Elon Musk’s proposed $44 billion swoop on Twitter has highlighted a growing debate on the merits of companies staying or going private.

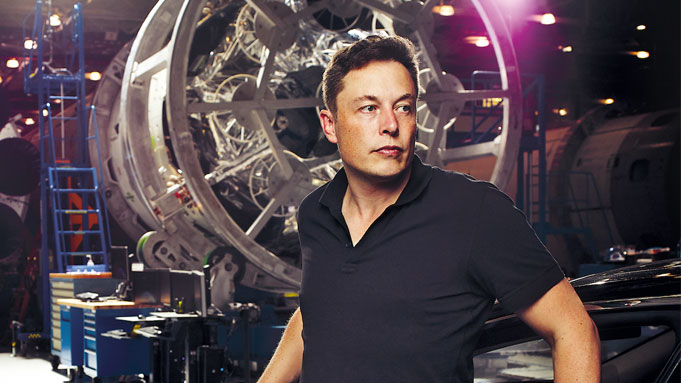

For now, the Tesla and SpaceX boss – and the world’s richest man ($244 billion) – is said to have gone cool on taking over the social media platform.

Speculation here ranges from Musk recoiling from the pressure his eye-watering proposal is placing on Tesla’s stock, to claims that he aims to secure Twitter for much less than his original headline-grabbing offer.

Neither changes the fact that he vowed to take Twitter private if the deal goes ahead, prompting comment from progressive broker-dealer Rialto Markets, which is masterminding the rise of many successful high-growth companies who have no intention of ‘going public’.

Rialto Markets CEO and Co-founder Shari Noonan said: “Staying private delivers a flexibility that has been supercharged by crowdfunding from smaller investors and accredited investors who readily ‘buy in’ to a firm’s products or ethos, enabling company expansion free from potential constraints by big corporate shareholders or VCs and public scrutiny of their accounts and plans.

Noonan, who has just received the prestigious Instinet Positive Change Visionary Award at the 2022 Markets Choice Awards in New York, highlighted the electric vehicle company, ATLIS, which Rialto Markets helped to crowdfund $30 million during its crucial start-up phase.

It has also enabled crowdfunding for Digital Twin pioneer, Cityzenith, whose futuristic tech helps real estate owners and even whole cities cut their carbon emissions and running costs dramatically.

“In both cases, and typical of the new breed of companies liberated by the 2012 JOBS Act and its crowdfunding opportunities, ATLIS and Cityzenith have built investor communities who know they can offload their holdings for potential profit eventually, through a secondary market platform like our own ATS (automatic trading system).

“Public ownership puts other strong hands on the company in the form of major corporate investors, who must then be kept on board with the management’s business strategy.

“This isn’t always popular with visionary and entrepreneurial CEOs who want flexibility, particularly in the fast-moving tech sector.

“When Elon Musk announced his abortive plan to take Tesla private in 2018, he said this would enable it to be ‘free from as much distraction and short-term thinking as possible”.

“In Twitter’s case, he will see that the social platform went public in 2013 – for what then seemed a colossal $1.8 billion – but returned profits in 2018 and 2019 only.

“Though this makes his multi-billion dollar offer even more staggering, Musk must surely see greater profit potential for Twitter.

“The key stat is Twitter’s user base: less than 220 million, tiny against Facebook’s at around three billion or even TikTok’s one billion, but it must be argued that Twitter punches well above its weight in terms of influence so there is surely scope to boost numbers and, therefore, advertising revenues.

“All of which supports his intent to go private if his takeover succeeds: it means he doesn’t have a potentially powerful gang of shareholders who might slow his plans to change Twitter by say, insisting on an immediate drive for profitability when he prefers to play a longer game for greater rewards.”

Noonan added that it was not unusual for major public companies to go private, often to recover momentum away from alleged short-termism imposed by shareholders.

The computer giant, Dell went private from 2013 to 2018 to enable it to “be even more flexible and entrepreneurial” according to Founder Michael Dell, while the Hilton global hotel chain re-structured and expanded as a private company from 2007to 2013.

Noonan added that private status also freed a company from the need to report its financial documents and other developments to the US Securities & Exchange Commission, which then become public information and available to scrutiny by competitors and other interested parties – perhaps would-be buyers, welcome or hostile.

Ends