Governor of the Bank of Ghana, Dr Ernest Addison has advanced that the economy of Ghana remains at the mercy of foreign investors and importers, whose actions trigger cyclical cedi depreciation.

According to him, significant pressure is brought on the local currency whenever non-resident investors take out their monies to chase after more attractive investments abroad or when importers demand significant amount of dollars to bring in goods or services.

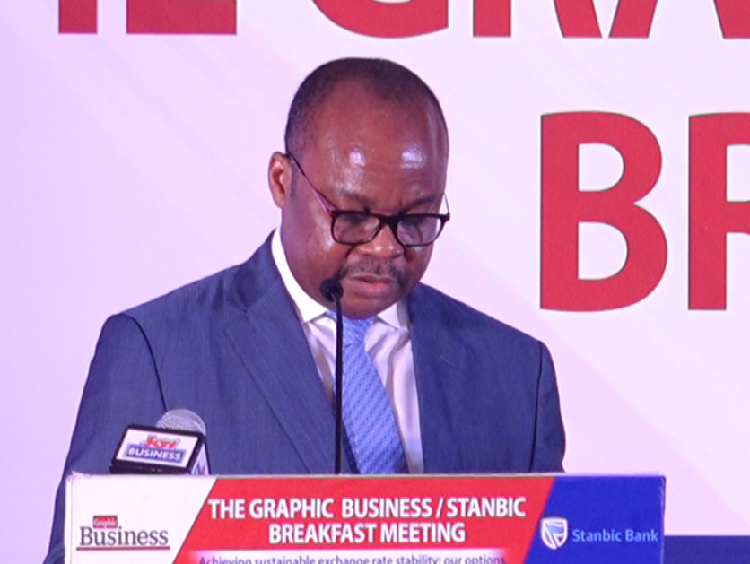

Below is a copy of the full address by the Governor of the Bank of Ghana

SPEECH DELIVERED AT GRAPHIC BUSINESS/STANBIC BREAKFAST MEETING BY DR ERNEST ADDISON GOVERNOR, BANK OF GHANA AT AT LABADI BEACH HOTEL ON TUESDAY, APRIL 23, 2019

Introduction

1. Ladies and Gentlemen, let me begin by thanking Graphic Business and Stanbic Bank for the opportunity to speak on the topic: “Achieving Sustainable Exchange Rate: Our Options” This topic is timely—coming at a time that we have successfully emerged out of a sudden bout of volatility in the exchange rate, which generated a lot of debate domestically and also externally. It is my expectation that my brief remarks and subsequently discussions will shape the narrative on currency and exchange rate management in the context of a small open commodity dependent economy that has adopted a flexible exchange rate regime to underpin the conduct of monetary policy.

2. The recent sharp movements in the exchange rate of the Cedi generated considerable debate on the options that we have as a country to deal with the seasonal bouts of depreciation in a more sustainable way. Before I jump into discussing the underlying causes of these sudden episodes of sharp currency depreciation, allow me to first put the key issues into context.

3. First and Foremost, I think what we need to understand is that the exchange rate reflects a price. And, as is the case with all prices for goods and services in the economy, the exchange rate will change and respond to the dynamics of the economy and will always be subject to the dynamics of demand and supply. As a country, we have adopted a flexible exchange rate regime, which has served us well in the past and continues to do so under the Bank’s inflation targeting monetary policy framework.

4. Looking at the history, the flexible exchange rate regime has served Ghana well, given the structural characteristics of the Ghanaian economy. I am sure there are some schools of thought that harbour the idea of Ghana pegging the Cedi to one of the major trading currencies to achieve some stability. Whilst this might sound appealing, empirical evidence, including analytical work by the IMF shows that growth has been more robust in countries with flexible exchange rate regime than in countries with fixed exchange rate regimes.

5. As we all know, Ghana’s economy is import dependent, hence the existence of persistent foreign exchange demand pressures by importers. In addition to these huge demand pressures, the seasonal repatriation of profits and dividends foreign-owned companies reflects in significant outflow of resources out of the services and income accounts, exerting additional pressures on the local currency. As a matter of fact, these developments explain why the two consecutive years of trade surpluses have not fully translated into current account surpluses.

