Introduction

Circa 2007, a year before the worse global financial crises, the automotive industry witnessed a spectacular crumbling of Detroit. Before this calamity, Detroit since the

1920’s had been famous for making the best cars in the world for the world and dictated

the rules of world transportation.

The enormous scale of the Detroit’s auto industry marvelled many including Henry Ford- the American Captain of Industry and founder of Ford Motor Company. His famous vertically integrated model where on one end of the River Rouge, ships and trains unload steel ore and timber and on the other, finished cars rolled in for the auto-market, gained traction as established dictum due to Michigan’s control of the global auto-business at the time.

The reign of Detroit was not ephemeral, and for many years only a few blips were reported. Several global automotive companies got attracted to Detroit, and many invested tremendously in mass production for years. They created creative models of cars which kept demand soaring for years. Detroit flourished and blossom and became an iconic city in the United States.

However, by the 1970’s, the signs of slowing auto-industry began to emerge following

the global Oil crisis. Subsequently, automobile demand shifted to fuel-efficient ones- a

technology that Detroit’s major manufacturer lacked at the time. The problems got

compounded by poor management systems, worker unrest, gruff riots instigated by

Unions and the eventual breakdown of the barrier to entry for many efficient vehicles

from Japan and elsewhere.

Detroit’s auto industry problems also lead to dwindled revenues of the local government to the extent that by 2013, the City’s debt had ballooned to 20.0billion dollars. The city run-out of options that in the same year, it filed for bankruptcy.

The sad collapse of Detroit’s over the century-old automotive industry is painful, but at

the same time, it offers valuable lessons for many countries where the auto-industry is

emerging (formative stages) or are about to develop.

Are there any lessons for Ghana?

Yes. Ghana has the golden opportunity to learn from the mistakes of Detroit and this

paper attempts at discussing some of the critical matters that Ghana must necessarily

consider as it builds its automotive industry.

Automotive Industry of Africa

The recent economic gains in many African Countries have aided many to transition into

middle-income class and many urbanised. At the same time, the rapid urbanisation has

exposed significant flaws in the transportation system of many countries. These include

congestion, noise, inadequate and inefficient public transport, pollution, frequent motor

accidents, and deaths.

These flaws are anticipated because at the nascent stage of urbanisation; transport systems are often weak. This relatively weak relationship between urbanisation and transportation is pretty much observable in almost all the major cities of Africa.

To make matters worse is the fact the African Automotive industry is still relatively small.

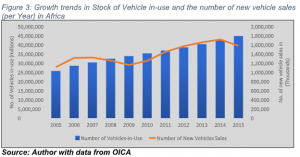

In 2005, about 1.2million new cars were sold in Africa representing only 2% of the

global sale of new vehicles. The total number of vehicles-in-use as of 2005, was

25.7million. By 2014, the number of new vehicle sales increased to 1.8million bringing

the total number of vehicles-in-use to 42.4million, and by 2015, the number of new

vehicle sales plummeted to 1.58million. The total number of vehicles-in-use, however,

surged to 44.8million in 2015 because of increase in importation of second-hand cars

which for years has been a dependable postern. By end 2017, the number of new

vehicle sales further dropped to 1.2million. It is noticeable that significant portions of

vehicles-in-use in Africa are second-hand vehicles. Some estimates have it that 8 in 10

cars in Africa are second-hand.

These numbers translate into average motorisation rate of 42 vehicles per 1,000

persons in Africa, a continent of over a billion people. This is abysmally low when

compared with the global motorisation rate of 180 cars per 1,000 persons for developing

regions of Latin America, Middle East, Oceania, and Asia. Four countries of South

Africa, Egypt, Algeria, and Morocco together account for over 80% of all car sales in

Africa. These are countries with relatively strong auto industries in Africa and also have

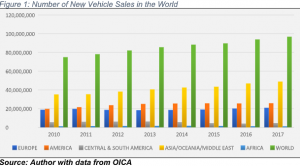

higher disposable income. The figure 1 below illustrates the number of new vehicle

sales among various regions of the world. It is evident that Africa’s share is negligible

when compared with the rest of the world. Figure 2 also illustrates the allocation of new

vehicle sales among selected countries in Africa. South Africa and the three giants of

North Africa is the major players.

Second-hand vehicles dominate the retail sector of the auto industry, and they are

mainly imported from America, Japan and Europe. The second-hand cars are preferred

to brand-new mainly on price, although the maintenance cost is high. The prices of

many second-hand vehicles often are within the income bracket of many. There are

usually several grades of second-hand cars that potentially meet each pocket. The

below figure 3 illustrates the growth trends in total Vehicle-in-use and the total number

of new vehicle sales for the period 2005 to 2015 in Africa. There is noticeable volatility

in the sale of new vehicles and is quite strong than in the total cars in-use numbers.

