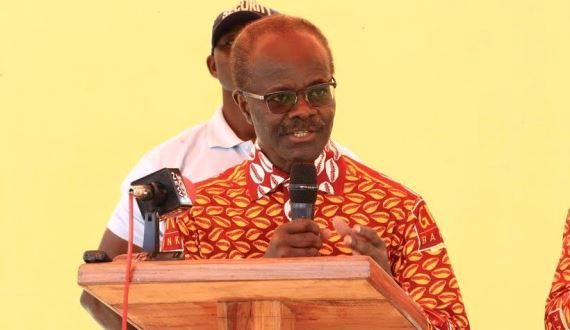

Second Deputy Governor Elsie Awadzi has revealed that 20 out of the 30 existing banks in Ghana have met the GH¢400 million Minimum Capital Requirement of the Bank of Ghana as the 31 December 2018 deadline looms.

Speaking at a JoyBusiness Financial Service Forum themed “The Changing Tide of Ghana’s Financial Service Sector: The Cause, The Cost, the Clean-up” monitored by Ghanatalksbusiness.com the second deputy minister said; “Over 20 banks have met [the minimum capital requirement] or are already there and we have 30 banks, so, the rest, we are meeting them on a daily basis to say: ‘Tell [us] where you are on your capital raising plans’.

She added that “We are confident that they are going to meet [it] but if for some reason they cannot meet and will not merge, well, then that is another matter altogether, but we cannot allow banks that are not well-capitalized to remain in the system after 1 January”.

Meanwhile, as reported earlier by Ghanatalksbusiness.com, the BoG has advised commercial banks who may not be able to meet the GH¢400 million minimum capital requirement by December 2018 to apply for a reduction in the class of their licenses from a universal bank status or risk closure.

According to the special advisor to the governor of the BoG, Dr Benjamin Amoah, whereas there was still a window of opportunity for the banks that were yet to meet the requirements to explore mergers, applying for a reduction in the class of license to become financial institutions or microfinance companies would ensure that the owners of those banks would be able to maintain their businesses.

“the BoG has a tier system made up of the universal banks, savings and loans, rural banks and microfinance institutions, so, if you cannot meet the standard requirements of a universal bank, it will be appropriate to apply to be reduced to a lower class, which is equally allowed,” Dr Amoah has stated.

ALSO READ: BOG cautions banks as Minimum Capital Requirement deadline looms