What is the stock market? Why must I invest in stocks? How do I begin my investment in stocks?

In a webinar series organised by Ghana Talks Business, David Tetteh, former CEO of Cal Brokers and a council member of the Ghana Stock Exchange provides answers to the daunting questions regarding the stock market. He looked at making money from investing in the stock market.

What is a stock?

He explained that a stock is a representation of part ownership in a business. Hence, buying a stock or investing in stock market, means buying part ownership of a business. For instance, Fan Milk is listed on the stock market and once you purchase the company’s stock, you become a part-owner of the company and thus have a say on how the company is run as well as have a share in its profit.

The buying process

A company’s stock is purchased through a unit of stock known as shares. The company’s shares are purchased during an Initial Public Offer (IPO) or through the secondary market (stock exchange). Buying a company’s shares has two main benefits. These are dividends and capital gains.

Dividends are profits shared amongst shareholders of the company while Capital gains are the increase in the share price of the company you have invested in.

David Tetteh in his presentation gave this analogy below for a better understanding of how the stock market works.

ALSO WATCH: Simple facts to consider before you start investing in stocks – Video

Stock Market – Case Study

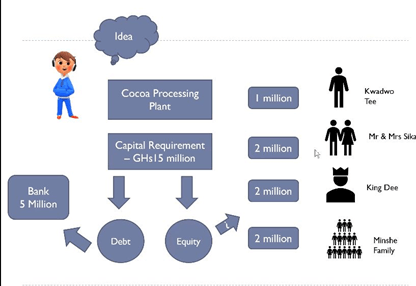

Assuming Yaw has an idea to start a cocoa processing plant that requires GH¢15 million to establish but has only GH¢3 million available, how does Yaw raise the needed capital to establish the cocoa processing plant?

There are two ways Yaw can raise the capital, which is by loan (a debt) or by equity (looking for investors to invest in the business). Yaw, therefore, decides to go to the bank and gets a loan of GH¢5 million. He now has a total of GH¢8 million available and a shortfall of GH¢7 million. He now decides to seek investors to make up for the shortfall so he can commence with the establishment of his business. Looking at the above diagram, Yaw manages to get Kwadwo Tee who offers GH¢1 million, Mr & Mrs. Sika who offer GH¢2 million, King Dee who offers GH¢2 million, and the Minshe family who also offer GH¢2 million. This gives Yaw the needed capital to commence with the establishment of his cocoa processing plant.

Including Yaw, there are 5 shareholders, and the bank which has invested a debt into the business.

At the end of the first year of business, the following financial records were revealed

| Sales | GH¢12,000,000 |

| Cost of Sales | GH¢7,000,000 |

| Operating Profit | GH¢5,000,000 |

| Interest (bank loan) | GH¢500,000 |

| EBIT (Earnings Before Interest and Tax | GH¢4,500,000 |

| Taxz | 1,125,000 |

| PAT (Profit After Tax) | GH¢3,375,000 |

Based on the above available data, the company has made a profit of GH¢3,375,000. It now becomes a conundrum of whether to plough back the profit into the business or share part of the profits and plough back the rest.

Given the case narrative, assuming the company wishes to share GH¢1 million of the profits among shareholders, shareholders will receive their dividends according to their investment. This will mean, the Minshe family, King Dee, and Mr and Mrs Sika will receive more money (dividend) than Kwadwo Tee as they invested GH¢2 million into the business.

As the year goes by, the cocoa processing plant experiences an increase in sales which translates to an increase in profits. With profits on the rise, dividends are also high. With high dividends, the company’s value increases. This is because should Mr and Mrs Sika wish to sell off their shares, they wouldn’t sell the shares at the value they invested in but rather at an increased value to make a profit. So, assuming Mr & Mrs Sika decide to sell their shares at GH¢3 million, they will make a capital gain of GH¢1 million (GH¢3 million – GH¢2 million).

Selling and buying shares – Investing in Stock Market

According to David Tetteh, the Stock Exchange is the facility/infrastructure that facilitates the buying and selling of shares. Following the case narrative above, should the cocoa processing plant wish to expand and shareholders look to exit by selling off all their shares, the company can decide to go public by placing the company on the stock market through the assistance of brokers.

The first time that shares are sold on the stock market is referred to as the Initial Public Offering. Once people buy, the company gets listed on the stock exchange and now the buying and selling of the shares are done between investors through the stock market. Investing in the stock market means buying shares of those listed companies.

Stock price determination

Just like the prices of foodstuffs are determined by the force of demand and supply so is the stock market. However, the forces of demand and supply in a company’s stock is also driven by performance.

So, if a company is making lots of profit, more people would want to buy. This increases the demand and price of its shares since fewer people would also want to sell. On the other hand, if the company is running at a loss, fewer people would want to buy, decreasing demand and price because more people would want to sell. “The better a company’s performance, the more likely that its share price is likely to go up, and the reverse is also true” said David Tetteh.

The Fan Milk Limited case study

Looking at the chart above, FML’s share price was fairly stable from 1990 to 2004. Since then, it has witnessed fluctuations in its price. It however reached a peak period in 2018. According to David Tetteh if an investor bought Fan Milk shares at around GH¢5.00 in 2015 and sold it around GH¢18.00 in 2018 the investor made a good return. However, if the investor bought Fan Milk shares at GH¢6.00 in 2010 and sold it at GH¢3.00 in 2013 the investor made a loss. This makes timing more very crucial in the purchase and sale of stocks.

List of Stockbrokers in Ghana

- African Alliance Securities Limited

- Algebra Securities Limited

- Black Star Brokerage Limited

- Bullion Securities Limited

- CDH Securities Limited

- Databank Brokerage Limited

- EDC Stockbrokers Limited

- Final Securities Limited

- IC Securities (Gh.) Limited

- NTHC Securities Limited

- Prudential Stockbrokers Limited

- Republic Securities (Ghana) Limited