Africa is the global leader in mobile money, which has become an important component of Africa’s financial services landscape.

Mobile network operators (MNOs) have dominated mobile money services in Africa for the past decade. More recently, fintechs have established a solid footing in the market, and a number of banks are beginning to compete aggressively for the mobile banking customer. While some banks have chosen to “go it alone”, others are forming partnerships in hopes of reaching the market faster. This article outlines five paths banks can take to retain ground in the battle for the mobile customer in Africa.

Africa is the global leader in mobile money

Mobile financial services (MFS) span the full spectrum of financial services, from payments and current accounts, to savings, loans, investments, and insurance. Mobile money, which enables customers to send, receive, and store money using their mobile phone, is a subset of MFS that is provided mainly by telco companies. The underlying funds are typically held by a bank in a dedicated stored value account or a linked current account.

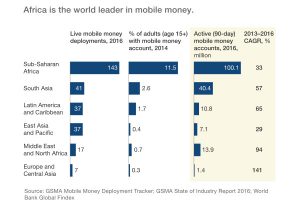

Just over half of the 282 mobile money services operating worldwide are located in sub-Saharan Africa, according to the GSMA. In Africa today, there are 100 million active mobile money accounts (used by one in 10 African adults). This far exceeds customer adoption in South Asia, the second-biggest region for mobile money in terms of market share, with 40 million active mobile money accounts (used by 2.6% of adults)(Exhibit 1).

Mobile money now extends far beyond Safaricom’s initial M-Pesa offering, which enabled consumers and small businesses – many of which had little or no access to a bank – to send and receive money quickly and securely across great distances. Today, mobile financial services have expanded to include a broad array of financial services, including credit, insurance, and cross-border remittances, and M-Pesa now accounts for less than a quarter of MFS users in Africa.

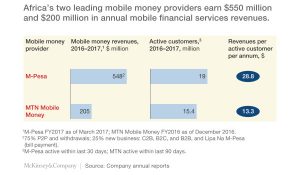

Despite the near saturation of certain markets, there is still ample room for growth in mobile financial services in Africa. In recent years (2013-16), the number of active mobile money users has grown by more than 30% annually. Furthermore, margins on payments in Africa remain among the highest in the world, at approximately 2% of the transaction value. Annual revenues can approach US$29 per annum per active registered user (Exhibit 2).

The market has diversified as it has matured

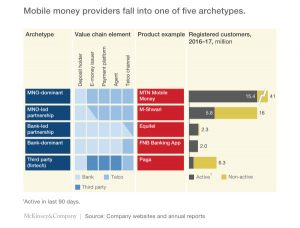

Africa’s mobile money market has expanded and diversified in recent years. Providers today fall into one of five different archetypes, defined according to which segments of the mobile money value chain they cover (Exhibit 3).

1. MNO-dominant. In this archetype, the MNO is responsible for most steps of the value chain, including the virtual telco network and the physical agent network and payments issuing and processing; a bank is the deposit holder. Beyond M-Pesa (26 million registered users in Kenya, of which approximately 73% are active), there are several other providers that have been highly successful in this category in Africa, including MTN Mobile Money, with 41 million registered customers (approximately 38% active) across 15 countries; Orange Money, with 16 million registered customers across 14 countries; and Tigo Money, with eight million registered customers across five African countries.

2. MNO-led partnerships. In this model, a banking partner supports the MNO in providing products beyond payments such as small consumer loans and deposits. The leading example is M-Shwari in Kenya, a partnership between Safaricom (Kenya’s leading telco, with a customer market share of nearly 70%) and CBA (a mid-sized bank in Kenya). This partnership reached 10 million customers within 18 months of launch, in part because it managed to cross-sell to users of Safaricom’s M-Pesa.

