I have always been fascinated by China’s sheer prowess of capital even though China is a proudly communist country. Within a few decades, China has strategically designed her international activities to place herself at the forefront of world conversation.

Since the end of the Cold War, China has displayed a reinvigorated interest in the African continent. There are differing viewpoints as to whether China’s increasing involvement in Africa is beneficial to the African continent, or whether there are negative consequences.

This write-up attempts to answer this question by exploring the nature of China’s political, economic and aid relationships with the African continent through new data provided by the China Africa Research Initiative (Johns Hopkins).

China’s interests in Africa are motivated primarily by economics and diplomacy. In other words, Africa is important to China as a vast source of resources to feed its growing manufacturing base, as well as a source of energy security. In addition, China sees Africa as an important destination for its affordable manufactured goods.

China’s interests in Africa, however, are not only confined to economics but extend to diplomacy as well. China is attempting to position itself as an important power in the international system and, by so doing, promote its own views and policies within international multilateral organisations.

Africa plays an important role in this regard, particularly in institutions with ‘one-country, one vote’ arrangements. Thus, China attempts to court African governments in order to secure access to Africa’s vast resources, as well as to garner support for its policies in the international arena.

Here’s all you should know about China’s activities in Africa.

CHINA-AFRICA TRADE

CHINA-AFRICA BILATERAL TRADE DATA OVERVIEW

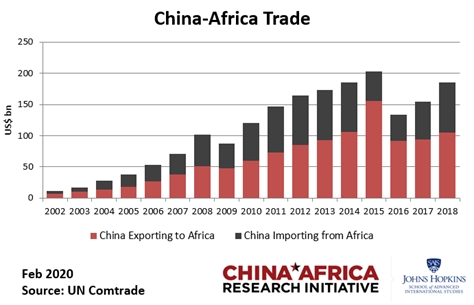

China-Africa bilateral trade has been steadily increasing for the past 16 years. However, weak commodity prices since 2014 have greatly impacted the value of African exports to China, even while Chinese exports to Africa remained steady. Our data includes North Africa.

- The value of China-Africa trade in 2018 was $185 bn, up from $155 bn in 2017.

- In 2018, the largest exporter to China from Africa was Angola, followed by South Africa and The Republic of Congo.

- In 2018, South Africa was the largest buyer of Chinese goods, followed by Nigeria and Egypt.

CHINESE INVESTMENT IN AFRICA

CHINESE FDI IN AFRICA DATA OVERVIEW

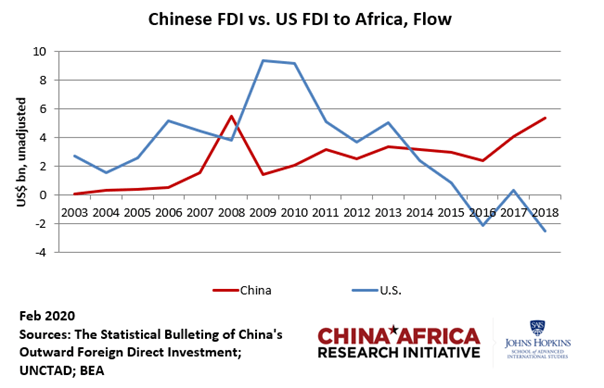

Chinese FDI annual flows to Africa, also known as OFDI (“Overseas Foreign Direct Investment”) in Chinese official reports, have been increasing steadily since 2003. From 2003 to 2018, the number has surged from US$75 million in 2003 to US$5.4 billion in 2018. The flows peaked in 2008 at US$5.5 billion because of the purchase of 20% of the shares in Standard Bank of South Africa by Industrial and Commercial Bank of China (ICBC).

As shown in the chart below, Chinese FDI flows to Africa have exceeded those from the U.S. since 2014, as U.S. FDI flows have been declining since 2010. The top 5 African destinations of Chinese FDI in 2018 were South Africa, Democratic Republic of Congo, Mozambique, Zambia, and Ethiopia.

CHINESE AGRICULTURAL INVESTMENTS IN AFRICA DATA OVERVIEW

Sustained interest in China’s role as an overseas agricultural investor in Africa has generated hundreds of newspaper articles and editorials, sensational statements and robust myths—but surprisingly little investigative reporting. CARI Director Deborah Brautigam’s 2015 book, Will Africa Feed China?, explores the scale and scope of Chinese farming investments in Africa. Our ongoing research updates our data on these investments to 2016*.

- Out of over 6 million hectares of alleged Chinese land acquisitions, CARI found that only 252,901 hectares of land have actually been acquired.

- Cameroon alone accounts for 41% of all lands actually acquired: driven by two large purchases of existing rubber plantations (over 40,000 hectares each) in 2008 and 2010.

- Chinese land acquisitions have slowed down in recent years.

*We only include projects reported to be 500 hectares or above.

WHY CARI DATA?