Notwithstanding the frailty of Africa’s automobile sector, the potential is great with

projected new vehicle sales pegged at 10million units within the next 15years. Africa’s

economic turnaround may persist albeit expected inequality among and within

countries. This means a lot for the automotive industry which is the most patronised

mode of transport in Africa. The demand for cars (new or used) will continue to surge

since owning a car has become a necessity and no more status symbol. Having more

vehicle manufacturing and assembling plants established in Africa means more people

could own brand-new vehicles since the prices are predicted to be less expensive when

compared with imported ones. It will also reduce the importation of second-hand cars

which is good for the environment. Servicing expenses are also expected to be

positively impacted when compared with second-hand vehicles which break down

frequently.

o Recent developments in Ghana’s automobile industry

In recent times, Ghana’s auto-industry has received considerable interest from major

global carmakers. Volkswagen (VW), the German carmaker as well as Sinotruck

International are the latest to indicate commitment and desire to set-up an assembling

plant in Ghana. Undeniably, the expression of interest showed by these companies in

Ghana’s automotive market is a positive one. Per the Memorandum of Understanding

(MoU) signed between the Ghana Trade and Industry Ministry and the German

Carmaker, VW is expected to commission the Ghana plant by early FY2019. The

Ghana plant follows the recent one established in Legos, Nigeria.

In all, VW’s plants in Africa would surge to five – South Africa (Manufacturing plant), Kenya, Rwanda, Nigeria and now Ghana (Assembly Plants). In specific, the Ghana plant would also have sales and service component as well as an academic institute to train people in automobile production and after-sales services. Sinotruck, the Chinese heavy-duty truck manufacturer, on the other hand, plans to have a 1,500-truck assembling capacity plant which will serve Ghanaians as well as the West African Market.

The development to mention, but a few, would create skilled jobs for many teaming

Ghanaians who have the required skillset, reduce the importation of second-hand

vehicles, generate revenue for the government, and place Ghana on the global

automotive map. It will also serve as a catalyst for the development of Ghana’s

automotive industry and eventually become pivotal in the economic growth and

development of Ghana. It would also increase the market share of VW and Sinotruck,

generate them revenue, expand the German and Chinese economies and solidifies

VW’s as well as Sinotruck’s hold of the African Market if all goes well.

All these potential benefits sound excellent and nice and worth the political risk as the local Ghanaian carmaker-Kantanka has registered its open abhorrence and disapproval of the deals.

o Building a robust automotive industry in Ghana

The volumes of new vehicle sales in Ghana (depicted in figure 2 above) is not that

promising to postulate about a possible takeover of Africa’s auto industry anytime soon.

South Africa, Morocco, Algeria and Egypt are in the clear lead, and it will take a much

deliberate state-level intervention to bring Ghana close to those countries. There are,

however, glimpses of hope for Ghana’s automotive sector. Ghana is politically stable

and democratic country and is a beacon of hope of the sub-region. Ghana’s economy

has been robust in recent times and is currently counted as one of the fastest growing

economies of the world. Its legal regimes, property rights, regulatory institutions, conflict

management as well as institutions of social insurance are fairly sound and active.

These institutions are reasonably healthy and largely independent and professional.

Ghana also has a relatively good social infrastructure. Ghana’s geographic location also

offers an excellent leveraging advantage as its easy to access other West African

markets via Ghana’s robust ports, rail and road infrastructure. Having mentioned Ghana’s comparative advantage over many other Countries in the region; it is important to reiterate that these factors alone are not enough to propel Ghana to the zenith of automotive industry of Africa.

Below, I discuss a couple of factors that authorities must consider as we seek to model Ghana as the Automotive hub of Africa.

Specialised regulatory regimes for the automobile sector

The most critical matter which must necessarily engage the attention of authorities

relates the enactment of respective regulatory regimes for the management of the

industry. Without a proper and functioning regulatory system(s), the expected gains

might not materialise. The first of such regulation is the Automotive Industry Policy

(AIP). The AIP must aim to assist the evolution of the auto industry and build it to

become a solid pillar of economic growth and development.

