Over the past weeks, there has been serious discussion all over the media (including social media) about the country (Ghana) registering a company in a tax haven country, The Island of Jersey.

Politicians and industry experts have been sharing their views, with others even saying the Country (Ghana) is promoting money laundering and the transaction lacks transparency. The question is, does investing in a tax haven wrong and why will one decide to do that? This article tries to share some light on the operations of tax haven location/ country and how it can be vulnerable to money laundering activities.

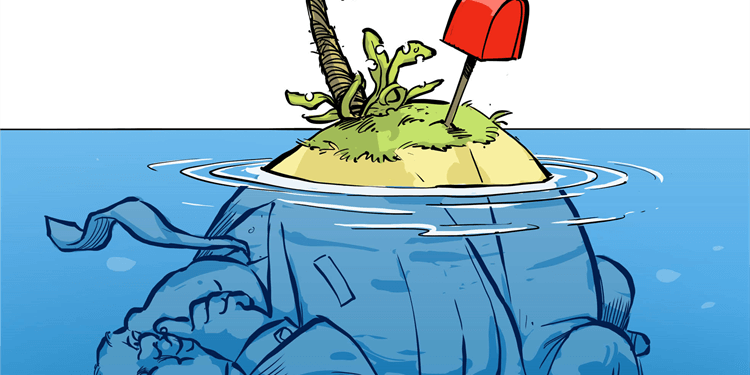

Tax Haven

A tax haven country by definition is an offshore country that offers foreign individuals and businesses little or no tax liability in a politically and economically static environment. These countries rely on the foreign inflows (foreign capital) into the country through financial institutions and other investment vehicles for their development. One doesn’t need residency or business presence in a tax haven country to benefit from the country’s tax policies.

Tax haven countries are characterized by their developed financial institutions and markets, low record of corruption, limitation on sharing and reporting financial information of beneficiaries to foreign tax authorities and lack of transparency obligations. Such countries also have lax Anti Money Laundering (AML) rules and laws. Investment in these countries are safe and hardly disclosed. Even though there is no comprehensively defined standard for the classification of a tax haven country, there are regulatory bodies such as Organization of Economic Cooperation and Development (OECD) and the U.S. Government Accountability Office that monitor tax haven countries and have listed the following countries as popular tax haven countries: Andorra, the Bahamas, Belize, Bermuda, the British Virgin Islands, the Cayman Islands, the Channel Islands, the Cook Islands, The Island of Jersey, Hong Kong, The Isle of Man, Mauritius, Lichtenstein, Monaco, Panama, St. Kitts, and Nevis.

To stretch the definition of tax haven countries further, any international location which have special tax laws to attract capital investment may be classified or identified as a tax haven. Example of such locations in the United States include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming, where no state income tax is required. Also United Arab Emirate offer special tax dispensation for investors.

Nevertheless, locating a business in a tax haven location can be used legally in tax planning where profits are properly attributable to the tax haven and sufficient economic substance is maintained.

Investing or operating a company from a tax haven country or location is not a crime but serious factors need to be considered as tax haven countries or locations are the target of criminals to launder their ill-gotten money. Simply put, tax haven countries are vulnerable to money laundering activities.

Criminals are attracted to tax haven countries because these countries offer extensive array of facilities to investors who are not willing to disclose the origin of their assets. It offers criminals the opportunity to hid their sources of funds from the control of their home regulatory authorities. These tax haven countries enforce very strict financial secrecy, effectively shielding investors from investigations and prosecutions from their home countries.

Also criminals are attracted to countries and/ or locations that offer high levels of secrecy, variety of financial mechanisms and provide anonymity for the beneficial owners for a wide variety of reasons including the potential cover and protection they offer for money-laundering and various exercises in financial fraud. Also jurisdictions with less transparent business practices attracts criminals to invest their dirty money.

Individuals and companies that operate and do business in a tax haven country or location must be classified as high risk and put under the microscope when dealing with them. Proper Enhanced Due Diligence need to be conducted when dealing with such people and business.

Also financial transactions emanating from tax haven countries must be properly documented and reviewed. Where the financial institution suspects the financial transaction to be suspicious of money laundering, report must be file with the Financial Intelligence Units/ Centre for further investigations.

Financial Institutions, dealing with customers that operate and invest in tax haven location, must institute systems that will enable them obtain the necessary documentations for customer identification and transactions processed and store these documents well for future reference and enable regulatory authorities to be able to carry out their supervisory oversight functions. Also safeguarding data related to every transaction processed facilitates investigation of suspicious activities.

Every country in the world, tries its best to attract potential investors into the country to boost economic activities by instituting one favorable policy or the other but measures need to be put in place so that the country doesn’t become vulnerable to criminals or a hub for criminal funds.

Would you mind doing me a favor? Share this article with someone so that the awareness of money laundering and terrorist financing could be spread to avoid being use as a conduit by criminals.

ALSO READ: The Church and Money Laundering

Author: By Richieson Gyeni-Boateng, CAMS

If you require further information on this article, please contact Richieson @richieson.gyeniboateng@gmail.com