The Ghana Stock Exchange (GSE) in 2018 raised a total of GH¢2 billion on the local bourse, this is as against the 2017 financial year when no capital was raised.

The amount was raised through the listing of two new companies which raised a total of GH¢1.15 billion and the floating of additional shares from nine other companies.

The nine companies, which included Access Bank, Societe Generale, Republic Bank, and Standard Chartered Bank, raised a total amount of GH¢906 million.

The two new companies which listed on the bourse last year are MTN Ghana which listed on the main exchange after raising a record GH¢1.14 billion and Digicut which listed on the Ghana Alternative Market (GAX) after raising GH¢28 million.

This was disclosed by the Managing Director of the GSE, Mr Kofi Yamoah, at a press briefing in Accra.

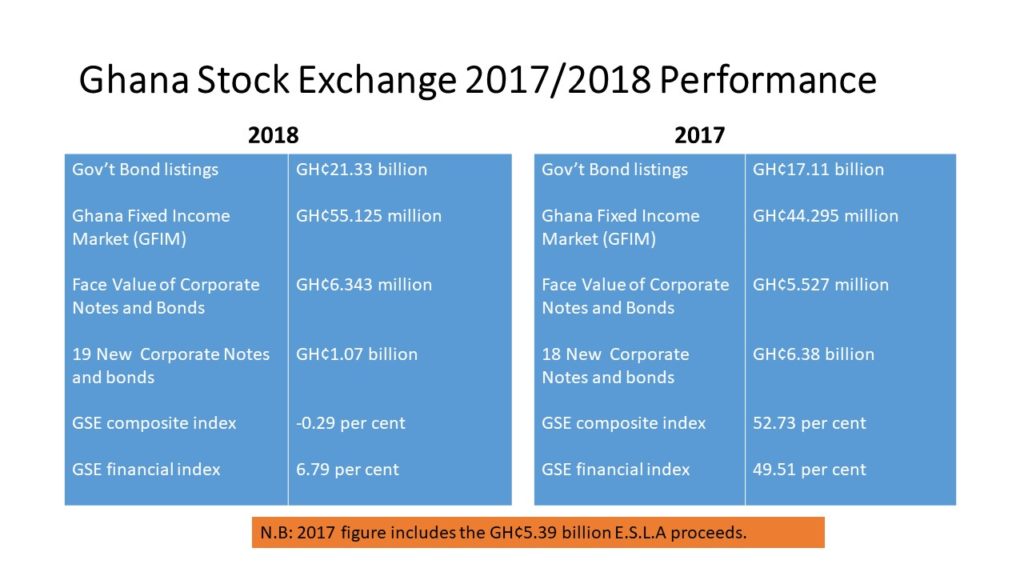

Below is a comparison of 2017 and 2018 GSE performance

The Market, however, witnessed strong interest from corporates for the issuance of fixed income securities and also witnessed a flurry of corporate actions, including rights and bonus issues by listed banks towards meeting the new GH₵400 million capital requirement.

The year 2018 also saw a representation of the telecom industry on the local bourse following the listing of telecom giants, MTN.

However, three non-performing equity securities were de-listed; Golden Web Limited, Transaction Solutions Ghana Limited and Kitchenware Limited (PKL)

Touching on why the composite index and the financial index underperformed, Mr Yamoah said it was due to high interest rates, the stronger US dollar against the cedi, focus on recapitalisations and the BoG’s cleaning of the banking sector, and mixed results of some of the key securities that drive the GSE composite index.

Ghana Stock Exchange Outlook for 2019

On the outlook for 2019, he said the GSE intended to support the BoG, Central Securities Deposits, MoF and dealers in finalising work and implementing repurchase agreement transactions on the Ghana Fixed Income Market.

He said it was also looking at introducing securities lending and borrowing, working on the deployment of mobile application for secondary trading of listed securities, and improving market compliance by dealers and issuers through the use of technology.

ALSO READ:

Ghana Stock Exchange delists Pioneer Kitchenware Ltd (PKL)