Provisional fiscal data on public finances for last year has shown that the government has collected some GH¢21.3 million in taxes from the implementation of the luxury vehicle tax between August and December 2018.

The amount is GH¢82.7 million below the GH¢104million that was projected to be collected within the period as contained in the 2018 mid-year budget review.

The law imposing the annual tax on vehicles with high capacity engines started August 1, 2018.

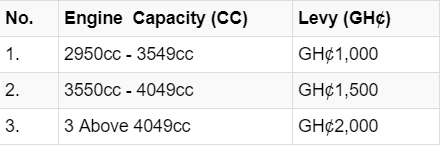

According to the GRA, the tax affects vehicles with engine capacity of 2950 Cubic Centimeters and more, and that the Driver and Vehicle Licensing Authority (DVLA) is the authorized body to collect the levy ranging from GHȻ1,000 to GHȻ2,000 on behalf of Government.

A statement issued by the Commissioner-General of the GRA said with effect from Wednesday, 1st August, 2018, the levy shall be paid on the registration of vehicles and subsequently on or before the annual renewal of the roadworthy certificate of such vehicles, with engine capacities listed above.

ALSO READ: DVLA to introduce ‘luxury vehicle license’ sticker

The tax also affects vehicles of the listed capacities existing prior to the passage of the law.

Exempted from the levy are;

- tractors;

- ambulances;

- commercial vehicles that have the capacity to transport more than ten persons;

- commercial vehicles for the transport of goods;

- other exemptions as

may be prescribed by the Minister responsible for Finance.

Meanwhile, a coalition of car dealers and owners on

They drove their vehicles in a convoy through some principal streets, protesting the levy which was introduced by the government in August 2018 specifically for vehicles with engine capacity of 3.0 litres and above.

In an interview with Citi News, the General Secretary of the Vehicle and Asset Dealers Association, Nana Owusu Duodu, expressed their resolve to embark on countless protests to ensure a reversal of the levy.

“We wrote reminders to them [the government] but they didn’t mind us. We held a press conference, but it was all to no avail. So the only option we had was to stage a demonstration to kick out this nuisance tax. We have three petitions, we are presenting to the Minister of Finance, Speaker of Parliament and the last to the seat of the government. If we are not seen and heard we would carry out the same demonstration across [the country],” he said

The protesters include car dealers, spare parts dealers among others from associations like the Vehicle and Asset Dealers Association (VADA), the National Concerned Spare Parts Dealers Association (NCSPDA), True Drivers Union (TDU), and Concerned Drivers Association (CDA).