Fraud is rife in the retail industry. It has crippled several retailers to the point of huge losses and a complete shutdown for some unfortunate ones. Every retailer has been a victim of some aspect of fraud, knowingly or unknowingly, and it is usually prevalent in two areas; fraud related to cash handling and stock related fraud (which is a major cause of stock shrinkage). It negatively impact a retailer’s bottom-line, according to research by an International Fraud Association, the typical business loses 5 percent of its annual revenue each year due to fraud. The first part of this article will identify some reasons for the widespread existence of fraud in the retail industry. Fraud could take anything up to two (2) years to detect and could be committed by anyone from senior management to outsourced staff. Some 80% of business victims never recover anything of fraud when detected.

Absence of Fraud Prevention & Punitive Measures

In every organisation, the use of fraud preventive and punitive systems and policies would help to curtail incidences of fraud and minimize occurrences. However, for some retailers, such systems may be absent because of the assumption that the business is built on trust and blessed with a crop of trustworthy employees who would never commit fraud. Such a blessing would be more of wishful thinking than a reality, and fraudulent activities will definitely occur at the blind side of the business owner. There is the story of a fast growing supermarket which at its peak had about 5 branches in Accra alone. Owners had employed friends and relatives to oversee operations and assumed the business was thriving on honesty and trust. Potent systems and policies to check fraud were non-existent, and this unfortunately became the bane that destroyed the once thriving and promising retail business. The business eventually suffered huge losses as a result of fraudulent activities of the relations in management, and eventually collapsed. Owners were left bankrupt with massive bank loans and overdrafts to clear.

From Same Author: 6 Things Customers Look Out for in a Shop

In explaining why fraud exists at the workplace, fraud prevention experts have developed the 10-80-10 principle. The principle suggests that in every organisation 10% of employees will never commit fraud with or without controls, an unscrupulous 10 percent will always commit fraud irrespective of control measures, and the majority 80 percent may end up committing fraud depending on circumstances. This estimated 80% need fraud controls to hold them in check and protect them. It effectively illustrates that fraud is widespread because majority of humans are more inclined to be dishonest in the absence of measures to check their behavior.

From same author: Go For Smart Sales Associates

According to the principle, retailers may pay dearly for failure to implement measures to effectively minimize and punish fraudulent activity. Majority of employees will take advantage of the circumstances and engage in fraudulent activity which in turn implies huge losses for the business. Every retail business in any form of partnership; be it a husband & wife, mum & daughter or a closely knit friendship business needs a clearly spelt out policy to check fraud, supported by fraud prevention systems to protect the bottom line from total collapse as a result of fraudulent activity. The policy should be a living document else it is of no use.

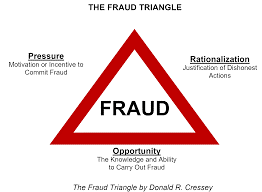

The Fraud Triangle at Play

Drawing from Donald Cressey’s Fraud triangle, there are 3 major areas that may instigate fraud in every business. In the first situation, fraud occurs as a result of the pressures faced by employees from all fronts. It has to do with financial or emotional force which may pull an employee to commit a fraudulent act. External pressures due to family obligations, sickness, educational and other urgent personal needs may likely push some employees into engaging in fraudulent acts such as cash theft. The situation is worsened with poor conditions of service, especially the absence of welfare facilities such as employee short term loans, assistance with medical bills, and salary advance schemes. For such employees, the only means of escape from financial pressure would be to steal.

Opportunity is the second factor that may instigate fraud in a business. This has to do with the ability to commit fraud without being caught or the absence of disciplinary measures to correct dishonest behaviour. As discussed under the 10-80-10 principle, majority of employees may be lured into committing fraud in the absence of security and other preventive measures. A cashier who can easily walk away from her till to her personal belongings whilst on duty may be lured to pocket some cedis from the till into her bag occasionally, especially if they know their personal belongings will not also be inspected at the close of the shift. For a retailer faced with continuous incidences of fraud, you may have unknowingly created the opportunity.

The third factor is rationalization which is the personal justification of dishonest acts. This occurs when employees turn to justify fraudulent acts with excuses such as poor conditions of service, poor human rights records, lack of respect for employees, and poor disciplinary measures. For most retailers who refuse to pay a reasonable wage or more so offer attractive work conditions, they may be gradually creating sufficient grounds for employees to continuously defraud them.

Fraudulent acts may be prevalent because employees feel they are not getting reasonable compensation, or not treated fairly for their contributions. To them, the only means to bridge the gap would be to steal.

Absence of In-store security Systems

Shoplifting is another common type of fraud that occurs in retail outlets. It may be prevalent because of the absence of in-store security measures such as ceiling mirrors, security persons, and surveillance cameras. Retailers should also beware of familiarity and connivance of frequent store visitors with shop floor staff, cashiers, and security staff. Absence of instore security systems may also encourage till pilfering by cashiers.

From same author: Mitigating the Syndrome of High Staff Turnover in Retail

Loopholes in operational & financial systems

Employees may take advantage of loopholes in operations of the business to commit fraud. In the absence of rigorous monitoring, a warehouse staff may frequently re-direct some quantities of new stock arrivals from the business into his personal possession, causing huge shrinkages in stock. A porous stock taking processes may not identify gaps in stock ordered and quantities received, which effectively increases shrinkage. These are all fraudulent acts which impact negatively on the bottom line of the retailer.

Fraud also may occur when security and stockroom staff remain in their roles for long periods and get too familiar with systems. A few unscrupulous ones may take advantage and engage in fraudulent acts.

Lack of Attention to Red Flags

There are telltale signs that the management should pay attention to when staff begins to exhibit them. They remain early warning signs to be looked into. Space would not allow full mention of them but a few are;

• Extremely close staff/supplier relationship

• Exhibiting “too good to be true performance”.

• Excessive Overtime.

• No leave or Sick Time.

• Staff who are always unwilling to delegate duties.

Fraud may be a menace which has lingered with man from the days of Adam, but awareness of the risk factors including those identified is the first step to mitigate occurrences and effects. In the second part of this article I will discuss some of the essential measures to put in place to help curtail incidences and effects of fraud.

Author: Amma is a Lead Consultant and trainer with M-DoZ Consulting. Kindly contact her on 0201196080 or email amma.antwi@ghanatalksbusiness.com for further information or contribution.