As part of effort to ensure the smooth implementation of government’s Medium-term Debt management Strategy (MTDS), the Government of Ghana has signed on to become a member of the African Trade Insurance Agency (ATI).

This will also ensure that Ghana borrows at a lower rate in the commercial markets. As the country will attract lower cost of financing with longer durations, using ATI’s Sovereign Credit Wrap. An innovative insurance solution which replaces sovereign rating with ATI’s strong rating.

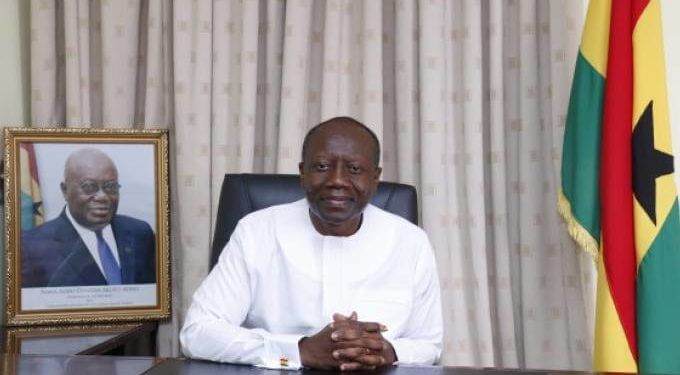

The Minister of Finance, Mr Ken Ofori-Atta, stated that the ATI membership means “financing on better terms and longer duration, which can help pay off more expensive debts and create a more sustainable debt management process.”

Again, he stated, in a statement read on his behalf at the official launch of ATI in Accra, on Thursday February 20, 2020, that “the IMF has looked favorably on this strategy in other countries and we look forward to exploring this possibility”.

Medium Term Debt Management Strategy

The 2019-2022 Medium-Term Debt Management Strategy (MTDS) seeks mainly to broaden the investor base and currency structure of the Government of Ghana debt portfolio.

Accordingly, the strategy focuses on reducing the refinancing risks embedded in the debt portfolio through liability management operations and development of domestic debt markets.

Based on this, Government is adopting financing options that support its infrastructural projects and programmes. While bearing in mind the cost of debt and minimising refinancing risks in the government’s public debt portfolio.

The Government’s 2020 debt strategy focuses more on an appropriate financing mix to lessen the costs and risks to achieve the desired composition of the public debt portfolio with respect to borrowing from external and domestic sources.

Eurobond

Government, on February 4, 2020, secured a total of $15 billion Eurobond, representing a five times oversubscription of the targeted US$3 billion Eurobond in three tranches with premium rates better that what was realised in similar bonds issued last year.

The three tranches were issued with a 7-year, 14-year and 41-year maturities at coupon rates of 6.375%, 7.75% and 8.75 per cent for the 7-year, 14-year and 41-year bonds, respectively.

The country also issued at a competitive rate of 8.75 percent for the 41-year Weighted Average Life (WAL) tranche of US$ 750 million, which matures in 2061.

This is the longest-ever tenor bond issuance by an African issuer, and compares to a rate of 8.95 percent on the 31-year bonds issued in 2019.

African Trade Insurance

The African Trade Insurance Agency is a pan-African institution that provides political risk insurance to companies, investors, and lenders interested in doing business on the African Continent.

It was agency was formed in 2001. So far, 17 African States have signed on to it with Ghana being the latest country to join the bandwagon.

It is also supported by the World Bank and the African Development Bank.