Digitization is one of the niche subject matters in the field of information and communication technology. However, its use and application have reached other fields, including the economy, to accelerate growth and development in recent times. The application of digital technologies is expected to characterize future economies as it offers a better quality of life. Many countries across the globe, especially in Africa, are increasingly embarking on the digitization of their economies.

Ghana is one of the African countries recognizing the opportunity that digital development (digital economy) has for creating decent jobs, enhancing productivity, innovation, and accelerating growth. Ghana began its digital governance strategy in 2005 (Demuyakor, 2021). The government of Ghana has undertaken several flagship projects, such as the digital address system, which is essential for digital commerce, and more aggressive automation of government business processes (World Bank Group, 2019).

Ghana has in place a widespread fibre-optic infrastructure and international bandwidth from five Submarine Optic Fibre cables, which are helping to provide adequate bandwidth capacity to support the digitalization agenda. The country is currently implementing the ICT4AD policy that is promoting public and private investment in various modes of infrastructure to support Ghana’s Accelerated Development Agenda.

Some of the flagship digitization projects include National ID, National Digital Property Addressing System, Mobile Money Interoperability, and Paperless Ports, and e-Government Interoperability Framework (e-GIF) (World Bank Group, 2019; Songwe, 2019; Tapscatt & Agnew, 2000). The Government of Ghana, over the years, is making significant efforts and investments that are expected to position the country as a regional hub for digital services.

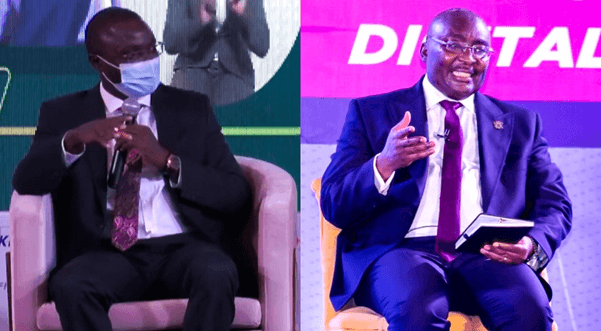

With the upcoming e-cedi, the nation gets a central bank digital currency that will be regulated by the Bank of Ghana. At the 2021 Ghana Economic Forum (GEF) held last month at the Kempinski Gold Coast Hotel, Accra, I interacted directly and publicly with the distinguished Mr Kwame A. Oppong, Head of FinTech & Innovation at the Bank of Ghana.

During Panel 2 on Day 1 of the Ghana Economic Forum, I expressed that I am 100% for regulation, actually 1000% for it. My fear with over-regulation is that it could potentially create black-market economies that would aim to circumvent the protocols that the Bank of Ghana has rightfully set in place to protect the stakeholders of the nation.

With the ongoing National Digital Agenda, we are all well aware that the Western World is very much interested in having a stake in all of it. The West and the rest of the World are now very ready and willing to invest in Africa especially when it is tech-based. Flutterwave, OPay, Interswitch, Palmpay and Paystack are a few of the many tech-based entities that have reaped the benefits of a continent leaning more and more towards digitalisation. The youth across Africa are now innovating and also leaning more towards tech as they realise that’s where the future is.

When the e-cedi finally arrives, it’ll be a game-changer because suddenly, the penny will drop for many naysayers and then they’ll want to get in on the action. I asked Mr Kwame A. Oppong how the Bank of Ghana is preparing the road to certification for these individuals that’ll be innovating left right and centre. My goal was not to suggest that BoG make it too easy because I recognise and agree that KYC and other due diligence measures on the applicant, the tech and how it integrates into the system must be carefully looked at. Still, I believe something should be done to promote and encourage widespread innovation, albeit still regulated.

The Head of FinTech and Innovation for Bank of Ghana, Mr Kwame A. Oppong answered my question. He said:

“Thank you very much. I think one thing you’ll observe over the years is that everything Bank of Ghana has done relating to this space has been by design. It’s been a carefully thought-through policy that has gotten to the point where you’re hearing some of these results. For instance, we can make a point about mobile money growth between before COVID and after COVID, even during the COVID. I think one of the interventions we made has to do with some enhancements to subscriber wallet balances, limits, etc. We saw some significant uptake in merchants acquiring digital means of collecting payment, and that trend has not subsided. It actually has continued strongly.

All through that period, we have not stopped. And so you would, for instance, have noticed that we introduced a new set of merchant account categories, which recognises the fact that if you look at the average merchant anywhere from a market in Tamale, a market in Takoradi, a market in Accra, some of the requirements that were in place in the law for them to be onboarded as merchants if you looked at it, it was a bit onerous.

