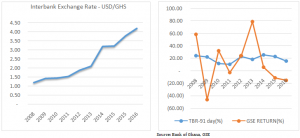

Investors all over the world lookout for avenues to put their funds in order to get some returns and the Ghana Stock Exchange is one of the possible options. In the article, “The performance of the GSE vs T-Bills”,published on citifmonline.com on 31st January, 2017, it was revealed that in the long term, the GSE returned marginally better than Treasury bills.

Looking at the GSE from the foreign investors’ perspective takes a different twist.

I was in a discussion with an investor who informed me he had invested about USD5 Million in the Ghana Stock Exchange in the last eight years but has lost more than 50% of his investment even though the stock market is returning about 40% Year-To-Date this year 2017. I decided to take a closer look at the figures within that period.

![]()

The graphs above depict the performance of the various factors that have impacted the funds placed in the investment over the period. The Ghana Cedi has depreciated more than 70% within the period under consideration whiles the GSE has returned about 13% on average -more than 5% lower than that of 91 Day Treasury bill.

Putting the investor’s funds into perspective, as shown in the table above, the investor converted $5M to GhanaCedis, which was GHC6M in 2008. He earned about 13% on the investment on the GSE to about GH¢16M. He then converted this amount to Dollars which as at end of 2016stood at about$3.8M. The result is that about 24% of his funds are depleted.

Even though the GSE may be returning positively to local investors, the investor that converts Dollars to Cedis to invest in the local bourse may be making a mistake.

The main issue here, after the analysis, is the stability of the cedi.

Managers of the Exchange and all stakeholders must work together to ensure measures are put in place to ensure that the GSE is competitive.

One major action that must be taken seriously is getting a policy in place that will compel multinationals to list.

Owners of these multinationals who are mostly foreigners receive their dividends in foreign currencies especially the USD which are shipped out of Ghana’s economy. This puts pressure on the local currency thus contributes to depreciation.

Others include taking a second look at the cap on price changes on the Ghana StockMarket. Market Forces should be allowed fully to determine price changes.

In bigger markets, the stock exchanges communicate the health of their economies, but ours do not tell the full picture as companies are not fully represented.

The GSE needs rebranding, repackaging and fresh ideas to ensure acceptable returns to all investors.

Author: Kofi Busia Kyei

Financial Analyst

kofibusia@outlook.com