The global landscape continues to improve and grow following the 2020 coronavirus pandemic. This growth is being supported by the opening up of more economies following the somewhat successful rollout of various COVID-19 vaccines. There has also been an increase in inflation on the back of global supply chain challenges and elevated energy prices. As countries continue to reopen, we anticipate the global financial market will gradually return to normalcy.

On the domestic front, the third quarter of 2021 has been positive as the country continues to grow and return to normalcy post covid. More vaccines have become available in Ghana, resulting in more people being vaccinated. The Government is making all efforts towards vaccinating a greater part of the population.

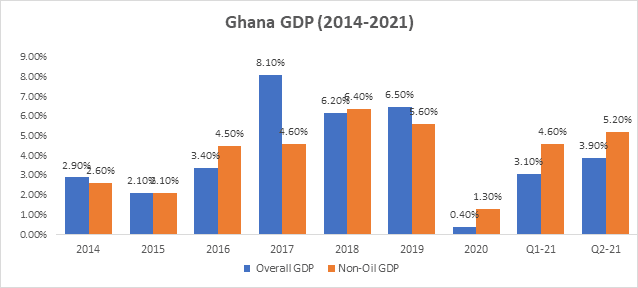

Ghana’s Economic Performance Q3, 2021- Gross Domestic Product (GDP)

The Ghanaian economy recorded impressive GDP growth of 3.9% as of June 2021 which was higher than the 3.1% recorded in Q1 2021. This growth is a significant improvement from the 5.7% contraction that was observed during the same period last year. The stronger growth performance in Q3 2021 reflects the speedy rebound witnessed within some of the major sub-sectors in the economy. The cocoa sub-sector grew by 27.6%, supported by the growth of 18.7% in hotels & restaurants as the economy gradually opened up. The real estate and trade sub-sectors also grew by 13.8% and 10.7% respectively. Growth across the entire economy was however not evenly spread as the mining and quarrying and oil and gas sectors contracted by 18.9% and 10.8% respectively.

The central banks Composite Index of Economic Activity (CIEA) for July 2021 reflected a continued recovery in domestic economic activity. CIEA recorded a 20.0% year-on-year growth in July 2021, compared with 20.2% in June 2021, and a 3.9% growth in July 2020. Increased economic activity was more significant across the aviation space and the ports.

Ghana’s Economic Performance Q3 2021 – Public Debt

Following the international and domestic backlash faced by the government concerning the country’s escalating debt levels, the ministry of finance reviewed its funding needs for the period. This however did not reduce the country’s debt stock which marginally increased from 76% (GHS 291.60) of GDP to 76.4% (GHS 335.90) of GDP from December 2020 to July 2021. As of July 2021, 52% of Ghana’s total debt stock was held domestically with 48% being held externally.

For most of 2021 government debt level has been an issue of concern amongst both the domestic and international stakeholders. The International Monetary Fund (IMF) has over the months consistently sounded the government on addressing the issues associated with its debt levels since its continuous rise will plunge the country into a stressed situation.

The recently announced issuance calendar for the 4th quarter of 2021 shows government plans to raise GHS 21.17 billion of which GHS 20.13 billion will be used to settle upcoming maturities and GHS 1.04 billion will be new issuances needed to support the government’s expenditure plans. These funds will be raised monthly in amounts of GHS 7.8, GHS 7.5, and GHS 5.8 billion for October, November, and December respectively. With the recent global and domestic challenges, we anticipate the interest in these securities, especially the longer-dated bonds, will be relatively higher than historically observed. This will possibly result in a further increase in the country’s overall debt stock.

Ghana’s Economic Performance Q3 – Inflation

Inflation ended the quarter much higher than it began. Over the last five months, inflation has been increasing at an escalating rate. Inflation ended the quarter at 10.6%, 0.6% above Bank of Ghana’s (BoG) upper band. This was due to increases in food and non-food inflationary pressures, currency depreciation, and the knock-on effect resulting from an increase in transportation costs in August 2021. Cost-push inflation for domestically produced items grew much higher due to the current global supply chain challenges and resulting in elevated freight charges, coupled with elevated petroleum prices which translated to higher transportation and utility cost.

Food inflation was much higher than expected and accounted for about 48% of overall inflation. This was due to the ripple effect of the increased petroleum prices and the resulting increase in transportation fares. Insufficient rainfall during the planting season has the potential to negatively impact the harvest season. Inflation for July and August were 9.0% and 9.70% respectively, jumping from 7.8% as at the end of Q2 2021.

Inflationary pressures are however expected to persist throughout the rest of the year from both domestic and imported forces. Supply chain challenges between Asian markets and the rest of the world, increasing energy challenges currently being experienced in China from the shortage of coal and increasing reliance on crude have resulted in an overwhelming increase in freight charges and crude prices across the globe.