3. Bank-led partnerships with MNOs. The best example of this model is Equitel, a partnership between Equity Bank and Airtel with over two million customers in Kenya. This service allows customers to send money from their accounts to any bank account in Kenya, take out loans, and maintain deposits. Equitel also offers services beyond banking, including airline ticket purchases and information on consumer-interest topics (for example, healthcare, education). In this case, the bank provides access to its agent network, as well as payments issuing and processing capability.

4. Bank models including banking apps for smartphones and text-based money transfer services using basic handsets. These services typically require the sender to be a customer of the bank providing the service, while the recipient does not need to be a bank customer. FNB’s banking app is an example, with approximately two million active customers in South Africa.

5. Fintech solutions. A successful example is Paga, in Nigeria, which has grown its customer base 81% annually, expanding from one million registered customers in 2013 to more than six million today. Paga, which processed $500m in payments in 2016, is now a fully fledged payments company allowing customers to send money via their phones and pay for online purchases on merchant websites.

Why mobile carriers are winning customers

Even as banks and fintechs have entered the market, MNOs continue to dominate the landscape in terms of customer numbers, as shown in Exhibit 3. The most successful MNO-led mobile money launches (M-Pesa and MTN Money) have from five to 10 times as many clients as bank-centric approaches (for example, FNB and Equitel).

While in many markets banks can rely on regulations to defend their deposit-taking capabilities, over the past decade MNOs have built scale and momentum in mobile payments on three pillars: 1) near ubiquitous distribution networks, 2) vast numbers of customers/strong market concentration, and 3) a superior client experience.

Of these considerable strengths, distribution is the MNOs’ main advantage. Thirty-seven African markets have 10 times more registered agents than bank branches. In Kenya, for example, Safaricom has more than 130,000 agents where customers can cash in or cash out. By contrast, leading banks in Kenya, where agency banking has been highly successful, have approximately 15,000 agents.

Second, mobile companies have vast numbers of customers. For example, MTN, the largest telco in Africa, has 171 million customers, whereas leading pan-African banks (for example, Ecobank, Standard Bank, Barclays Africa) typically have between 11 million and 15 million customers. There are two primary drivers of telcos’ vastly superior client numbers. First, mobile phone penetration across Africa is on average 80%, twice the rate of banking penetration. In addition, telecommunications is a much more concentrated industry than banking. The top five telcos in Africa have 60% of all telco customers in Africa, versus 22% for the top five banks in Africa.

Finally, a number of telcos have managed to develop a superior client experience early in the evolution of mobile financial services in Africa. M-Pesa’s client experience is remarkably simple: it takes only three inputs and six clicks to send funds, on any type of handset. Registration is straightforward, merchant acceptance is widespread, and there are no transaction fees on bill payments.

East Africa leading the charge

While demand for mobile money is evident across the whole of Africa, the availability of service is uneven from one market to the next. National markets fall into one of three categories based on the maturity of MFS (Exhibit 4). East Africa and Ghana, where penetration exceeds 1,000 mobile money accounts per 1,000 adults, are “mature” markets. (Some consumers hold more than one MFS account in order to circumvent limitations on interoperability, and some dormant accounts are included.) In “maturing” markets, MFS penetration is between 100 and 1,000 mobile money accounts per 1,000 adults, and growing rapidly. Among the “sleeping giants” (for example, Nigeria and Morocco), mobile money penetration remains below 100 accounts per 1,000 adults.

In “mature” markets, the regulatory framework has allowed a number of MNOs to compete with relatively small banks in a fragmented financial services market. For example, Safaricom had nearly 80% customer market share in Kenya when launching M-Pesa, while the banking systems in both Kenya and Tanzania remain fragmented, with approximately 40 banks each and less than 15% customer market share for Kenya’s largest bank.

In “maturing” markets, mobile money is gaining traction. These markets tend to have regulations allowing for MNO-led partnerships and prohibiting or discouraging agent exclusivity (as in Malawi). MNOs in these markets have also invested heavily for sustained periods before building scale. For example, Orange launched Orange Money in Cote d’Ivoire in 2008, but only saw real uptake in the number of active users in 2012.

