US DOLLAR/CANADIAN DOLLAR (USDCAD) – SECOND TIME BEARISH FAKERY SETUP VALID AT KEY RESISTANCE LEVEL;

Last week, I discussed a bearish fakery setup at 1.32827 key resistance level on the USD/CAD Pair which presented selling opportunities to traders. We did not see price plunge during trading session last week, rather, the market did rally upwards past our 1.32827 key resistance level, but failed to sustain above this level as we saw price plunge sharply downwards below 1.32827 – thereby forming a second bearish fakery setup.

Trade Idea;

The general directional bias of the USDCAD pair remains downwards and the decline in prices below 1.32827 presents valid selling opportunities for traders to go short on this pair. A valid stop placement can be spotted above 1.33460 and downside targets sits at 1.31882 and 1.31155 support levels.

See chart below for reference;

- EURO DOLLAR (EURO/USD) – SURGES FURTHER TO THE DOWNSIDE

Last week, I discussed in my weekly newsletter that the Euro/Dollar pair was likely to plunge further due to the various bearish price action indications as the market tested 1.12404 key resistance level. The market did plunge during last weeks’ trading session as bears continued to sell short the Euro/Dollar aggressively.

Trade Idea;

We shall continue to assume a bearish stance on this pair this week and look to sell strength preferably within the zone 1.11258 – 1.11875

See chart below for reference;

- DOLLAR-SWISS FRANC (USDCHF) – DOWNWARD TREND REMAINS INTACT

We continue to see massive selling pressures on the USD/CHF as price continue to plunge intensively. Last week, we saw price rebound to test near term resistance at 0.97958 and closed lower. This presents selling opportunities for traders to take short positions on this pair as we sell short the current strength.

Trade Idea;

Consider going short within the zone 0.97651 – 0.98160. Downside target for short sellers can be marked at 0.95971 and possibly lower. On the other hand, should we see a sustained price rally above 0.97958, our trading plan will be nullified and we would stand aside.

See chart below for reference;

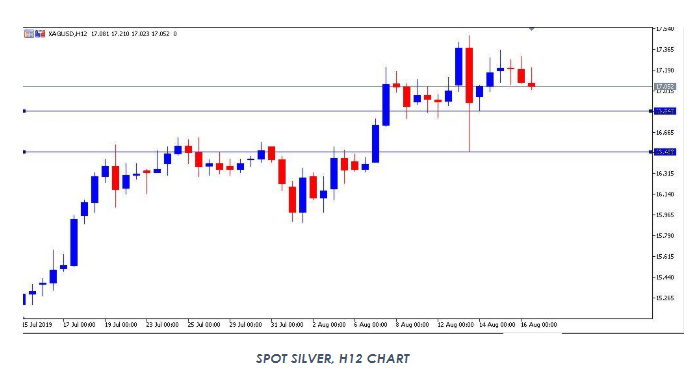

- SILVER SPOT (XAUUSD) – BULLISH BIAS REMAINS SOLID

Previous buying zone for silver spot was 16.134 – 16.619. Last week, we saw price retraced into this zone and then rebound strongly upwards.

The overall directional bias of silver spot remains bullish over the short and medium term.

Trade Idea;

Apparently, new near term support can be spotted within 16.498 – 16.843 and traders not already long on silver spot may watch for buying signals within this zone as trading session unfolds this week. A sustained decline in prices below 16.498 shall nullify bullish sentiments on this pair this week.

See chart below for reference;

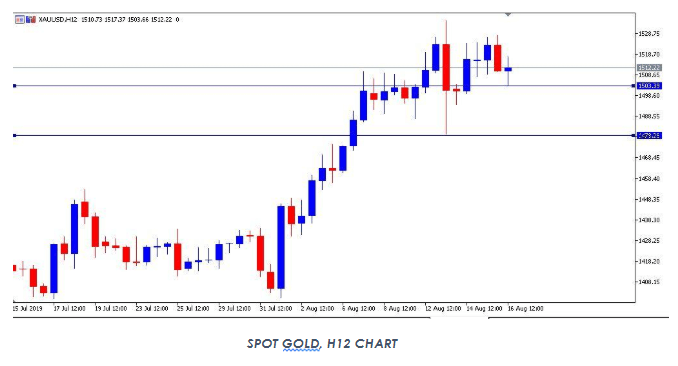

- SPOT GOLD (XAUUSD) – MAINTAINS BUOYANT STEAM

Last week, we saw Spot Gold maintain its upward rally as price continued to trade above near term support levels.

The current Price Action dynamics surrounding Spot Gold indicates that bulls remain in control, hence, we would assume a bullish stance on spot Gold this week and look for valid buying signals as price retraces to mean levels using the 10 period Exponential Moving Average (EMA) as reference on the H12 price chart.

Trade Idea; consider looking for buying signals on Spot Gold within the zone 1479.08 – 1503.39. Nevertheless, a sustained decline in prices below 1479.08 shall render this trading plan invalid for this week.

See chart below for reference;

Want more trade setups and trading ideas? My trading community members receive daily Price Action Analysis and Trade Ideas. Take the stress out of your trading by Signing up for my trading community one off lifetime membership.

Learn simple but powerful Advance Price Action Trading Methodology without indicators to enhance and simplify your trading;

- Low frequency trading and trading around a busy life;

- Coaching and mentoring;

- Market Price Action Commentary;

- End of Day Trading;

- Guide to installation of professional trading software platform;

- Effective customization of MT4/MT5 Platform;

- No Mobile phone trading;

- Guide to professional market price action analysis;

- Effective Money Management Strategies;

- Trade forex, stock indices, commodities and metals;

About E.O. Essien

E.O Essien is a Chartered Financial Economist with accreditation from the Global Academy of Finance and Management (GAFM) and the Association of Certified Chartered Economist (ACCE). He is a Professional Forex Trader, Trainer and Coach who received his professional Trading Education from Nial Fullers’ Online Price Action Trading Course. Where he obtained the trading strategies and success secrets used by Millionaire Trader Nial Fuller and many prop firms who trade stocks, bonds, commodities, currencies etc.

He is the founder of Knowledge and Action Price Action Trading Community, the fastest growing community of forex traders in Ghana.

Call or whatsApp +233 240080104 or Email; elijahotoo.eo@gmail.com for lifetime VIP Membership. Enjoy 20% discount in August.