Barclays Bank of Ghana and the Ghana Commodity Exchange on Friday 2019

The MOU also affords the bank the opportunity to finance the electronic warehouse receipts and provide aggregator financing. Exciting times ahead for the Ghanaian Farmer and actors along the Commodity Value Chain.

The Ghana Commodity Exchange (GCX) is a platform that brings buyers and sellers together to facilitate local trade. The Exchange is expected to create a seamless interface for the trading of food, minerals and other commodities in the country.

It is expected to bring transparency in agribusiness, boost confidence in the industry, raise standards of food quality to global standards and ultimately give farmers their due for all their hard work of tilling the ground.

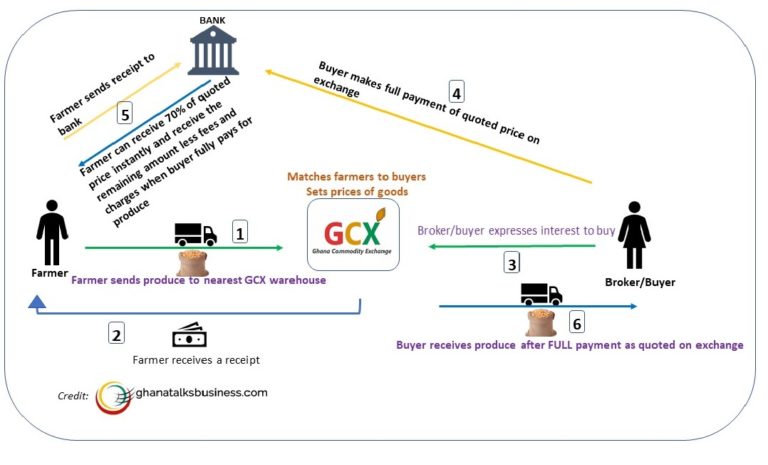

How does a typical Commodity Exchange work?

The Commodities Market works like any other market we know of. It is a physical or virtual space where one can buy and sell. Modern commodity markets began with trading of agricultural products like maize, livestock, food

The GCX which is licensed and regulated by the Securities and Exchange Commission (SEC) would operate a fully electronic or digital trading platform which would be devoid of human interventions and manipulations. The trading activities would be preceded by registration of farmers, brokers and buyers as members of the trading activities. They would provide warehousing services where farmers of the various produce would deposit their physical products.

The major players of the exchange would be farmers (supplier or client), buyers, brokers, traders, warehouse managers and financiers. The exchange is expected to help in curbing post-harvest losses, boost export of food, improve food security in the country and open up investment and entrepreneurial opportunities.