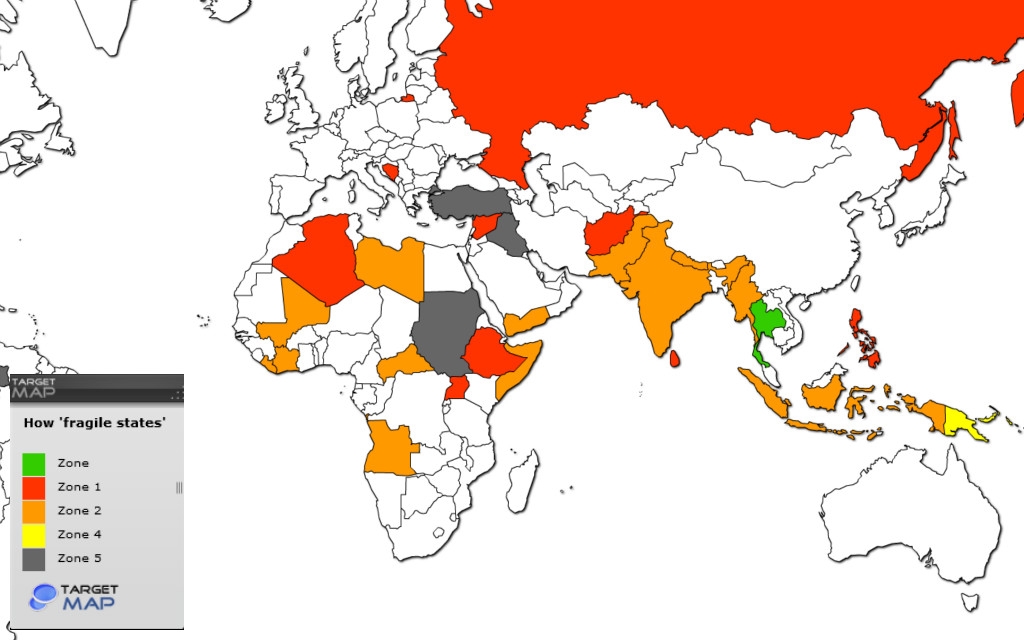

A recent list by Washington-based Fund For Peace Fragile State Index has Sudan, South Sudan, Somalia, Democratic Republic of Congo and the Central African Republic top the record of fragile African countries in business terms.

The non-profit research institute also listed countries within the Middle East among those with poor ratings.

The report described the challenges faced by South Sudan alone as enormous with the country’s distorted political system and the attendant military and militant attacks. It is almost impossible that South Sudan will give up the top position in this ranking in a short time, the report said.

These economies all showcase a common characteristics; a relatively thin GDP with a small population and have once dealt with, or currently dealing with spats of violence (terrorism or war).

World Bank estimates suggests that Somalia’s 2013 Gross Domestic Product (GDP) stood at $2.6 billion. However, a population of 9 million, showed a poverty rate in excess of 73 percent. As the militancy of Al-shabaab continues unabated, investors worry that the war ridden nation offers little in terms of investment safety and stability.

According to the global lender, Sudan has been facing hard economic times with high inflation – a result of heavy fiscal deficit financing – crippling consumer spend. The country, after the secession of South Sudan in July 2011, has suffered the brunts of a very low economic growth, the report claimed.

Sudan has a population of 11.3 million people and holds a GDP of $14 billion. Analysts worry that only the risk loving investors can dare to venture into this economy. Also, with the population of 4.5 million and a GDP of $1.5 billion, Central African Republic (CAR) is yet rated mostly as one of the unstable countries in the globe. After the 2013 overthrow in Bangui of former President Francois Bozize by Seleka – the rebel group which was condemned by the United Nations (UN) – the country has seen a rise in political instability.

Business analysts worry that investors might be slow in their quests to maximize investment opportunities in the troubled African countries.

Source: ventures AFrica