Financing options for low-income countries expanded over the past decade

Increase in debt vulnerabilities in last two years

Less favourable global environment calls for fiscal prudence, improved debt management

More diverse financing sources can raise new opportunities but can also pose risks, said a joint IMF-World Bank report on public debt vulnerabilities in low-income countries.

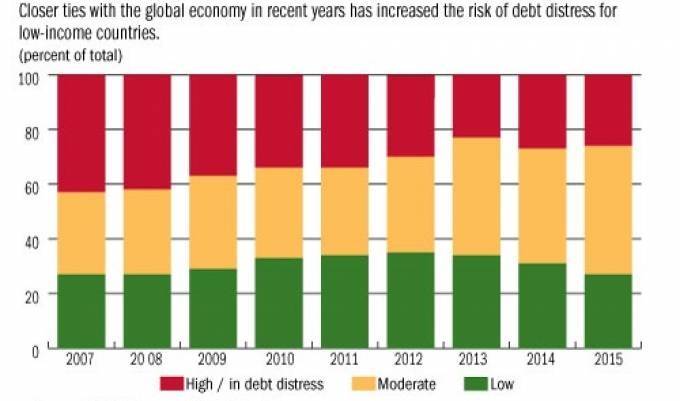

While the share of low-income countries at high risk fell by almost half between 2007 and 2013, debt vulnerability has actually increased in the past two years (see Chart 1).

According to the report, which looks at 74 low-income countries, public debt trends have changed significantly over the past decade. Debt relief programmes, strong growth, and high demand for commodities, drove the average debt-to-GDP ratio down from 66 percent in 2006 to around 48 percent at end-2014 (see Chart 2).

The changing financing landscape, pros and cons

Good macroeconomic performance in many low-income countries — especially frontier-market economies — helped expand their financing sources through increased access to external markets. The study shows the share of non-concessional to total external debt broadly doubled between 2007 and 2014 for frontier-market economies and commodity exporters (see Chart 3).

Moreover, of the 74 countries covered by this report, 13 issued Eurobonds during 2010–14, with each market issue providing average financing equivalent to 3.2 percent of GDP (see Chart 4). And analysis suggests that low-income countries’ bond issuances have been mainly driven by greater economic development, although ample global liquidity has also helped.

The study also shows that issuance of Eurobonds is generally not associated with a near-term loosening of fiscal policy. Thus, issuers substitute bond proceeds for other forms of financing rather than increase expenditure in the short run. At the same time, access to international capital markets appears to reduce financing constraints, providing countries with more flexibility to conduct discretionary fiscal policy.

Borrowing from domestic markets is also on the rise, most importantly in frontier markets. For these countries, domestic public debt increased from 14 to 19 percent of GDP from 2007 to 2014, compared to a stable ratio of 13 percent of GDP for the average low-income country. Non-resident investors are showing increased interest in domestic debt markets in some frontier markets.

The report says domestic borrowing avoids currency risk, and is typically more predictable than overseas borrowing. For many countries, it appears to be associated with financial deepening and economic development. However, the report also says domestic borrowing generally carries a higher interest rate than bilateral official financing or international market borrowing, and that excessive domestic borrowing can crowd out private credit and investment.

Although this shift broadens borrowing options and appears to be part of a natural progression to more market-based borrowing, it elevates the risk of refinancing debt — and currency risk in the case of Eurobonds. In this regard, the report sends a cautionary message, particularly in the context of shifting global conditions. “To minimise vulnerabilities associated with enhanced market access, sustainable fiscal and debt policies will be important…together with strengthened debt management,” the study says.

Official financing sources also changing

A decline in official bilateral lending from the 20 advanced economies that make up the informal group of creditors known as the Paris Club, has been broadly offset by a rise in loans from large emerging markets — notably China. The report says debt to non-Paris Club creditors has risen from about 8 percent of GDP in 2007 to almost 12 percent of GDP in 2014 (see Chart 5). Non-Paris Club creditors financing helped support low-income countries’ investment spending without having to resort to higher levels of potentially less concessional domestic or other market borrowing, at a time when traditional sources of donor support have stagnated.

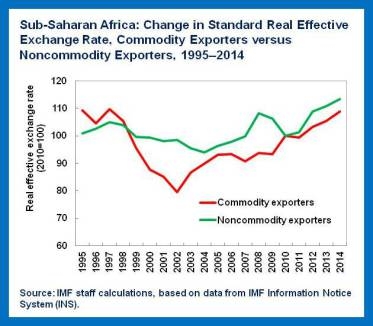

Look ahead and prepare

How countries respond to shifts in the global environment will determine whether their public debt vulnerabilities will remain manageable, the report said. “Looking forward, strengthened policy frameworks and careful debt management will be critical for all low-income countries. The weaker growth outlook in key advanced and emerging market economies is likely to impact low-income countries through lower demand for traded goods, with commodity exporters particularly affected. Prospects for tighter global liquidity conditions could raise the cost of borrowing and especially impact frontier markets with increased reliance on market-based financing, both domestic and external,” the study said.

Small states face the most challenging debt conditions, according to the report, and will need to strengthen their fiscal frameworks to help increase their resilience to shocks, boost potential growth, and reduce their debt.

Authors: Amr Hosny and Said Bakhache IMF Strategy, Policy, and Review Department