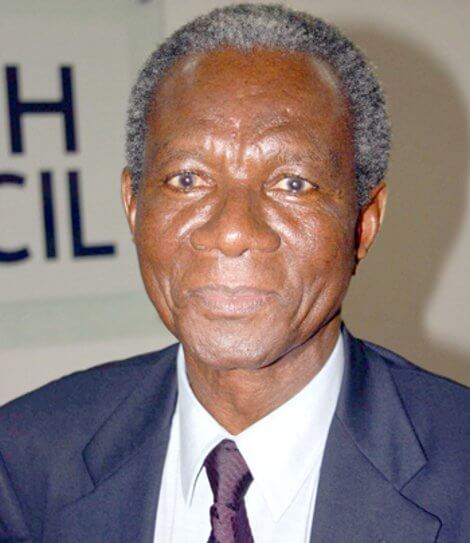

Two top economists have taken divergent views on the government printing money to pay the depositors whose cash are locked. Both economists are talking about the urgent need to pay depositors whose cash are locked with collapsed financial institutions. However, their mode of meeting the need differ. Mr. Kwame Pianim, the renowned economist, earlier suggested that the government could print cash to pay the depositors. This is a view Prof. Peter Quartey, disagrees with. The Director of the Institute of Statistical, Social and Economic Research (ISSER), Prof Quartey posits that the move would rather lead to inflation to the point of jeopardizing the 5% budget deficit threshold. He is of the view printing of money is a sure recipe for inflation. Coincidentally, this is a view shared by many economists.

The question Ghana Talks Business (GTB) asks is whether the increase of money supply would necessarily, and at all times, lead to inflation. The theory suggests that inflation occurs if money supply is increased in a full to capacity economy where factors of production are used up. Is that the case with Ghana?

The depositors ‘ locked up cash has been accounted for as part of government expenditure and which makes it a function of budget deficit. Other questions that need asking is how the depositors would deploy the funds once they get access to them. It is uncertain if this cash would go to ‘chase goods’, as pertains in most saturated western and stable economies.

Paying Depositors to Boost Productivity

A deep analysis of the situation of locked up cash is that businesses have stopped running, projects have ceased and some capital investments have been held up. The release of these locked up deposits would most likely end up in economic activities that boost productivity. In that case, inflation is less likely. The case of increased money supply leading to inflation is likely, however, the current ‘cash tight’ economy could well absorb printed money used to pay depositors.

Unfortunately due to government’s inefficient means of capturing tax payers, the payments of depositors would only lead to a marginal increase in tax revenue. This is the part where the budget deficit argument would hold. The fact that government would have printed money to finance its expenditures but got no returns (even in the short term).

Full Employment Capacity

We live in an economic space where productive capacity and labour is lying idle, therefore price level is not likely to rise much when printed money is used to pay depositors. In any case, if Ghana was operating a near full employment capacity then inflation would have been imminent. Is Ghana operating in a full employment capacity? The answer is NO! Therefore some printed money to pay depositors may not necessarily lead to inflation.

One problem it would as well solve is the public loss of confidence in the financial sector.

Much as Prof. Peter Quartey’s expert view holds in most situations, Kwame Pianim’s suggestion would hold in this case. One thing they both agree though is for the government to speed up the process.