Import-driven markets like Ghana will likely continue to suffer higher inflation and resulting in further currency pressures for the short term as the world increases supply to fill the demand gap that currently exists. These global dynamics will likely translate to elevated petroleum prices and the resulting knock-on effect on transportation and utilities domestically. This will lead to higher inflation in the non-food inflationary subgroups.

Ghana’s Economic Performance Q3 – Currency

As of the end of Q3 2021, the cedi had depreciated against the USD, its major trading partner, by 1.83%. About 90% of the depreciation occurred within the third quarter alone. The underperformance of the cedi was underpinned primarily by weak offshore inflows following increasing concerns about Ghana’s increasing debt levels coupled with excess demand from corporations and investors looking to repatriate funds out of the country. BoG’s continuous attempts to support the supply of dollars on the market were met with demand outstripping supply.

As the quarter progressed and US interest rates began to increase, foreign investors initiated steps to reduce their exposure to emerging market securities across the board. This negatively affected the cedi as investors dumped these securities and repatriated their funds back.

The global supply chain crises coupled with the increase in crude prices have further reduced the confidence of foreign investors about the potential risk facing the country. The cedi also recorded a year-to-date depreciation against the pound by 0.63%. It however had a year-to-date appreciation against the Euro of 3.71% on the interbank forex market. The currency is expected to face additional challenges on the back of the already aforementioned risk of rising crude prices, inflation, and an increase in demand due to the upcoming yuletide celebrations.

Ghana’s Economic Performance Q3 – Fixed-income Market

The third quarter continued to show improved liquidity within the bond market as witnessed during the first half of the year. Domestic appetite for both government and corporate issuance increased as witnessed with the successful issuance of Letshego, Daakye and ESLA listed corporate papers during September. Foreign appetite for domestic bonds showed some volatility during the quarter with marginal exit and re-entrance during the quarter. However domestic investors i.e. banks and pension funds, remained resilient in their interest in government securities.

Interest rates remained relatively stable over the quarter as the government continued to pursue its agenda of yield compression in the primary market to reduce its cost of debt. At the end of Q3-2021, the yield on shorter-dated securities, 91-day bill, 182-day bill, and 364-day bill, declined marginally and ended the quarter at 12.5%, 13.2%, and 16.1% respectively. This translated to a decline of about 13bps, 15bps, and 19bps for the 91-day bill, 182-day bill, and 364-day bill respectively.

Interest in the demand for primary market issuances was rather lacklustre this time round as compared to the first half of the year. The government struggled to meet its issuance target on three out of the four bonds issued during the quarter. This translated to marginally higher yields on longer-date securities as compared to the previous quarter. Secondary market activity continued to grow and hit record levels by the end of the quarter.

The Ghana Fixed Income Market (GFIM) traded approximately GH¢154.65 billion from January to September 2021 which was 44% greater than the trades executed for FY-2020 (GH¢107.26 billion). This demonstrated the continuous increase in interest in treasury securities. It is expected that the government will likely have to rely more on domestic borrowing if the perceived risk associated with the global crisis persists beyond the current quarter into the beginning of Q1-22. This will possibly translate to higher yields on longer-dated securities as the government will possibly try and entice domestic players to continue to lend.

Ghana’s Economic Performance – Equity Market

The Ghanaian stock market sustained its bullish run and returned a year-to-date return of 47.1% from the beginning of 2021 to the end of September-2021. As of the end of the quarter, the benchmark index, the Ghana Stock Exchange Composite Index (GSE-CI), sustained its record as one of the best-performing stock markets in Sub Sahara Africa. The GSE’s Financial Stocks Index (GSE-FSI) was also up by 15.28% as of Q3-2021.

The gains in the stock market came on the back of improved financials of listed companies brought on by improvements in the general economy post covid. The volume of shares traded by half-year 2021 was down by 0.8% to 401 million shares compared to the same period last year. Market turnover however increased by about 39.3% to GH¢411.10 million.

Telco giant MTN Ghana (MTNGH) lost its spot as the best performing stock to Fanmilk. Fanmilk reported a return of 198% at the end of the quarter. This was followed by Societe Generale with a return of 95% and MTN Ghana with a return of 94%. CPC, Unilever, Access Bank, and SIC were some of the worst-performing stocks posting returns of -33%, -29%, -21%, and -13% respectively.

We anticipate the equity market will still end on a high note barring any unforeseen shocks or volatilities as we draw near the end of 2021.

Author: Yehonatan Ayertey

Yehonatan is an Associate Director at Sentinel Asset Management Limited, one of the fastest-growing fund management firms in Ghana. He has several years of experience in investment advisory and fund management