The Institute for fiscal Studies, IFS, has cautioned the government ahead of the 2019 budget presentation to cut down on it numerous policies it’s implementing and seeks to implement to ensure economic growth in the country.

According to the IFS , whereas it is laudable for government to roll out ambitious programs for the development of the country, the fiscal space is too weak and fragile to do that.

IFS also believes domestic revenue generations is extremely low and so government may rely on excessive borrowing to fund the projects with a rippling effect economic growth.

Since NPP government took over the 2017, it has announced several policies it seeks to undertake for the development of the country, which include the Free SHS policy, the One District One Factory initiative and the Nation Builders Corps program.

However, addressing the media ahead of the 2019 budget presentation, the IFS is of the view that the numerous projects are not sustainable and will kick economic growth off balance.

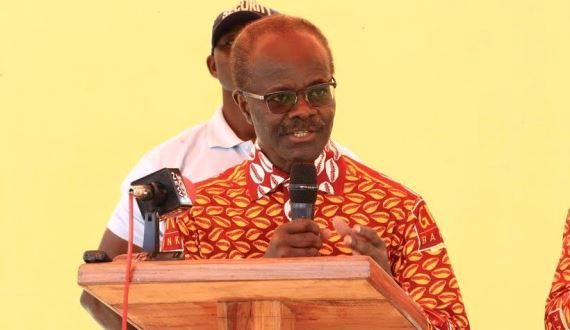

A senior fellow at the institute, Dr. Saeed Boakye said the policies must be reviewed.

“If care is not taken, the aggressive move by the government to do many projects can backfire, which can plunge the country into economic mess in the future.”

The institute has there recommended among other things for government to consult experts who will help analyze the sustainability of the projects and reduce its burden on the public purse.

First, giving the weak fiscal and financial state in which the country finds itself, in terms of free fiscal space to maneuver, which is called by the weak revenue capacity, of the state, government should consider pruning down the policies. The money is just not there! and if you force yourself, you can cause economic instability.”

The IFS has therefore urged government to reduce borrowing and increase domestic revenue generation to fund some of its flagship programs.

“In trying to fund the initiatives for economic growth, the government should limit the amount of money it borrows to the barest minimum in order not to cause fiscal over run.”

The IFS futhermore revealed that, it has submitted several documents on it recommendation to government to help in the drafting of the 2019 budget.

In related development, Ghana’s Finance Minister, Ken Ofori-Atta has stated that the yet to be read 2019 budget will boost corporate tax mobilization in Ghana. According to the Minister, the 2019 Budget will bring to bear several initiatives that will encourage corporate entities to file their tax returns.

Addressing some corporate companies at a budget forum, Finance Minister, Ken Ofori-Atta disclosed that lots of corporate companies have defaulted in paying taxes to the tune of GH¢3bilion. He stated that most of the PAYE companies in the country have issues in paying taxes, resulting in the government losing lots revenue.

ALSO READ: Peasant Farmers Association makes 3 key contributions to 2019 budget