The volume of mobile money transactions amounted to 200 million transactions in December 2019. This is in contrast to the volume of transactions through the banking system which reached 2.8 million, representing just 1.4 percent of the volumes of mobile money transactions

This is contained in the recent Summary of Macroeconomic and Financial Data for December 2019 and released in the last week of January. The transactions through the direct bank engagements are done through clearing of cheques, (Automatic Clearing House) ACH direct debit, ACH direct credit, E-Zwich, Ghipss Instant Pay(GIP), ATMs and GH-link.

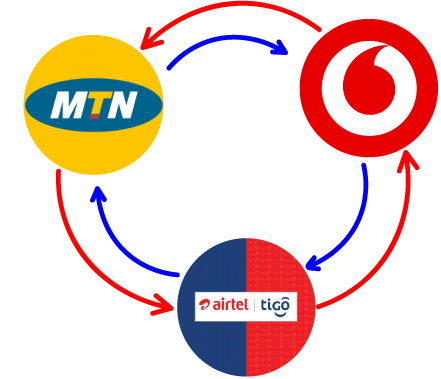

Mobile Money Trend

In total 2.8 million transactions are done directly through the banking system amounting to approximately GH¢21.53 million. The value of transactions directly through the bank is however 65 percent of the value of transactions in the mobile money space. The total value of transaction on the mobile money platforms including interoperability reached GH¢32.9 billion.

One other significant trend was the growth from November 2019 to December 2019 in which the value of the mobile money transactions has grown by GH¢29 billion.

The mobile money users are however operating with 44 percent capacity as there are only 14.5 million active users out of the 32.5 million registered users. The active user segment is expected to grow as public confidence would continue to surge. The convenience and independence of the mobile money system would continue to drive the growth of its engagement. Though the mobile money charges are high, the convenience makes up for it. This places a lot more demands on the banks to further innovate to at least maintain the current rates of usage by the public.

GHIPSS

Ghipss is also expected to work hard to deepen engagements of the public to their platforms. It seems that awareness of some of the potent platforms by GHIPSS is quite low.