Prices of fuel on the domestic market remain fairly stable in the second pricing window of July. As world economies emerge from the lockdown and ease restrictions on economic activities, demand for fuel is also on the rise which has resulted in crude oil prices going up over the last couple of days. This might drive up fuel prices in Ghana in the near future.

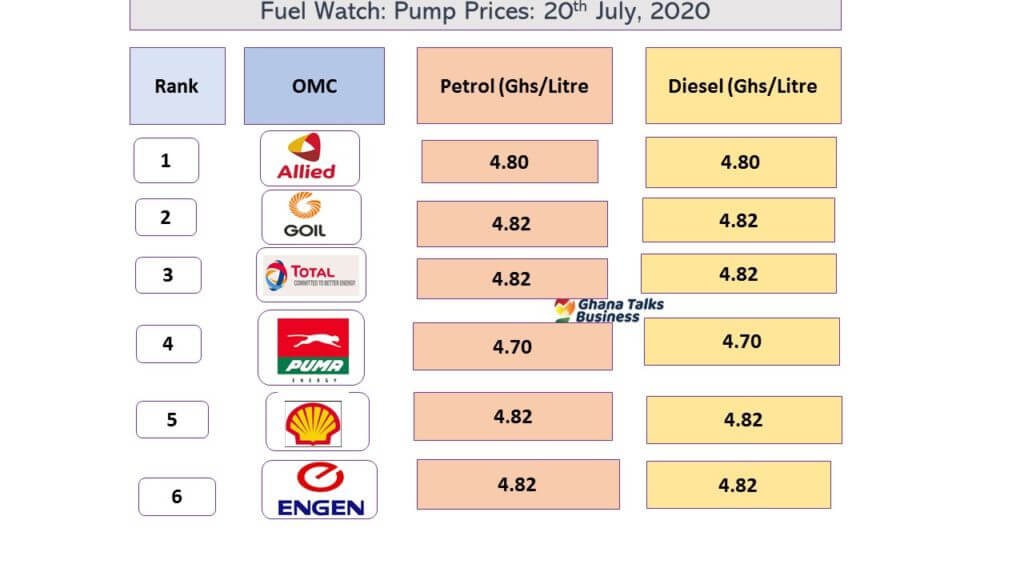

However, OMCs in Ghana have maintained fuel prices for the second pricing window in July. Here are the latest fuel prices, when Ghana Talks Business visited stations of selected OMCs at the weekend.

Less popular OMC brands usually sell cheaper than the top brands listed. Goodness is selling super at GHC4.50 and disel at GHC4.50.

Fuel Price Hikes

The First Pricing-window of July 2020 revealed Oil Marketing Companies adjust prices at the pump to record a percentage average increase of 3.66%, which placed the national average price of both Gas and gasoline at GHc4.79 per litre. Oil market giants such as GOIL, Shell (Vivo), and Total sold at GHc4.82 as at the closing of the 16th July.

ALSO READ: Fuel prices increase, as drivers threaten strike

Given the increase in demand for crude products such as gasoline and jet fuel, Brent crude price gained 3.68% from $41.08 per barrel recorded at the end of the second Pricing-window of June to close at $42.59 per barrel at the end of the first Pricing-window of July.

S&P’s Platts benchmark for fuels shows average Gasoline price gained 5.59% to close at $390.73 per metric tonne, from a previous average of $370.05 per metric tonne. Gasoil appreciated by 5.31% to close trading at $361.80 per metric tonne, from a previous average of $343.57 per metric tonne.

Prices now stable because of Competition

According to a statement issued by the Institute for Energy Security (IES) “Going by the 3.68 percent surge in the price of Brent crude oil, in addition to the 5.59 percent and 5.31 percent rise in the prices of gasoline and Gasoil respectively on the international market; the Institute for Energy Security (IES) foresees prices of fuel on the domestic market going up marginally even though the cedi appreciated against the US dollar by 0.17 percent.” IEA is expecting a1.5% increment in fuel prices.

Given this available data, we might see the price of fuel averagely close at GHc4.86 per litre at the end of the second pricing window in July.

This notwithstanding, further statement by IES indicated that “competition between Oil Marketing Companies (OMCs) to control and gain more market shares, and mounting pressure on the government to reduce prices of fuel may result in fuel prices remaining largely stable within the second pricing-window of July 2020.”