It may be okay for maybe a Kempinski or an organisation somewhere mid-range, but it was a bit burdensome to ask that of them. And so we introduced a new merchant account category and the corresponding requirements for onboarding them that is consistent with their tier KYC approach within the mobile money space, which by the way, Ghana is one of the first countries to implement. And you see this across the sub-region a bit more.

We have subsequently implemented several policies and embarked on several initiatives, including the Sandbox. I heard a conversation about Singapore and some other countries. We’re working with them on a Business Sans Borders, which is a Business Without Borders initiative that connects a financial trust corridor between Ghana and Singapore: Ghana as a hub for our region and Singapore as a hub for their region as well.

There are several things that we’re doing.

But let me point out this: when it comes to the issue of regulation vis-à-vis investment, let’s first understand that so far how we’ve evolved policy has wound up in consumers voting with their feet. When the Findex Survey by the World Bank was published in 2018, then using data from 2017, it put Ghana’s financial inclusion number at 58%. At that time we only had about 11 million mobile money customers. The population was about 29 million overall and you had about 21 million adults. Now the recent statistics suggest that we have 22 million adults and our mobile money is already hovering between 18-19 million. So we don’t know what the next number will be in terms of the specific number.

But certainly, we can all do the math and extrapolate and get a sense of how significant the growth has been and that growth reflects a certain level of consumer confidence. Demand is a very important element to all of this. Now, that demand has been a result of proper regulation that ensures that you have safety and security and confidence in using these payment services.

Mobile money was regulated in the past in 2008 when we were looking at what was happening in Kenya and it was interesting; the M-Pesa conversation came up. When that was introduced, we had to modify and enhance our regulatory framework to capture what was happening in Ghana. So there was an electronic money issuer guideline in 2015. We further enhanced it recently with a law that aggregated all the payments sector guidelines, policies, etc. into a Payment Systems and Services Act [2019] that addresses all aspects of it. As an investor, just like as a lender, do you invest in something you’re not confident in? Do you invest in markets you’re not confident in?

What we sought to do is make sure that we have a licencing framework that is robust but is also reasonably configured to balance the burdens on innovators with the risk that they present. So if you look at our existing payment service categories of licences, it’s structured in different categories, including the smallest licence category level, for instance, that doesn’t have a capital requirement, but it has certain permissible transactions that are well-calibrated to suit the type of risk that they present, even the requirements for them from a governance standpoint, from a legal standpoint, etc.

And then you have the Enhanced Payments Licence, for instance, which details and has a bit more permissible activities. We have strict governance requirements for them when it comes to operational risk issues [and] enterprise risk management framework. We inspect all these things. They go through a thorough process, including an on-site inspection. So by the time we licence you as a payment service provider by the Bank of Ghana, investors can have a certain measure of confidence in the fact that you are a well-established company from a legal standpoint; you are well-governed from a governance standpoint; operationally, you are adhering to a certain level of international standard efficiency, and the rest becomes how well you’re doing on the market, which obviously is what would have attracted them to you anyway.

And so we’re really looking carefully at that triad. It’s a demand, supply, and from the central point, a policy intervention issue as well. So we’re mindful of all of this, and our actions have been clearly designed to intervene to promote the sector.

And so you mentioned some of the acquisitions, some of the investment rounds that you’ve heard recently. You’d be surprised if you look at the Africa-wide investments over the years. You’ll see some that are actually Ghanaians. Ghanaians are typically more modest in the PR we do around these things, but we all know a few FinTechs here and there that have gotten international investments much earlier, and some of the other ones actually also started from Ghana before it went into Nigeria but they re-identified themselves as Nigerian-started fintech.

But the most important thing is we have an opportunity as Africa. This is the next opportunity for growth. Let’s be confident in the fact that we know what we’re doing. We’re clearly thinking through what we’re doing and where we are going is in the right direction. It was so comforting to hear some of these comments coming from each panel member. I mean, the examples that Ankit [of Regulus Financial Services Limited], for instance, shared, is no different from what we’re doing. The issue of foundation.

So if you look at what’s happening in India, you’d go out of maybe Delhi into a small town like a Haryana or something. And you’d see individuals collecting/getting government support in the form of social benefits/transfers, and they are leveraging the Aadhaar system [the world’s largest biometric ID system]. It is a simple approach to biometric authentication, a single source of truth, that if I say I’m Kwame Oppong it validates that I’m Kwame Oppong.

We have a Biometric National ID. We have a national digital property addressing system, and we have an interoperability system that ensures that we are able to make transactions from bank accounts to mobile money and to E-zwich.

