Mobile Money Interoperability (MMI) recorded more than 4.4 million transactions in its first year of operation.

Beginning with just 96,907 transactions in its first month, public usage of the cross network platform grew phenomenally to 422,275 transactions in December last year and 502,873 transactions in May this year.

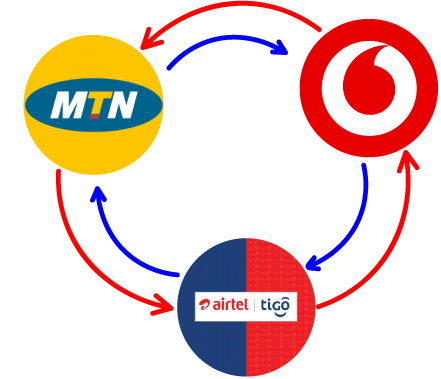

MMI or seamless cross mobile money network transactions became possible in May last year, following a challenge thrown to the Ghana Interbank Payment and Settlement System (GhIPSS), the Telcos and financial institutions by the Vice President, Dr Mahamudu Bawumia.

The Chief Executive Officer of GhIPSS, Archie Hesse in an interview described the MMI initiative as successful.

He said it has provided a very efficient way of funds transfer for many people, opening up the mobile money payment platform, enabling people and businesses to use it in different ways.

Before MMI came into being, cross network transactions through the ‘token’ system was hovering around 90,000 transactions per month. This shows that the MMI is serving a need.

Individuals therefore could not directly transfer funds to another wallet of a different network. But that cumbersome process and the inconvenience ended a year ago.

Besides individual transactions on the MMI platform, many Fintech companies have found it very useful to support new products as payment can now be made easily across networks.

Mr Hesse said the increased acceptance of mobile money by shop owners and service providers was largely because payments could now be made seamlessly across networks.

He added that the linkage of the MMI platform to the e-zwich and bank accounts had further opened up the payment system and encouraged many more initiatives.

Mr. Hesse expressed the hope that with the passage of the Payment Systems and Services bill into an Act, a lot of products and services will be developed, which would further boost the usage of the MMI platform.

He said GhIPSS was equally working on some initiatives that would make the use of mobile money for payments easier and quicker.