6. The strong policy reforms introduced in the last 24 months—fiscal consolidation, complementing monetary policy stance, and financial sector reforms are yielding results. Growth has rebound from a low of [3.6 percent] in 2016; inflation has dropped sharply from 15.6 percent in 2016 to single digits; fiscal deficit more than halved; and supported by a very strong external payments position—trade surpluses for the first time in decades. All these together meant that we were able to build reserves to the tune of US$7.6 billion (in 2017) representing 4.4 months of import cover. The level of reserves moved to US$9.9 billion (5.1 months of import cover) following the recent sovereign bond issuance. All these reflect the attraction of the positive turnaround in the Ghanaian economy to foreign investors, who have been contributing to finance the deficits.

7. The growing exposure to foreign investors also means that the country becomes susceptible to movements in global sentiments.

Recent Trends in Exchange Rates

8. The remarkable turnaround in the performance of the cedi continued in the first few months of 2018 supported by improving macro fundamentals, strong external payments position alongside significant build up in international reserves. However, from the week beginning May 21, 2018 a combination of external factors such as US monetary policy normalization, sharp oil prices hikes, and a stronger US dollar impacted adversely on emerging market and frontier market economies, including

Ghana.

This resulted in some portfolio reversals from emerging markets to take advantage of higher yields in the US. In Ghana, we saw increased coupon repatriation, exerting additional pressures on the local currency. At end October 2018, the cedi had cumulatively depreciated by 7.8%.

9. The start of 2019 has been characterized by intense cedi volatility reflecting the following:

First, as has always been the case, was the seasonal foreign exchange demand pressures fuelled mainly by importers and corporates;

Second, investor sentiments weakened on concerns about the economic outlook as Ghana was on the verge of exiting from the IMF program. This triggered some outflows, putting pressure on the cedi. We also witnessed significant repatriation of coupons by non-resident investors, which contrasted past trends of re-investment of coupon proceeds;

Third, as part of the objective to build up lost reserves in 2018, the BoG, decided to improve Net International Reserve levels to what pertained at the end of December 2018. This required that the BoG limit its presence in the market. Consequently, the efforts to build up reserves in a period of strong foreign exchange demand, exerted additional pressures on the local currency.

10. The interplay of these factors resulted in a year-to-date depreciation of the Cedi by 8.0 percent (as at March 19, 2019) compared with 0.02 percent depreciation in the same period of last year.

What then explains the recent turnaround in the FX market?

11. Since the last week of March 2019, the Cedi has recovered remarkably against the US dollar, appreciating from GH¢5.9/US$ at the peak of the episodic jump to the current levels of GH¢5.1/US$ and reflecting:

Reversal of sentiments on the economic outlook;

The successful completion of the IMF-ECF programme has served to provide an endorsement of macroeconomic policy management and the subsequent release of the last tranche of FX resources associated with the completion; and the

Positive news effect associated with the $3.0 billion Eurobond inflows which has improved the country’s reserve buffers.

12. In addition, S&P Global Ratings affirmed its ‘B/B’ long and short-term foreign and local sovereign credit ratings on Ghana with a stable outlook. The affirmation of the rations was attributed to Ghana’s relatively strong growth prospects driven in large part by increased oil production which is expected to support sound fiscal policy

management and help deliver a favourable macroeconomic outlook. On these positive accounts, the broad expectation is for a further rally in the value of the currency.

Conclusion

13. In conclusion, let me emphasize the key point that ensuring stability in the value of the currency in a sustainable manner must be underpinned by a variety of factors. These should include the following:

Continued strengthening and maintenance of a stable macroeconomic environment;

Improving debt management strategies and engineering policies to shift financing of the budget away from non-residents and towards more of domestic financing. Successful implementation of this strategy will help moderate the country’s external vulnerabilities arising from shifts in investor sentiments. Currently our bond market is significantly exposed with non-resident holdings of domestic bonds above 25 percent in the domestic debt market;

Addressing Ghana’s import dependence through the pursuit of structural reforms geared towards promoting local production;

Continued improvement in the business environment, especially in the area of ease in doing business, to attract investments into the country; These should include re-examining laws that serve to improve the business environment, pursuing business-friendly regulations, making it easy to move goods across the country, and pursuing policies to facilitate trade among others;

Taking a re-look at Ghana’s retention agreements and promoting local content, especially in the downstream oil sector, and finally;

Promoting non-traditional exports, including areas such as Tourism.

I believe that these pointers will help shape the follow-up discussions on achieving exchange rate stability in a sustainable manner.

Thank you.