We have the foundation.

We have certain goals and objectives. We’re seeing what the value is. Let’s continue to work like this. Let’s continue to come together around a digitalization conversation, and we can make a lot happen for ourselves as Ghanaians.”

I transcribed Mr Kwame Oppong’s comments from the video and you can watch him eloquently explain by using the link www.bit.ly/mrkwameoppong.

He ended his answer by urging Ghanaians to come around the digitalisation conversation for that is how we can make a lot of things happen for ourselves as Ghanaians. I totally agree! And that is what leads me to speak about the Vice President’s recent public lecture that was themed “Transforming an economy through digitization: the story of Ghana,” held at Ashesi University.

Dr Mahamudu Bawumia, the Vice President of the Republic of Ghana, has been trending of late for defending the government’s agenda of digitalizing the Ghanaian economy towards placing Ghana on the global map of monumental progress principally in preparation for the Fourth Industrial Revolution.

One of the major banes of our national progress and cohesion has been the problem of arguing over semantics and diluting national achievements so I found it fitting, as a proud Ghanaian, to fact-check if the foundation that Mr Kwame A. Oppong so very well explained is what the Vice President of the Republic of Ghana spoke about, a foundation on which “a lot happen for ourselves as Ghanaians”.

This is an opinion piece and if I feel he is wrong in an assertion, I shall say so. I’ve been writing about the digitisation agenda of Ghana for years now! For the fun of it because it excited me from Day 1 (I want life in Ghana to be as comfortable and integrated as life in London, California, Paris) and I also wrote them as educational pieces, evidenced by my August 2019 article.

Here’s an easy recap:

Digitisation is changing from a physical format to a digital one.

Digitalisation is the use of such activities to improve processes.

Digital Transformation is the impact such improvement has.

So, the Vice President noted that the benefit of the digitization agenda is in the best interest of Ghana. He stated that per the World Economic Forum’s Global Information Report estimates, it indicates that “an increase of 10% in a country’s digitization score fuels a 0.75% growth in GDP per capita”. Therefore countries that “fail to digitalize their economies are more likely to be uncompetitive in the emerging global digital revolution.” According to the Vice president, digitization of Ghana’s economy is critical to transforming social services, agriculture, finance, health, and education.

The new system that the government is building through digital transformation, according to Dr Mahamudu Bawumia contains the following elements;

- A system with unique identification numbers for the population.

- A system with addresses for all properties and locations.

- A system that is transparent and promotes accountability, discipline, and trustworthiness.

- A system that is inclusive and not based on who you know.

- A system that provides efficient public services delivery and tackles corruption.

- A system that improves efficiency in the health sector.

- A system that provides financial inclusion and a cash-lite economy.

- A system that addresses high-interest rates.

- A system that enhances domestic revenue mobilization.

Dr Mahamudu Bawumia also listed the various digitization programs the government has embarked on to address the issues raised. The special kind of mobile money interoperability between mobile money, E-zwich, and bank accounts, which is rightly termed the Financial Inclusion Triangle, comes to mind because Mr Kwame Oppong from BoG mentioned that last month, as you may have just read.

Among the key initiatives, he spoke about is the Motor Insurance Database (MID). The National Insurance Commission implemented the Motor Insurance Database (MID) in January 2020 and was chiefly spearheaded by the Vice-President and operationalised through the leadership of Dr Justice Ofori, the NIC Commissioner. The digitization of motor insurance includes everything motor insurance; it now has key security features and is synchronized to a national database. The digital platform can easily be accessed with any mobile phone by the insured, the Police, and the general public. The introduction of the MID aims to curb vehicles’ menace with fake motor insurance stickers plying our roads, endangering lives and property.

Dr. Mahamudu Bawumia who champions Ghana’s digitization agenda believes that no other African country has put together this type of motor insurance database that Ghana has done. Ergo, Ghana is the first to put together this kind of database. The Vice President’s assertion that Ghana is the only African country to have this kind of Motor Insurance Database (MID) is based on the unique features this particular database has, which makes Ghana’s MID distinct from other African countries.

It was easy to find these features online. The question is, are these valid assertions, and why? Because the Vice President seemed to place emphasis on the special features of the Motor Insurance Database (MID) than the fact that there merely exists a Motor Insurance Database (MID).

