest the money.

Again, according to Investopedia an investment is an asset or item that is purchased with the hope that it will generate income or will appreciate in the future. In an economic sense, an investment is the purchase of goods that are not consumed today but are used in the future to create wealth. In finance, an investment is a monetary asset purchased with the idea that the asset will provide income in the future or will be sold at a higher price for a profit.

From the rates published by the BOG, the rates quoted are mostly lower than inflation rate. Pointing to loss of purchasing power in real terms.

None of the rates also match up with rates offered by investment firms in the country, making it risky to save money over a long periodin a bank account.

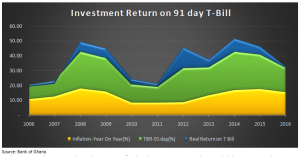

Treasury bills for example have over the period offered savers/investors cushion on inflation.

Game 1

Real return over the years on the 91 day Treasury Bills, though not very impressive, has provided the necessary cushion to protect the purchasing power of investors.

From the graph above, since 2006to 2016, it is realized that though real return is quiet slim, it’s still better than negative.

The Ghana Stock Market is also an avenue that gives appreciable returns.

game 2

Unilever Ghana Ltd, Enterprise Group Ltd, Ecobank Ghana Ltd, Fan Milk Ltd, Benso Oil Plantation Ltd, GOIL and GCB Bank are a few selections of companies listed on the Ghana Stock Exchange that have returned appreciably to investors. An average of 13.65% inflation rate is far below the average return of the seven stocks of 258%, when funds were kept from 2007 to 2016.

Bank savings accounts are not investment accounts. Opening bank accounts should not be to prime motive; how much we earn on our monies should also be of concern to us.

Author: Kofi Busia Kyei

Financial Analyst