Investing in any emerging market is complex, but perhaps none are quite as challenging as sub-Saharan Africa (SSA). Unlike the vast nations of China and India, whose respective economies are governed by a single fiscal policy and regulatory framework, sub-Saharan Africa is a patchwork quilt of vastly different economies and cultures. It is a continent dotted with a myriad of colonial histories, religions, languages, currencies and political systems. But Africa is, of course, evolving. In countries such as Angola, the banking sector is liberalised and operates in a free market and there is a much greater impetus from government to promote lending to SMEs. There are other challenges however. Unlike economic blocks such as the GCC or the EU, Sub-Saharan Africa has no singular regulatory body. So, companies looking for a pan-African approach need to work differently in each country. In Africa, one size never fits all, which makes it difficult for foreign companies or entrepreneurs to connect with the right kind of Venture Capital Company. All of these challenges raise fair questions – can we find a reliable local source of capital? Who can we partner with in the local market – and how? Who can introduce us to the right people in the supply chain? Are their venture capitalists we can rely on to help us succeed? Such questions might make investors think twice – but they shouldn’t.

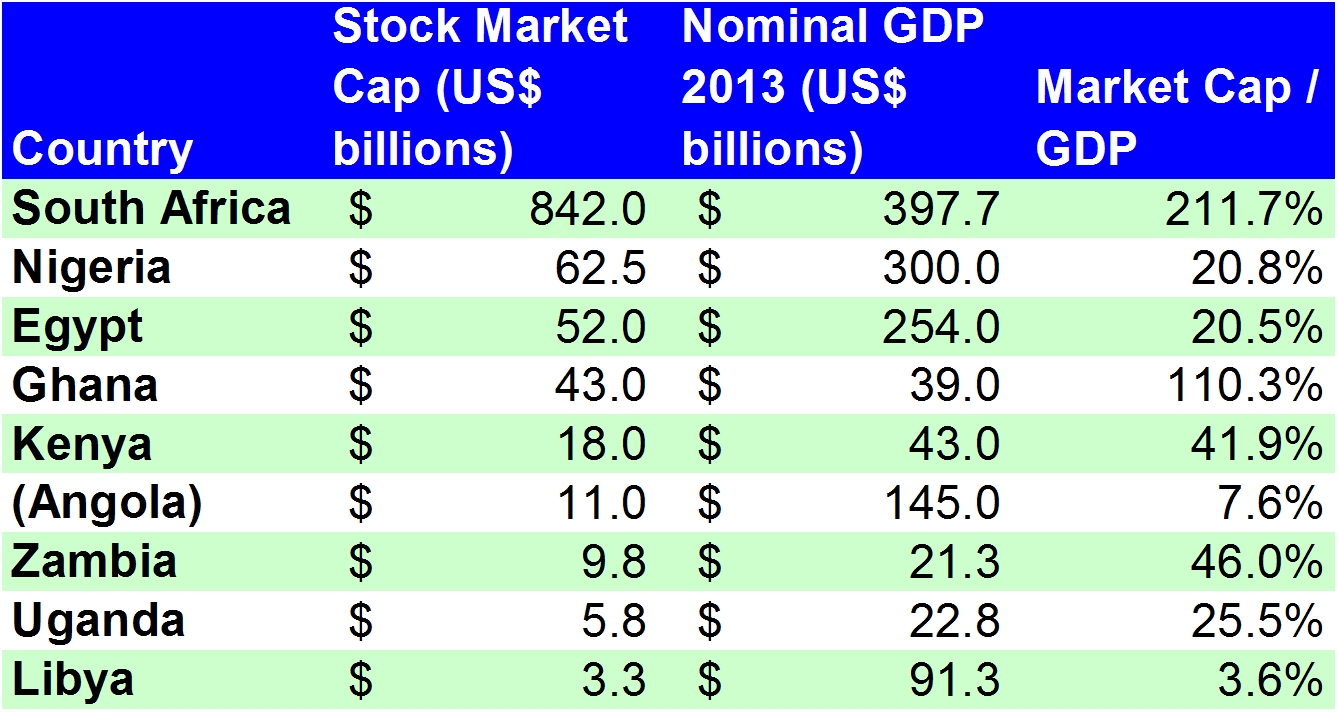

Africa’s top capital markets of 2014.

Africa’s top capital markets of 2014.

