Following the 100 basis points cut in the policy rate by the Bank of Ghana on Monday, May 22nd 2017 during its policy meeting, the Bank of Ghana has now cut the monetary policy rate by a total of 300 basis points this year alone – given the 200 points cut in the month of March 2017. The policy rate now stands at 22.50%. This drastic reductions has been the results of declining headline inflation and other macroeconomic variables that points to the fact that the economy is heading towards a single digit inflation regime any time soon.

In my opinion, the declining inflation and the improvement of other macroeconomic variables of the economy has broadly been influenced by positive economic sentiments right at the beginning of the year, following the peaceful 2016 presidential and parliamentary elections and Government transition.

The historical data analysis below will serve us well as it throws more light on the possibility of a single digit inflation sooner than we all might be expecting.

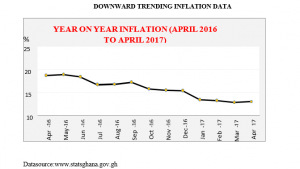

DOWNWARD TRENDING INFLATION DATA

From the chart above, inflation plummeted from 17.2% in September 2016 to 13.3% in January 2017, and then further dawnwards to 12.8% in March 2017. However, inflation inched up by 0.2% to 13.0% from March to April 2017. This upward move from the month of March to April can be interpreted in two ways :

Either underlying inflation pressures are still high, suggessting that the 12% area is acting as a support for further rise in flation or

This is just a temporary shock from volatile exogenous variables such as transportation and energy.

In spite of the possiblility of the former factor, the underlying directional bias of inflation remains downwards as headline inflation and inflation expectations continue to trend downwards. Barring any unexpected shocks, this downtrend is set to continue over the medium term – making the attainment of a single digit inflation figure any time soon a fair reality .

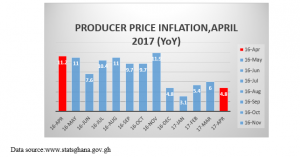

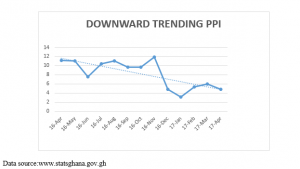

PRODUCER PRICE INFLATION (PPI)

Prouducer price inflation measures the avearge change in the prices received by domestic producers for their goods and services over a given period of time, especially one year. The Year on Year PPI for the month of April 2017 stood at 4.8%. A drastic decline from the 11.2% recorded over the previous year. This suggests that the average prices received by producers of goods and services are trending downwards, which is in proper alingment with the argument of declining inflation.

STAILITY OF THE GHANA CEDI

The stability of the Ghana cedi against its major trading currencies especially the U.S dollar has also contributed significantly to falling prices over the medium term. The depreciation of the cedi stood at 1.0% against the U.S dollar by May 18th 2017. Which is an improvement from the 2.7% depreciation recorded at the Monetary Policy Commitee Meeting of the Bank of Ghana in March 2017.

Nervertheless, it is essential to note that the improvement in the strength of the cedi against the U.S dollar is not essentially underpinned by domestic growth, rather partly influenced by the uncertainties surrounding the Trump lead admisnistration as to the extent to which he will be able to deliver on his major campaign promises of massive tax cuts, increased expenditure on infrastructure development and loosened industry regulations. Additionally, recent Trump press on former FBI director James Comey to drop Russia probe and other geo-political tensions in some parts of Europe has spike the plunge of the U.S dollar to near six month low on the foreign exchange market, as investors run for safe haven assets like Gold, Yen and the Swiss franc.

In the light of the domestic economy, the extension of the IMF bailout deal to December 2018 is a step in the right direction in line with efforts to stabilize the domestic economy. The multiplier effect of the IMF bailout extention deal will be to keep the Cedi stabilized over the medium term as the supply side of the U.S dollar in the domestic economy adjusts upwards, relative to the demand side.

Following these historical data, there is the need to keep positive economic sentiments alive as the new Government strives to put measures in place to recover the economy. Generaly, the future economic propects of the nation still looks bright, and as individuals, firms (especially SMEs) and investors continue to regain confidence in the domestic economy, price stability and for that matter a single digit inflation is sure to be realised by end of 2018.

Author: E.O. ESSIEN. Email: elijahotoo.eo@gmail.com(0240080104)