The remoteness and size of Small Islands Developing States (SIDS) limit FDI options, but despite the limiting factors, FDI to SIDS as a group is very high compared to the size of their economies, a new report by the United Nations Conference on Trade and Development (UNCTAD).

The report, which considered 29 SIDS, including Seychelles and Mauritius located on the Indian Ocean off the coast of Africa, however conceded that the constraints identified are reduced when “low competitive pressures result in relatively high market shares for market-seeking FDI, mitigating the impact of the small size of the market and making some SIDS – in particular those with relatively high purchasing power –attractive niche destinations for specific services such as retailing, telecommunications, and energy.”

UNCTAD noted that for efficiency-seeking FDI, the development of information and communication technologies (ICT) has opened up opportunities in new areas that are not sensitive to transport costs, provided a skilled labour force and access to telecommunication and information networks are available.

Structural Characteristics Limiting FDI Options

For Seychelles and Mauritius, like other SDIs, their small market size, remote location, narrow resource base, and high vulnerability to natural disasters limit the nature and the scope of economic activities that can be developed in these countries.

The smallness and remoteness of SIDS puts them at a disadvantage when it comes to production for local consumption as well as for exports. The situation gets worse when local production is more dependent on imported goods, as transport costs are high; especially with air and sea transport being the only options for the movement of goods and people. This makes SIDS less attractive to market-seeking FDI and to FDI aiming at the export of goods, with the exception of raw materials.

SDIs’ GDP Dwarfs world avearge

These limitations, according to the report has presented opportunities for some foreign investments, as the ratio of inflows to current GDP over 2004–2013 was almost three times the world average and more than twice the average of developing and transition economies. The ratio of stocks to current GDP also reached 72 percent, more than twice the world average at 30 percent. FDI flows and stocks per capita are also higher than the world and developing and transition economies average, but lower than developed economies.

Fiscal advantages invite investments to Seychelles and Mauritius

According to UNCTAD, Seychelles and Mauritius are two of the most attractive SIDs for FDI due to their fiscal advantages to foreign capital. Those rich in mineral resources and those with relatively bigger market size are also attractive for FDI. SIDs that combine small size to remoteness, small population, low income, and lack of natural resources will however discourage FDI.

companies move to low-tax countries

companies move to low-tax countries

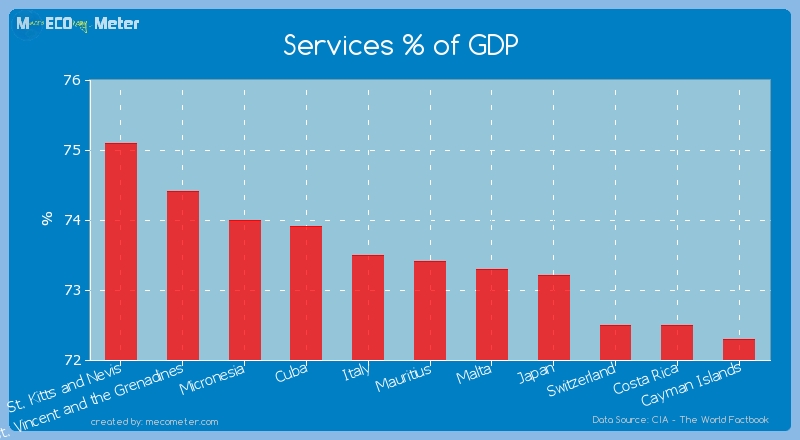

Investments soar in Mauritius’ service sector

For lack of sectoral data, which is available for very few SIDs, investment into different sectors could not be evaluated for Seychelles. In Mauritius, FDI flows are directed almost totally to the services sector, with activities such as finance, hotels and restaurants, construction and business experiencing soaring investments in the period 2007–2012.

Using information on greenfield FDI projects announced by foreign investors in the SIDS between 2003 and 2013, UNCTAD however found out that Seychelles was one of the favourite destinations of investors interested in Hotels and restaurants, the other being Maldives in Asia. Hotels and restaurants gulped 12 percent of total greenfield FDI projects announced by foreign investors.

US important investor in SIDs; China following closely

Although only three SIDs – Cabo Verde, Papua New Guinea and Trinidad and Tobago – provide official information on the origin of the FDI they receive, with investors from developed economies identified as the main source of FDI, according to the report. US is however believed to be the largest source of FDI for Seychelles, while Mauritius’ relations with India and China has been said to be for historical and commercial reasons.

Multinational oil companies have explored the waters around the Seychelles islands, but no oil or gas has been found. The country however signed a deal with US firm Petroquest in 2005, that gave it exploration rights to about 30,000 km2 around Constant, Topaz, Farquhar and Coëtivy islands until 2014.

Information on greenfield FDI projects announced by foreign investors in the SIDS between 2003 and 2013 confirms however, that developed countries are the source of almost two thirds of the announced value of greenfield FDI projects.

The UNCTAD report noted that Transnational Corporations (TNCs) from developing and transition economies have focused their interest mainly on Mauritius and three other SIDs – Papua New Guinea, Maldives and Jamaica, which together accounted for 89 percent of developing and transition economy TNCs’ planned capital expenditure in SIDS.

UNCTAD noted that China is becoming a large investor, coming third place after the United States and Australia as a source of announced greenfield FDI projects. Chinese TNCs have pledged $5 billion in capital expenditures in the SIDS in the period 2003-2013, mainly targeting Papua New Guinea and Jamaica. The Asian giants have been enhancing economic links with SIDs since the mid-2000s; this is expected to continue.

investors look to invest in Mauritius tourism

investors look to invest in Mauritius tourism

Opportunities for sustainable development in Mauritius and Seychelles

Although their structural characteristics significantly limit investment prospects, SIDS have still attracted relatively high amounts of FDI, especially in natural resources. The report noted that foreign investors have also increasingly been targeting a number of other industries, including financial services, tourism and offshore business services that are sometimes linked to the locational advantages of SIDS.

Seychelles has attracted significant FDIs in its tourism sector; this is expected to continue. The sector also holds promise for other SIDs.

High value-added financial services activities have prospered in Mauritius, Seychelles, as well as several other SIDS, that have become hosts

of offshore financial centres (OFCs), driven by incentives such as favourable tax regimes, efficient business registration, secrecy rules and lax regulatory frameworks.

FDI flows to the SIDS have been shown to target precisely the activities that contribute most to SIDS’ growth. While these countries exploit the environment to grow the economy; as their small size means that development and the environment are closely interrelated; it is important to ensure the competition for land and water resources among tourism, agriculture and exploration for natural resources is balanced as ‘overdevelopment’ of one sector may be detrimental to another and on the long run affect the economy, UNCTAD advises.

Source: Ventures Africa