In recent years there has been much debate about the true size of Africa’s middle class, and even the appropriate definition of the term itself.

A 2010 report by McKinsey & Company, titled Lions on the move: The progress and potential of African economies, predicted that by 2020 more than 128 million households in Africa will have discretionary income (in excess of US$5,000 a year). The following year an African Development Bank (AfDB) study put Africa’s middle class at nearly 350 million, or 34% of the population. The AfDB defined the middle class as those with daily consumption of $2-$20, although it conceded that the $2-$4 segment is extremely vulnerable and can easily fall back into poverty. And in 2014 Standard Bank provided a more sober assessment, saying in a selection of 11 focus countries (together accounting for half of sub-Saharan Africa’s GDP) there are 15 million middle-class households (annual consumption of $5,500 or more).

Yet, this apparent growth in consumer spending has not reflected on the bottom lines of many companies. For example, in 2015 food giant Nestlé admitted that it overestimated the growth in spending power. “We thought this would be the next Asia, but we have realised the middle class here in the region is extremely small and it is not really growing,” Cornel Krummenacher, Nestlé’s chief executive for the equatorial Africa region, told the Financial Times.

In an effort to dispel some of this confusion and give businesses a better understanding of sub-Saharan Africa’s middle class, the University of Cape Town Unilever Institute of Strategic Marketing teamed up with research firm Ipsos to produce its own middle-class survey. They interviewed a sample of 7,500 people living in 10 African cities – Abidjan (Côte d’Ivoire), Accra (Ghana), Lagos (Nigeria), Kano (Nigeria), Douala (Cameroon), Luanda (Angola), Lusaka (Zambia), Dar es Salaam (Tanzania), Nairobi (Kenya) and Addis Ababa (Ethiopia).

The UCT team defines the middle class as those who: 1) earn over $4 per day; 2) have disposable income; 3) are employed, run a business or studying; 4) made it to secondary school; and 5) are not earning more than $70 per day. Some 60% of those surveyed fit this criteria, although the numbers vary from city to city. At 68%, or 14 million people, Lagos has the highest proportion of middle-class consumers, while Nairobi has the lowest at 49% or 1.6 million people.

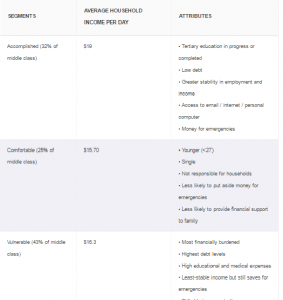

The study further segmented the middle class into three groups:

In total, it is estimated there are over 100 million middle-class people in sub-Saharan Africa (excluding South Africa), with a combined spending power of more than $400m per day.

The middle class in an African context

The report offers some interesting insights into the realities of Africa’s middle class – from the appliances they own, to their attitudes towards cultural traditions. Here are the some of the main takeaways.

1. The majority are financially vulnerable

The average income for a middle-class individual is $12.3 a day, while the typical household income for middle-class families is $16.9. About a third of the middle class have a full-time job, and 31% are self-employed.

2. Life remains uncomfortable for many

Less than 42% of middle-class households have indoor running water, while 20% have hot running water. Only 69% have a flushable toilet inside the house, and half have a built-in kitchen sink. And although 96% of the middle class enjoy electricity, power cuts are a regular occurrence. Some 80% of the respondents in Lagos indicated they own a generator.

3. Limited material possessions

While 64% own a satellite television dish, possession of household items is low in most cases. For example, 82% own an electric iron, 56% a plasma/colour LCD TV, 52% an electric kettle, 43% a fridge/freezer, 44% a gas stove, and a low 18% and 15% have a washing machine and vacuum cleaner respectively. Some 42% still cook over an open fire. According to the report these numbers are indicative of labour-intensive home lives.

4. Home ownership not a given

Forty-eight per cent of those surveyed own their home or live in a property owned by a household member – the remaining 52% rent. As for the rented units, 42% are stand-alone houses, 33% are flats, and 15% are single rooms. Many middle-class individuals are, however, investing in property.

5. Most don’t have a car

Public transport is the most common form of travelling among the middle class, as 68% of households don’t own a car.

6. Education is important

The report states that middle-class Africans generally believe education to be an essential stepping stone to success. Fifty-four per cent have some post high school education, and 31% are studying further to improve their skills.

7. Nuclear households are common

City dwellers typically live in small households of an average size of 3.6 people. One respondent who resides in Addis Ababa, commented: “The middle class tend to have fewer children than the poor and spend more on their nutrition and schooling.” Another from Accra said: “Who can afford to have larger families?”

8. They purchase branded goods when they can

As mentioned before, the middle class has limited disposable income. Some 45% have enough money for food and clothing, but not much else; 37% can afford other items, but not everything they would like. However, 71% will typically purchase branded over unbranded goods if they have the option.

9. Middle-class consumers are less traditional

The middle class’ main focus is on progression, with the majority (65%) not wishing to return to rural areas. However, 74% believe people must respect their traditional cultures. Just under 80% said it is their duty to take care of their parents even though they’ve left home.

10. Women are more empowered and independent

Despite the fact that women today are more empowered to make decisions about their own careers, they are less likely to earn high-paying incomes. Fifty-five per cent of middle-class Africans earning $30-$40 per day are men. Moving out of their parental homes are viewed as a leap towards independence by many women.

According to the report, some men are choosing to marry later, in comparison to their parents’ generation, to gain financial muscle as life has become expensive. This is a sentiment mainly expressed in Cameroon and Côte d’Ivoire.

Authors: Jaco Maritz And Justin Probyn