UNIQUE FEATURES OF GHANA’S MOTOR INSURANCE DATABASE (MID)

There is no doubt that other countries globally also have a motor insurance database in place and with varying names. However, Ghana’s MID features make it one of a kind and distinct from the others. Any and every Ghanaian should be proud of that. Any and every Ghanaian should defend that. “Yɛn ara asase ni”, remember? From my close monitoring of the MID since it was introduced it is easy for me to make the following observations and to draw factual conclusions therein;

- The motor insurance Database (MID) of Ghana is centrally controlled and managed by the Regulator. The NIC, the Regulator, is solely responsible for overseeing Ghana’s (MID). There is no third or private party involved. Since the NIC is a state institution, it implies that the MID is national in character and strictly and confidentially held.

Similarly, Ghana’s MID gives no room for lapses and process circumvention. The purpose of MID is to aggregate all information related to motor vehicle insurance and for underwriting purposes. The platform was developed and built here in Ghana, and I am proud of that. Other countries like Nigeria have the Nigerian Insurance Industry Database (NIID), which was initiated and owned by the Nigerian Insurers Association (NIA), and not their national Regulator. I must put on record and as a matter of fact that Nigeria introduced theirs long after Ghana had started and this is verifiable.

In South Africa for instance, some individual Insurance Companies have the software for verification but are not nationally centralized and controlled by the Insurance Regulator. These are all facts.

- With Ghana’s MID, the electronic motor insurance stickers have QR codes generated from the database and can be scanned with a Quick Response (QR) code reader to verify their authenticity. This enables the security agencies, especially The Motor Transport and Traffic Directorate (MTTD), an agency under the Ghana Police Service, to authenticate the vehicles plying the roads of Ghana to curb the menace of fraudulent motor insurance. This feature enables the Police to undertake motor traffic investigations with ease and in real-time with the GoTa phone devices deployed to them.

- The system is web-based, such that one can purchase a motor insurance policy online and obtain an electronic sticker without necessarily physically going to an insurance company. I purchased a Motor Insurance policy just last week and I didn’t even have to enter their offices. However, although Nigeria also has a web-based system, the purchase of insurance cannot be made online.

- The system is designed in such a way that the general public, including passengers of vehicles, can check the validity of vehicle insurance instantaneously via the use of mobile phones. Verification of the validity of insurance on vehicles is available to every member of the public just by dialling short code *920*57# before boarding any vehicle, be it commercial or private, at no cost to them.

- Contrary to Ghana’s MID, the Nigeria regulator is not directly involved in the rating; hence there is no standardization of premium. In Nigeria’s case, the Insurance Companies’ underwriting information is wired to the Regulator’s portal soon after purchase. However, the Regulator has no control over the premiums charged. Thus the insurance companies compete on pricing and not necessarily on quality service. The underwriting information is forwarded to a central repository but not in real-time like the Ghanaian system. This exposes the Nigerian system to risks during the period a policy is purchased and the period the underwriting information is forwarded to the Regulator.

But in the case of the Ghanaian system, there are standardized premium rates across the board where Companies compete on good quality service rather than on pricing. For example, when the premium on a particular vehicle is GHC327 with insurance company A, the same applies to all other insurance companies, which didn’t use to be the case thus giving room for undercutting and for fraudsters to operate in the space. What it means is that should the insurance company charges a premium of say GHC326 which is GHC1 short of the standard rate, the MID will reject it.

This is the uniqueness of Ghana’s MID.

Also, the Ghanaian system provides instant SMS notifications upon purchase of motor insurance. I got my SMS almost instantly when I purchased my insurance. And guess what… the text wasn’t even from the Insurance company… it came straight from the national regulator – the National Insurance Commission (NIC).

But in the case of the Nigerian system, it takes 24 hours for a new policy to reflect on the NIID. Further information on NIID can be accessed on the website of the NIID.

- Compared to what has been deployed in countries such as England, South Africa, Panama, and Canada, Ghana’s MID is the only software that can detect a vehicle with the same registration number as another elsewhere.

For instance, in Panama, the insurance companies have their own software and forward the information periodically to the Regulator; the Regulator itself has no centralized underwriting software for this purpose. The insurance companies are given timelines within which they have to submit the underwriting information to the Regulator. Not in real-time, and the tendency by insurance companies to default is high. Also, the system deployed in Canada is similar to that of Panama.

How many times will we as Ghanaians have the chance to say “the system is working better here in Accra 24/7 than in Toronto”.

SOMEONE GET ME TWENE JONAS ON THE PHONE!

Look, the core advantage of Ghana’s MID over all the countries named above is that it is centralized, monitored, and controlled by the NIC, where underwriting information can only enter the portal so long as all the requirements, including the right premiums, are met.