CARI’s list of Chinese agricultural investment deals were triangulated by a combination of fieldwork, interview, and desk studies. We now partner with the Land Matrix in helping them verify cases of Chinese agricultural investment in Africa.

CHINESE CONTRACTS IN AFRICA

CARI DATA OVERVIEW

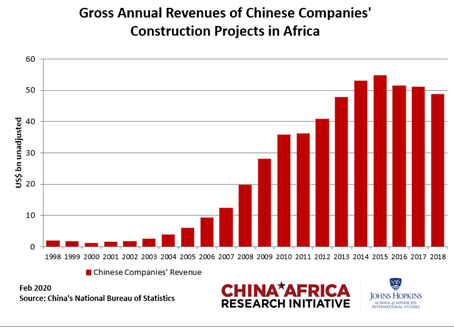

- In 2018, the gross annual revenues of Chinese companies’ engineering and construction projects in Africa totaled US$48.84 billion, a 0.5% decrease from 2017.

- The top 5 countries are Algeria, Angola, Kenya, Nigeria, and Ethiopia. These top 5 countries account for 50% of all Chinese companies’ 2018 construction project gross annual revenues in Africa; Algeria alone accounts for 15%.

- This is the third consecutive year that gross annual revenues of Chinese companies’ construction projects in Africa have declined.

CHINESE WORKERS IN AFRICA

CHINESE LABOR DATA OVERVIEW

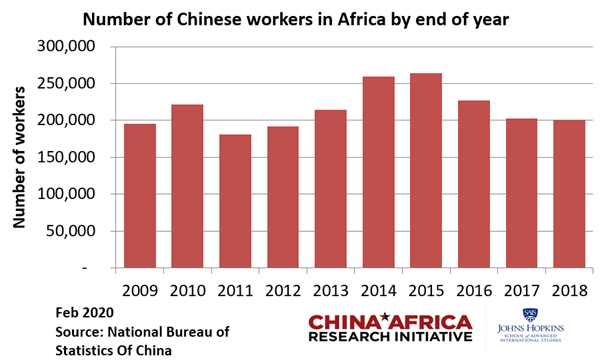

- The number of Chinese workers in Africa by the end of 2018 was 201,057, according to official Chinese sources.

- In 2018, the top 5 countries with Chinese workers are Algeria, Angola, Nigeria, Kenya, and Ethiopia. These 5 countries accounted for 58% of all Chinese workers in Africa at the end of 2018; Algeria alone accounts for 30%.

- From 2017 to 2018, the total number of Chinese workers in Africa has declined by 1,632 workers. This continues the trend of declining numbers of Chinese workers in Africa, down from a peak of 263,659 in 2015.

These figures include Chinese workers sent to work on Chinese companies’ construction contracts in Africa (“workers on contracted projects”) and Chinese workers sent to work for non-Chinese companies in Africa (“workers doing labor services”); they are reported by Chinese contractors and do not include informal migrants such as traders and shopkeepers.

CHINESE FOREIGN AID

FOREIGN AID DATA OVERVIEW

Chinese foreign aid expenditures increased steadily from 2003 to 2015, growing from USD 631 million in 2003 to nearly USD 3 billion in 2015. Foreign aid expenditures dropped sharply to USD 2.3 billion in 2016, but have since rebounded to a new high of USD 3.3 billion in 2018.

References

China Africa Research Initiative (2020). ‘DATA: CHINA-AFRICA TRADE’, Johns Hopkins University’s School of Advanced International Studies.

China Africa Research Initiative (2020). ‘DATA: CHINESE INVESTMENT IN AFRICA’, Johns Hopkins University’s School of Advanced International Studies.

China Africa Research Initiative (2020). ‘DATA: CHINESE AGRICULTURAL INVESTMENTS IN AFRICA’, Johns Hopkins University’s School of Advanced International Studies.

China Africa Research Initiative (2020). ‘DATA: CHINESE CONTRACTS IN AFRICA’, Johns Hopkins University’s School of Advanced International Studies.

China Africa Research Initiative (2020). ‘DATA: CHINESE WORKERS IN AFRICA’, Johns Hopkins University’s School of Advanced International Studies.

China Africa Research Initiative (2020). ‘DATA: CHINESE FOREIGN AID’, Johns Hopkins University’s School of Advanced International Studies.

Mark-Anthony Johnson (2020). ‘New Data on China’s Activities in Africa – Facts not Fiction’, JIC Media.

Hit me up on social media and let’s keep the conversation going! I read all the feedback you send me on LinkedIn, Twitter, Instagram and Facebook.

Have a lovely week!

Maxwell Ampong is the CEO of Maxwell Investments Group, a Trading and Business Solutions provider. He is also the Business Advisor for the General Agricultural Workers’ Union of TUC (Gh). He writes about trending and relevant economic topics, and general perspective pieces.