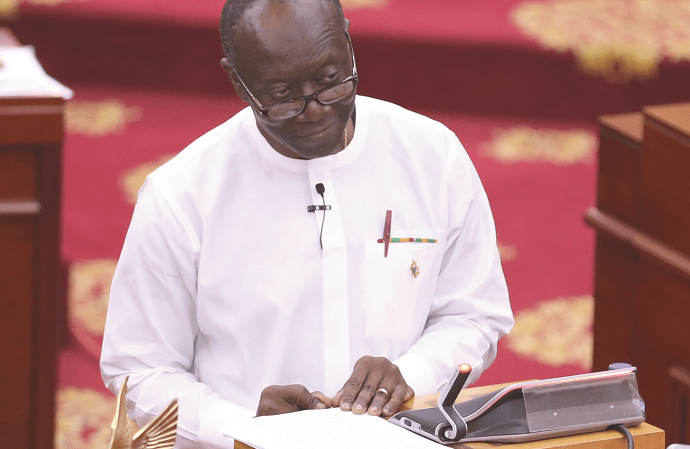

The Finance Minister, Ken Ofori Atta has disclosed that Ghana is spending close to 55 per cent of tax revenue to service interests on loans.

He said last year, of the GH₵37.8 billion raised in tax revenues, GH₵21.1 billion was used to service interest payments alone.

Data from the Bank of Ghana (BoG) shows that the public debt stock, as of the end of 2018, hit GH₵173.2 billion or $35.92 billion.

The debt in ratio to the gross domestic product (GDP) stood at 58 per cent last December.

Of the total, external debt stood at $17.9 billion or 28.9 per cent of GDP while domestic debt stood at GH₵86.9 billion or $18.02 billion, translating into 29.1 per cent of GDP.

Finance Minister Ken Ofori-Atta made this known at a Danquah Institute forum, on the theme ‘Bridging the gap between the formal and informal economy: The role of domestic revenue mobilisation in an era of Ghana beyond Aid’.

He explained that the less revenue the country generates, “the more we will have to spend because arrears and interests accrue and our maintenance culture suffers”.

He appealed to Ghanaians to pay their taxes, promising to protect the public purse.

He said, “While we plead with Ghanaians to respond to their civic duties by paying their taxes, we want to assure you that my staff at the Ministry of Finance and I will protect the public purse with uncompromising courage, integrity, fortitude and love for the country.”

According to him, “Over the last two-and-a-half years, we have reviewed contracts and saved the nation hundreds of millions of Ghana cedis in the process.”

Revenue to GDP increases from 11 to 13%

The Minister explained that domestic revenue collection has seen a significant rise from 11 per cent (GH₵24,283.5 million) of GDP in 2016 to 13 per cent in 2019 (GH₵45,270.2).

Cabinet working on tax exemption

Mr Ofori-Atta said that the cabinet is reviewing the country’s tax exemption policy for parliament’s consideration.

According to the Minister, the government is challenged with revenue mobilisation, and there’s the need to take a look at the tax collection process.

Some tax exemptions have not been useful

According to Ofori-Atta, Cabinet has identified that some of the tax exemptions have not been useful, hence the need for a review.

He has also downplayed the assertions that the reduction in benchmark value implemented at the port is having a negative impact on revenue.

He stated that the cleanup in the banking sector embarked upon by the central bank last year has put banks in better shape than they were two years ago.

Banking sector cleanup

Mr Ofori-Atta stated that but for that bold decision by the government, the distressed banks could have collapsed with deposits belonging to more than 15 million Ghanaians.

“Today, we can say with confidence that our banks are in much better shape than they were yesterday [two or three years ago].

“They are better capitalised with more robust governance structures, portfolios much safer for depositors, broad liquid assets of up to GH¢68 billion by February this year, as against GH¢43 billion in 2016.

“Growth in non-performing loans (NPLs) has shrunk to 14.6 per cent [as of February 2019] and credit to the private sector has increased,” the Finance Minister said.

Mr Ofori-Atta said the government was mindful of the concerns depositors raised last year as the central bank embarked on the radical cleanup of the banking sector.

He said the exercise cost the taxpayer about GH¢13 billion, which could have been used to fix more roads, build more hospitals and schools.

He said the livelihoods of millions of depositors were at stake as the banking sector headed for imminent collapse.

Touching on the broader economy, Mr Ofori-Atta said the government was on course as it had taken measures to fix the broken economy that it inherited, saying “the broken economy is on the mend”.

For instance, he said the government had reduced the stifling deficit from 7.3 per cent of gross domestic product (GDP) in 2016 to 4.2 per cent in 2018, reduced inflation from 15.4 per cent to single digit and successfully exited the International Monetary Fund’s (IMF) bailout programme.

He stated that the IMF predicted that Ghana would be the fastest growing economy in the world this year at 8.8 per cent.

The Finance Minister explained that the next phase of the development agenda was focused on industrialisation and changing the structure of the economy.

Consequently, he said, the government was investing in ‘Planting for Food and Jobs’ ‘Planting for Export and Rural Development’, ‘One District, One Factory’, setting up the developing authorities and revamping the collapsed railway sector to ease movement of goods and services.

Mr Ofori-Atta said one could easily be misled that Ghana was worse off today than it was two or three years ago when one listened to some commentators in the media.

Executive Director of Danquah Institute, Edward Asomani urged Ghanaians to hold the government of President Nana Akufo-Addo accountable.

According to him, “As investors, we will demand more accountability, and the government will be more responsive.”

He added that “we have elected our leaders not by the number of boots they have matched, but by the presence of mind to put country first even at great personal cost”.

Commissioner-General of the Ghana Revenue Authority, Emmanuel Kofi Nti has issued a strict notice to its heads of taxpayers’ offices to ensure that collection from the informal sector, especially the self-employed, records positive growth.

According to him, the non-performance of tax revenue from that sector is a source of worry for the commission, and all necessary measures are being put in place to address the situation.

Informal tax collection has been a challenge for the Ghana Revenue Authority due to the unavailability of credible data for the sector.

Mr Kofi Nti hinted that informal tax mobilisation has been key on his agenda to increase revenue.

He disclosed that a strict notice has been issued to all officials at the various revenue offices to ensure positive growth in the informal collection.

On his part, Commissioner of Customs, Isaac Crentsil hinted that the country recorded negative growth in the collection at all the ports as a result of non-compliance.

“The collection has been slow because some of the importers try to cut corners to evade tax and swerve the system, but we’re working to seal all loopholes. All the ports in 2018 recorded a negative growth though it’s higher than the result for 2017,” he noted.

Credit: The Finder Newspaper