Reasons for the slow uptake among the “sleeping giants” include the availability of alternative mechanisms (for example, Morocco has a sophisticated banking system with 60% banking penetration) and regulatory constraints (for example, the mobile money activities of MNOs are restricted in Nigeria, which has resulted in a highly fragmented market, with 18 companies holding mobile money licenses).

The future is mobile: How should banks respond?

MNOs currently have 100 million active mobile financial services customers across Africa, and McKinsey estimates that the total MFS opportunity approaches $2.1bn or approximately 2% of total African banking revenue pools. While banks are doing a reasonable job of defending their share of banking revenues, the battle for the mobile financial services customer is on. To strengthen their position in MFS, banks should weigh their options and devise a plan that fits with their multichannel strategy for delivering consumer and commercial services. Banks can choose one of five approaches.

1. Go it alone. McKinsey’s Finalta benchmark indicates that banks in a number of emerging markets are building strong momentum in digital financial services (including MFS). For example, banks in India achieve 25% of core product sales through digital channels, and banks in Turkey achieve 18%. A leading Indian bank captured 30% of sales through digital channels, which sets a high bar for banks in Africa. Garanti Bank’s iGaranti – a mobile-based set of financial services centered on an engaging app – is the type of initiative that can propel banks in this direction.

2. Build a digital bank. A digital bank is defined here as a bank that predominantly uses mobile devices and the internet to offer banking services and has relatively limited branch distribution. Examples of digital banks have emerged around the world, including in China, Eastern Europe, Turkey, and Africa. For example, Airbank captured 4% of transactional market share within three years of opening in the Czech Republic. mBank in Poland has four million clients. McKinsey research shows that digital banks can have cost/income ratios that are 10 to 30% lower than that of their peer banks in a given market. Since digital banks tend to have compelling client value propositions centered on simplicity and price transparency, this is an attractive option for banks looking to counter mobile money disruption.

3. Partner with a fintech. Fintechs in Africa have launched a number of mobile-first solutions that are building momentum. For example, BIMA offers mobile-based insurance services in four African countries and has approximately two million active clients. Paga’s mobile payments offering has six million registered clients in Nigeria. Jumo is using telco data to underwrite credit for clients across Africa.

4. Partner with a non-telco, for example, African e-commerce business, tech company. In China, a number of ecosystems provide mobile financial services to hundreds of millions of customers. For example, Alipay has more than 800 million registered accounts for merchants using the Alibaba e-commerce platform. Alibaba is now a significant provider of SME financing in China thanks to the data on merchant transactions available on the platform. As another example, WeBank, an offshoot of Tencent’s WeChat, is using customer data on social media activity and contacts to help underwrite credit. Standard Bank has partnered with WeChat in South Africa to launch WeChat Wallet, enabling WeChat South Africa’s five million users to send and receive money and make payments.

5. Partner with a telco. This has been a common path in Africa, including, as noted above, Equity Bank’s partnership with Airtel and Standard Bank’s partnership with MTN.

Each of these five options is a viable path for a bank. The choice depends on a variety of factors, including the bank’s starting position (for example, can the bank’s current systems be retooled or must they be replaced?), the available partnership options, and the bank’s track record in partnerships. The one path that is not viable is “business as usual”.

While financial services have until recently been the preserve of banks and insurance companies, MNOs and fintechs are giving banks a run for their money in Africa, particularly in the retail and SME segments. MNO-led innovations have enhanced financial inclusion in Africa, and now it is time for banks to develop their own distinctive mobile and digital services with an eye to protecting their leading role not only in payments and deposits, but across the full spectrum of financial services as well.

Authors: Mutsa Chironga is a partner in McKinsey’s Johannesburg office, where Hilary De Grandis is a specialist; Yassir Zouaoui is a partner in the Casablanca office. This article was originally published by McKinsey & Company.