The policy must also be able to influence the location decisions of other automotive companies to choose Ghana as the preferred place for business, detail out the mode of entry and guide such companies in the conduct of their respective businesses. AIP must also promote and encourage good business practices and performance. The policy must again aim to raise the capacity of all parties in the auto industry, focus on product quality and technology devolution along the value chain. Ultimately, the AIP must improve the long-term competitiveness and viability of Ghana’s automotive sector. To this end, there will

be the need to strengthen the Industrial Policy of Ghana (IPG) to create the convivial

symbiosis between the two policies for the best of industrial development of Ghana.

Again, there is the need to create a linkage between the AIP and the National

Innovation Strategy (NIS) to guarantee innovation generation and technology transfer.

For many of us, having a healthy linkage between AIP and NIS will be the ideal catalyst

for the generation and diffusion of technology which ultimately affects innovation. This is

particularly important because innovation is a single most important catalyst for long-

term economic growth and development. Having such broad base linkage must impact

the creation of technological and scientific innovation in Ghana and potentially

guarantee technology catch-up.

Make “Local Content” a vital component of the AIP

To ensure maximum benefit from the automotive industry for Ghanaians would require

of authorities to ensure that “local content” becomes an integral part of the AIP. Under

such arrangement, Ghanaians must be prioritised first to benefit from all forms of

employment and other opportunities created by the auto industry. Partnerships between

Ghanaian businesses and foreign automotive companies must be encouraged and

supported. In some instance, quotas of some specific jobs must be assigned specifically

to Ghanaians. Skill training and technology transfer schemes must also be promoted

through local content arrangements.

International companies must be incentivised through tax breaks and special reprievals to enable them to transfer technology and knowledge to the Ghanaian counterparts. Deliberate programmes and policies of government must, however, help build the capacity of these local counterparts to ready them for new technology. Through the local content intervention, Ghana should be able to create within the shortest possible time, an automotive industry controlled by Ghanaians.

Policymaking transparency to generate credibility and sustainability

To ensure that the automotive industry becomes a solid pillar of economic development

requires that the policymaking process concerning the sector be transparent and free of

possible corruption. Having a transparent auto industry would assure the credibility and

sustainability of the sector. When decision making is made transparent, it ultimately

deflates the farrago of doubt often associated with government-led initiatives such as

this. In this direction, ensuring that; permitting processes, resources allocation

decisions, as well as performance reporting, among others are transparent will be

pivotal in eliciting public support for the sector. Transparency clauses must also be

provided in the AIP.

Creating equal opportunities for indigenous automotive companies and

those of foreign ownership

Another issue that authorities must not lose sight of relates the creation of equal

opportunities for indigenous automotive companies and foreign ones. Currently, there

are two artisanal local automotive production companies in Ghana. They are the

Apostle Safo Suaye Technology Research Centre (ASSTRC) and the Small and

Medium Industries Development Organisation (SMIDO). The local production, for now,

is negligible. Two foreign entities apart from VW and Sinotruck are also planning to put

up assembly plants in Ghana. These are Mahindra & Mahindra and Guangzhou

Automobile Group Motor Company (GAC Motor). Providing equal opportunities under

the AIP for all the companies could prove to be critical for the future of the automobile

industry of Ghana. Such a move will also create a harmonious business environment

devoid of cleavages.

Mitigating potential impact on the international vehicle franchise and the

local dealership

There is no denying of the fact that the developments in the auto industry would cause

significant disruptions for international automobile franchises as well as local dealers

and other vehicle dealers in the country. The disruptions could be dire for many

especially the second-hand car dealers. There is the need for authorities to evaluate the

possible implications of the industrial shift and institute measures to mitigate the

anticipated impact on those to be affected.

Conclusion

On the back of the ample evidence on the true state of Ghana’s auto industry today, I

guess, it will be so wrong for anyone to assume that Ghana is ready to challenge the

likes of South Africa or any one of the North African countries to become the hub of

Africa’s automotive industry. However, the high political commitment of the Ghanaian

authorities coupled with the congenial institutional and political environment, it should

not come as a surprise to anyone to see Ghana in a couple of years rubbing shoulders

with the current automotive leaders of Africa. At such point, the benefits would be

enormous for the economy and Ghanaians. The share of brand-new vehicles would

increase and would potentially impact the rate of road accidents in the country.

Neighbouring countries would also benefit from a thriving auto industry of Ghana.

Procurement and shipment cost of vehicle dealers in the neighbouring countries will

drop drastically by importing from Ghana. It, therefore, makes economic sense for the

government to continue efforts at building the automotive industry and all must support

such efforts. Detroit’s bitter experience must, however, guide Ghana as she develops

the AIP.

Written By: Henry, KYEREMEH

Kyeremeh@gmail.com