The uniqueness of Ghana’s MID set it apart from the others initiated in Africa. Ergo the Vice President Dr Mahamudu Bawumia’s assertion concerning Ghana being the only African country to have this kind of motor insurance database in Africa is not far from the truth.

Feel free to reach out with your views. It’s a discussion, not a declaration. You don’t have to agree with me to talk to me… still, the fact is a fact.

Dr Mahamudu Bawumia also spoke on the Mobile Money Payment Interoperability System, which was targeted at dealing with financial exclusion as one of the main challenges impeding the financial sector development in Ghana. The collaboration of the telecom industry, the Bank of Ghana, Ghana Interbank Payments and Settlement System (GhIPSS) led to the creation of mobile money payments interoperability, which has made it possible to transfer money seamlessly across different mobile money providers and between bank accounts and mobile wallets.

This system has made it possible for a customer of one telco to transfer money to a customer of a different telco and also make payments from your mobile money account into any bank account—and people can receive payments from any bank account into your mobile money account. Customers can receive interest on their savings, and acquire loans (e.g., qwick loan) on their mobile wallets. This initiative has made it possible for many Ghanaians to access a “bank account now.”

Vice President Dr Mahamudu Bawumia again made it emphatically clear that “Ghana is the first country in Africa and one of the few in the world to achieve this type of interoperability between bank accounts and mobile wallets.” He keeps his emphasis on “this type”. Although Ghana is not the first country to implement money payments interoperability, Ghana’s kind of mobile money interoperability (MMI) is the first of its kind.

GHANA’s MOBILE MONEY PAYMENT INTEROPERABILITY SYSTEM

- Although, countries such as Tanzania and Rwanda were the earliest to launch mobile money interoperability in Africa. Their system is not the same as Ghana’s System. They differ in terms of the model and how it is led.

Ghana’s Mobile Money Payment Interoperability system is government-led, while the latter is industry-led. I can see how you might think that’s a stretch but it’s a fact that the most vocal advocate for Ghana Digital Transformation has been the Vice President. He made Ghana’s Digital Transformation Agenda his motto for like since ever (typing as I think here).

The Mobile Money Payment Interoperability system in Ghana is the first in Ghana that is government-driven. Another country in Africa whose Mobile Money Payment Interoperability system is government-led is Uganda. However, the Ugandan system was implemented after Ghana had implemented its Mobile Money Payment Interoperability System (MMI) (Lamia Naji, 2020). Again, I’m just giving Ghana the wins we rightfully deserve.

- Furthermore, Ghana’s Mobile Money Payment Interoperability system is a Global payment hub interoperability model.While that of Uganda is Bilateral & Aggregator model, Tanzania is currently Bilateral model and yet to transition to Global payment hub model. (Lamia Naji, 2020).

Based on the archetype of the Ghanaian system, the interoperability model that is used, and the fact that it is the only system that is government-led in Africa, Dr Mahamudu Bawumia’s statement is not far from the truth.

It is worth repeating that one of the major banes of our national progress and cohesion has been the problem of arguing over semantics and diluting national achievements. Let’s not do that this time. I am open to discussion. These pieces are a two-way conversation between myself and you the reader, after all.

Have a blessed week!

Author: Maxwell Ampong

References

Dr Maxwell Ampong, DBA. (2021, November 12). Mr Kwame A. Oppong, Head of Fintech & Innovation at Bank of Ghana, at the Ghana Economic Forum [Video]. YouTube. https://www.youtube.com/watch?v=e8U3OQEvpVY

Demuyakor, J. (2021). GHANA’S DIGITIZATION INITIATIVES: A SURVEY OF CITIZENS PERCEPTIONS ON THE BENEFITS AND CHALLENGES TO THE UTILIZATION OF DIGITAL GOVERNANCE SERVICES. International Journal of Publication and Social Studies, 6(1), 42–55.

Group, W. B. (2019). Ghana Digital Economy Diagnostic. World Bank.

Lamia Naji,( 2020) Tracking the journey towards mobile money interoperability Emerging evidence from six markets: Tanzania, Pakistan, Madagascar, Ghana, Jordan and Uganda. retrieved from https://www.gsma.com/mobilefordevelopment/wpcontent/uploads/2020/08/GSMA_Tracking-the-journey-towards-mobile-money-interoperability-1.pdf

Organization, W. H. (2019). The United Nations Interagency Task Force on Religion and Development-Annual Report 2019.

Songwe, V. (2019). A digital Africa. Finance & Development, 56(002).

Tapscatt, D., & Agnew, D. (2000). Governance in the digital economy. Finance & Development, 36(004).