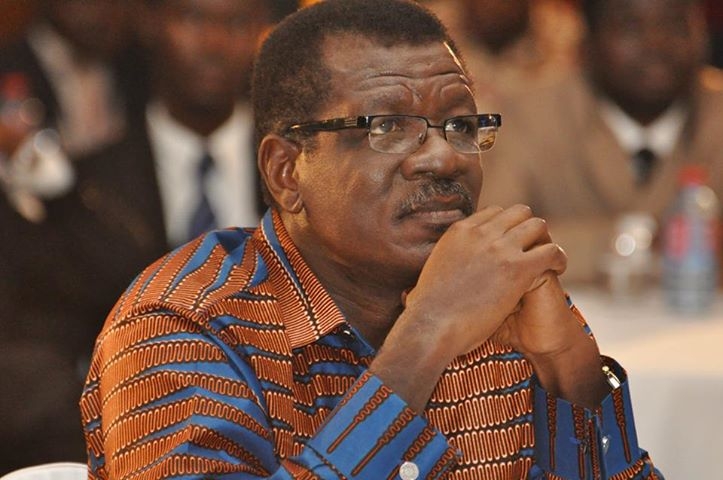

Managing Director of the Ghana Stock Exchange (GSE) Kofi Yamoah has reiterated calls for the enactment of a law that will compel huge multinationals operating in key sectors of the economy to list on the market.

The GSE boss argues that there are huge multinationals operating in areas of the economy such as telecommunications, mining and banking that are not listed on the stock market.

Presently there are more than 30 companies listed on the local market. While these companies cut across manufacturing, banking, pharmaceutical and agricultural sectors, the GSE boss argues that the market “does not reflect the true barometer of the economy.

“We need to create wealth for Ghanaians by making sure that all the sectors are well represented on the stock exchange. Why can’t we have the telecoms being represented on the market if they claim they have mobile penetration of more than 90 percent?” he asked.

While the leaders of the GSE have continuously argued for the enactment of a law to compel multinationals to list on the local bourse, industry players have disagreed as such a measure would affect business and investor confidence.

Mr. Yamoah, who was speaking at a panel discussion held by the Central Securities Depository as part of events marking its 10th anniversary celebrations, said a bigger stock market would ensure a proper distribution of wealth.

However, opponents of the GSE’s stance say rather than a law compelling companies to list, GSE should provide more incentives to lure companies to list on the local bourse. According to the Ghana Revenue Authority (GRA) listed companies enjoy a 22 percent concessionary corporate tax rate as against the regular 25 percent.

Kwaku Sakyi-Addo, CEO of the Telecoms Chamber whose industry has been targetted by proponents of this local content policy for the stock exchange, has warned of the disadvantages of pressuring companies to list.

Commenting on the issue, he said: “You ought to be careful about using compulsion when you are dealing with investments…If you want to drive companies toward a certain direction, you use incentives rather than compulsion. Once you provide the incentives, you leave them to take their business decisions. If it’s good business case, they will go for it. When we use compulsion, we will end up driving away investments.”

CSD anniversary

The Bank of Ghana spearheaded the Central Securities Depository’s (CSD) establishment in 2004, alongside the introduction of an Electronic Auction system to handle the issue, custody, dealing and redemption of government securities.

Under the CSD system, there is total elimination of risk such as the loss, mutilation and theft of certificates associated with holding and trading the paper-based securities of investors. The CSD system ensures Delivery vs. Payment (DVP) where securities and funds are settled simultaneously.

Source: B FT