A survey of Bank Charges at the end of the second quarter of 2019 conducted by the Bank of Ghana has shown the cost of opening a savings account with the all the 23 banks in Ghana now.

The survey indicates that, the cost of opening a savings account in Ghana is somewhat significant as at the end of the second quarter of 2019.

The data has it that 3 banks – Zenith, Standard Chartered and Societe General require that a new customer makes an initial deposit of GHC100 to open a savings account.

Whereas, ADB, Bank of Africa, Barclays, Consolidated, Fidelity, Republic, Stanbic, Universal Merchant Bank takes GHS50 as initial deposit for a savings accounts, GCB and Ecobank takes GHS80 and GHS30 respectively.

According to the data, First National Bank, FBN, First Atlantic, NIB, Prudential, UBA takes GHS20 as the initial deposit for a savings account.

Out of the 23 banks, only GT Bank requires a GHS0 initial deposit to open an account.

Meanwhile, Access bank and CAL bank will require you to make an initial deposit of GHS10 for a savings account.

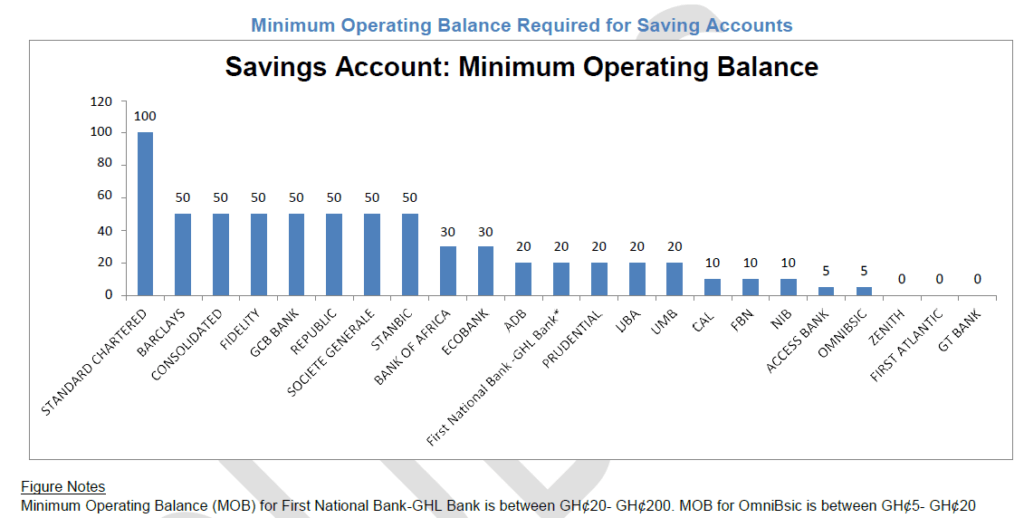

Minimum Operating Balance

A Minimum Operating Balance is the minimum amount that a customer must have in an account to receive some service benefit, such as keeping the account open or receiving interest.

The diagram below shows the Minimum Operating Balance Required for Saving Accounts in the 23 banks operating in Ghana as at the second quarter of 2019.

Data Source: Financial Stability Department, Bank of Ghana