One of the first steps towards entering SSA and building a sustainable business is to understand the socio-economic needs of the region’s constituent countries. The key here is sustainability. African policymakers are acutely aware of the dangers they face from global companies that simply wish to swoop in, take advantage of their natural resources and then disappear. Investors should understand that any foreign company looking to invest in Africa will be scrutinized for the long-term social and economic impact that they have on the country. This doesn’t mean that businesses need to operate as charities in Africa, but they do need to bring something useful and long-lasting to the table. Foreign companies need to demonstrate that they are bringing innovation, skills and/or experience. Some countries regulate which type of companies can invest. Angola stipulates a minimum investment of $1 million and all companies entering the market are obliged to hire a quota of local workers. There are many tax incentives to make investing in Angola attractive, including preferable corporation tax rates and tax holidays for companies that invest in rural industries such as manufacturing. The government is happy to make it fiscally attractive to do business but on the grounds that the business respects African needs – investors in Africa need to serve the African people.

Africa-Stock-Market-Cap-Figures

Venture capitalists also need to understand this – and so too do firms looking to partner with VCs. A quick Google-search of venture capital companies in sub-Saharan Africa shows how dominated the VC scene is by companies from the other side of the world – global firms headquartered in Silicon Valley, Mauritius, Luxembourg and the Netherlands. Or, alternatively, VCs based in South Africa. These companies are often happy to invest in sub-Saharan Africa with low-risk ventures such as copycat companies, which introduce proven business models. However, while copycat investments and VC initiatives from outside of the region provide a quick return, they are often unsustainable because they are not driven by local innovation – they are implemented from the outside by managers. Copycat investments, specifically, often have limited scalability and are vulnerable to being displaced once the globally recognised brand then moves in to the market. For these reasons, such ventures are typically small-scale and geographically restricted. VCs that are currently operating in sub-Saharan Africa tend to service the entire region. They offer breadth, international expertise and deep pockets – but as foreign firms spending cash on setting up shop themselves, they are largely driven by profit. This is not what Africa or global investors need. So how can international companies work with a VC that is driven by more than profit and that can help them to build a business that is relevant and sustainable?

africa-2

The solution may be to bypass foreign VCs and go directly to government. Angola benefits from a VC created by the government in order to support the diversification of the Angolan economy. The Fundo Activo de Capital de Risco Angolana (FACRA) is one of the largest equity funds in Africa, with the equivalent in the local currency Kwanzas to $250 million in financial assets under management. The advantage of a state-backed VC is that it has a greater interest at heart – to stimulate innovation and enterprise in the entire country. Whilst it can obviously do this by investing directly in Angolan businesses, it also partners international best-in-class companies with growing local businesses and entrepreneurs. Unlike profit-centric foreign VCs, FACRA proactively searches for opportunities to bring new technologies and skills in to the country – for the country’s sake. This is great news for companies that are looking for a way to enter the market and even better news for aspiring Angolans.

Companies that choose to work with government-backed VCs like FACRA gain an immediate advantage because they are working directly with a government-backed organization, meaning that they receive first-hand guidance on laws and government regulations, and all of the other practical aspects of entering a new market. In this respect, FACRA acts as a one-stop-shop for foreign entrepreneurs and co-investors.

FACRA held its first annual FACRA Day symposium on 22nd January 2015, an event that saw international investors come to Angola to learn about ways and incentives to do good business in Angola. This initiative enables FACRA to kill two birds with one stone: to identify great businesses opportunities that it can directly support – but also to bring FDI in to the frame by providing co-investment opportunities for non-African firms. Holding an event such as this enables promising Angolan companies to showcase their business and meet with potential investors. In addition, it helps the government stimulate growth of the SME sector and provide significant added value for foreign investors.

For foreign companies, this guidance is priceless. It provides an immediate in-road to the marketplace and the supply chain, it means working with a VC that actually understands the local market and it means entering the market in the right way. African countries such as Angola have a great need for international expertise in areas as diverse as technology, agriculture, manufacturing, chemical/pharma industry, health services, fish farming, poultry farming and the services sector – as long as they have an high component of innovation. These needs present foreign companies with huge opportunities to break new ground in the Angolan market and to create a positive impact on the Angolan economy.

By Teodoro de Jesus Xavier Poulson,

Teodoro is a Member of the Investment Committee of FACRA. Poulson leads FACRA’s overall investment strategy and helps to source investment opportunities in Angola and across the Sub-Saharan African region.